Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 19, 2025

Week Ahead Economic Preview: Week of 22 December 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Pre-Christmas data flurry preludes New Year's fresh PMIs and payrolls

The final edition of the Week Ahead in 2025 covers the extended holiday period, with key upcoming economic data releases and events extending into the first full week of the new year including the worldwide manufacturing and services PMIs as well as non-farm payrolls, eurozone flash inflation and FOMC minutes.

Ahead of Christmas, updates to Q3 GDP in the US and UK are key highlights, alongside US industrial production for both October and November, consumer confidence and durable goods orders. The minutes from the latest FOMC meeting will also be available to assess policymaker appetite toward further rate cuts. December's meeting saw the Fed funds rate lowered for the third time in a row to a three-year low of 3.5-3.75%. However, FOMC members expected just one more cut in 2026, and views were mixed as to whether rates will end 2026 higher or lower. Some policymakers are concerned about the weak labour market, others fret over sticky inflation. These twin worries were underscored by the flash US PMI for December, which showed low hiring alongside a spike in tariff-related price pressures.

In the UK, any potential revision to the 0.1% GDP growth signalled for the third quarter needs to be viewed alongside the flash UK PMI for December, which showed business growth ticking higher. Although households grew gloomier, firms reported that some of the uncertainty created in the lead up to the November Budget cleared, driving stronger order inflows. Moreover, while price pressures reaccelerated, the survey suggests inflation has further to fall even after the drop to 3.2% recorded in November, potentially paving the way for more rate cuts in 2026.

The New Year brings global PMI surveys, which will include manufacturing and services data for all major developed and emerging economies. A key focus will be on the PMIs for mainland China, but after the ASEAN region reported surprisingly strong growth in November, further clues will be sought as to the resilience of global manufacturing and trade following a year littered with tariff uncertainty.

Early January also brings flash eurozone inflation data for December, which surveys suggest will remain close to the ECB's 2% target. January also sees updated non-farm payroll and unemployment data for the US, which could shift a greater focus toward Fed policy supporting the labour market should the jobless rate rise further above the four-year high of 4.6% seen in November.

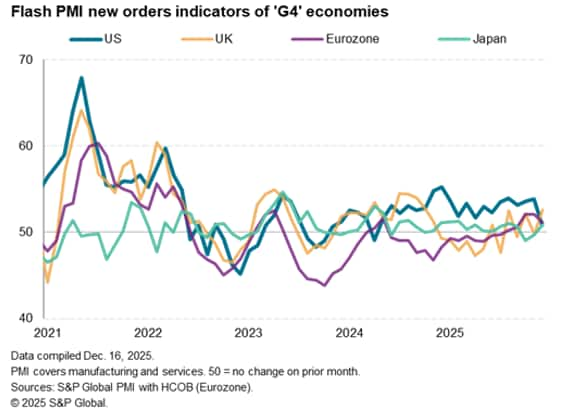

US goes from leader to laggard

S&P Global's flash PMI surveys showed output rising across all four largest developed economies (the "G4") for an eighth successive month in December. However, while the US continued to lead the expansion, as has been the case for much of the past two years, its outperformance has narrowed to the smallest seen over these past eight months. Furthermore, the forward-looking new orders index comparisons now show the US to be the worst performer of the G4 in December, with demand reportedly impacted in part by tariff-related price rises.

The next Week Ahead Economic Preview will be published on 9 January 2026.

Key diary events

Monday 22 Dec

Americas

- Canada PPI (Nov)

- US Chicago Fed National Activity Index (Sep)

EMEA

- UK Current Account (Q3)

- UK GDP Growth (Q3, final)

- Spain Balance of Trade (Oct)

APAC

- Malaysia Inflation (Nov)

- Taiwan Unemployment Rate (Nov)

- Hong Kong SAR Inflation (Nov)

Tuesday 23 Dec

Americas

- Mexico Balance of Trade (Nov)

- US ADP Weekly Employment Change

- Canada GDP (Nov, prelim)

- US GDP (Q3, 3rd est.)

- US Durable Goods Orders (Oct)

- US Industrial Production (Nov)

- US CB Consumer Confidence (Dec)

- US New Home Sales (Nov)

- Canada BoC Summary of Deliberations

EMEA

- German Import Prices (Nov)

- Spain GDP (Q3, final)

APAC

- Australia RBA Meeting Minutes

- Singapore Inflation (Nov)

Wednesday 24 Dec

Americas

US, Brazil Market Holiday

- US Initial Jobless Claims

- US EIA Crude Oil Stocks Change

EMEA

Austria, France, Germany, Italy, Netherlands, Poland, Spain,

Sweden, Switzerland, UK Market Holiday

APAC

Australia, New Zealand Market Holiday

- Japan BoJ Monetary Policy Meeting Minutes

- Taiwan Industrial Production (Nov)

Thursday 25 Dec

Americas

US, Canada, Brazil, Mexico Market Holiday

EMEA

Austria, Denmark, France, Germany, Italy, Netherlands, Norway,

Poland, South Africa, Spain, Sweden, Switzerland, UK Market

Holiday

- Türkiye Business Confidence (Dec)

APAC

Australia, Hong Kong SAR, India, Indonesia, Malaysia, Pakistan,

Philippines, Singapore, South Korea, New Zealand Market

Holiday

- Japan Housing Starts (Nov)

Friday 26 Dec

Americas

Canada Market Holiday

EMEA

France, Germany, Hong Kong SAR, Italy, Norway, Poland, South

Africa, Spain, Sweden, Switzerland, UK Market Holiday

- Germany

APAC

Australia, Indonesia, New Zealand Market Holiday

- Japan Unemployment Rate (Nov)

- Japan Industrial Production, Retail Sales (Nov)

- Philippines Trade (Nov)

- Thailand Balance of Trade, Industrial Production (Nov)

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-december-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-december-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+22+December+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-december-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 22 December 2025 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-december-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+22+December+2025+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-december-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}