Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 03, 2023

Week Ahead Economic Preview: Week of 6 February 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Central bank meetings in Australia and India will be closely watched post the Fed meeting while comments from Federal Open Market Committee (FOMC) speakers are also in focus. Meanwhile, inflation figures from Germany, mainland China, Taiwan and the Philippines will be assessed for indications of inflationary pressures, especially in gauging any impact from the easing of COVID-19 restrictions in mainland China. December output data from the UK are also a highlight for the coming week, with UK recruitment data also likely to be of value in assessing the next move by the Bank of England. In the eurozone, Germany's inflation and industrial performance come under scrutiny.

The market has been squarely focused on two key themes of late, namely the Fed's inflation fight and China's reopening. Both have seen developments that supported risk-on behaviour in the past week.

Specifically, above-consensus China NBS PMI surveys were followed by indications of shallower a rate of decline in the Caixin China General Manufacturing PMI, outlining improvements of conditions in the Chinese economy after the easing of COVID-19 restrictions. This is while price pressures remained largely muted in the manufacturing sector, even with the Lunar New Year holidays in play. All of which should be music to the ears of equity investors fearing renewed reopening price pressures. Next week's PPI and CPI data from China will be watched for confirmation of the dovish price trend.

Meanwhile the first FOMC meeting of the year concluded with US equities trading higher despite caution from Fed Chair Jerome Powell. The perception that the Fed had started to acknowledge progress in their inflation fight, previously affirmed by survey and official inflation gauges, lifted equity prices with the S&P 500 index's IT sector closing with more than 2.0% gains on Wednesday. Financials were left behind, however, alongside energy shares. This is largely mirroring the sector performance in accordance to December's US sector PMI data. Next week's global sector data will therefore be of interest to gain insights into differentials in sector performance across the globe.

Are we nearly there yet? Rate hike path likely to cool subject to China data.

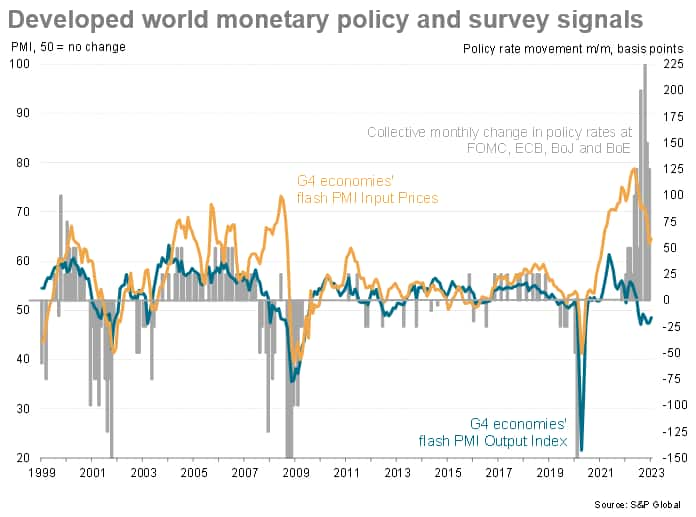

The past week saw further rate hikes from the FOMC, Bank of England and ECB, adding to the largest tightening of monetary policy seen in the developed world in recent history. The hikes totalling 125 basis points came despite signs of cooling headline inflation and persistent, albeit moderating, recession risks. A glance at how this tightening compares with leading survey data on output and prices suggest that we are close to calling the top of the rate hike tightening path.

However, much will depend on the impact on global inflation from China's reopening. On one hand, the relaxation of COVID-19 restrictions is likely to boost global supply of many goods and inputs, helping further cool worldwide inflationary pressures. On the other hand, resurgent demand from a busier economy on the Chinese mainland could stimulate higher commodity price inflation. Copper, for example, is already showing signs of rising amid expectations of stronger future demand. However, demand elsewhere in the world is showing further signs of moderating amid higher borrowing costs.

Whether improving supply trumps stronger demand in the inflation equation remains to be seen, which is why early data such as this week's Chinese inflation numbers will be so eagerly awaited by the markets.

Key diary events

Monday 6 February

New Zealand, Malaysia Market Holiday

Australia Retail Trade (Q4)

Thailand CPI (Jan)

Germany Industrial Orders (Dec)

Germany Consumer Goods (Dec)

Eurozone S&P Global Construction PMI* (Jan)

Germany S&P Global Construction PMI* (Jan)

Eurozone Sentix Index (Feb)

United Kingdom S&P Global/CIPS Construction PMI* (Jan)

Eurozone Retail Sales (Dec)

Germany CPI (Jan, prelim)

Indonesia GDP (Q4)

S&P Global Sector PMI* (Jan)

Tuesday 7 February

Japan All Household Spending (Dec)

Australia Trade Balance (Dec)

Philippines CPI (Jan)

Australia RBA Cash Rate (Feb)

Malaysia Industrial Output (Dec)

Switzerland Unemployment Rate (Jan)

Germany Industrial Output (Dec)

United Kingdom Halifax House Prices (Jan)

Norway Manufacturing Output (Dec)

Switzerland Forex Reserves (Jan)

Taiwan Trade (Jan)

United States International Trade (Dec)

Canada Trade Balance (Dec)

S&P Global Metals and Electronics PMI* (Jan)

Wednesday 8 February

Thailand BOT Meeting Minutes

Japan Current Account Balance (Dec)

India Repo and Reverse Repo Rate

United Kingdom KPMG / REC UK Report on Jobs* (Jan)

United States Wholesale Inventories (Dec)

Thursday 9 February

Taiwan CPI (Jan)

United States Initial Jobless Claims

Friday 10 February

Australia RBA Monetary Policy Statement (Feb)

China (Mainland) CPI and PPI (Jan)

United Kingdom monthly GDP, incl. Manufacturing, Services and Construction Output (Dec)

United Kingdom GDP (Q4, prelim)

United Kingdom Goods Trade Balance (Dec)

Norway Consumer Price Index (Jan)

Canada Unemployment Rate (Jan)

United States UoM Sentiment (Feb, prelim)

Taiwan GDP (Q4, revised)

India CPI Inflation (Jan)

China (Mainland) M2, New Yuan Loans, Loan Growth (Jan)

* Press releases of indices produced by S&P Global and relevant sponsorsmcan be found here.

What to watch

Global sector, metals and electronics PMI

Following the release of worldwide manufacturing and services data, sector PMI, metal users PMI - including Copper, Aluminium and Steel - and electronics PMI will be eagerly watched. December sector data indicated an especially steep deterioration in financial services with real estate and banking performance under particular pressure.

Americas: US and Canada trade data, US UoM sentiment, Canada employment figures

A light week for North American economic releases comes around next week with trade figures likely to be the highlights from both the US and Canada. Comments from Fed speakers in the week will also be of interest.

Europe: UK output data, German CPI, industrial production, eurozone retail sales

The UK releases GDP data for December, rounding off growth data releases for the year. According to the S&P Global / CIPS UK Composite PMI for December, output remained in decline at the end of 2022, albeit at a shallower rate compared to the month prior. This was nevertheless consistent with modest GDP declines which we will be tracking with the release of the official Q4 GDP reading. Recruitment industry survey data will also help assess hiring and wage growth in the UK.

In the eurozone, Germany CPI and industrial orders and production are in focus, with retail sales numbers also studied for the consumption picture at the end of 2022.

Asia-Pacific: RBA, RBI meetings, mainland China, Taiwan, Philippines inflation data

In APAC, central bank meetings in Australia and India will be the highlights amid expectations of further hikes. Consensus expectations currently point to a 25-basis point hike in India. This was with the latest S&P Global India Manufacturing PMI indicating strong sector growth while selling price inflation remained historically elevated.

Meanwhile mainland China's inflation will be watched closely for indications of price development upon the easing of COVID-19 restrictions. Encouragingly, the Caixin China General Manufacturing PMI revealed that selling price inflation in the manufacturing sector eased on the back of softening supply chain pressures. Taiwan's export performance will also be eagerly assessed as a bellwether of global trade.

Special reports:

Global Factory Downturn Shows Signs of Easing as China Re-opens - Chris Williamson

South Korea's Economy Faces Rising Headwinds in 2023 - Rajiv Biswas

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-february-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-february-2023.html&text=Week+Ahead+Economic+Preview%3a+Week+of+6+February+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-february-2023.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 6 February 2023 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-february-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+6+February+2023+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-february-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}