Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 17, 2025

Flash PMIs show US demand growth falling behind all other major developed economies

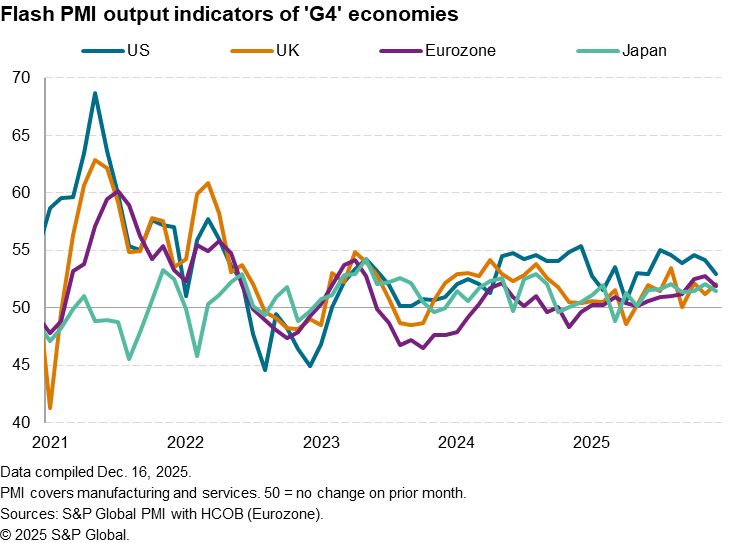

S&P Global's flash PMI surveys showed output rising across all four largest developed economies (the "G4") for an eighth successive month in December. However, while the US continued to lead the expansion, as has been the case for much of the past two years, its outperformance has narrowed to the smallest seen over these past eight months. Furthermore, the forward-looking new orders index comparisons now show the US to be the worst performer of the G4 in December, with demand reportedly impacted in part by tariff-related price rises.

US outperformance wanes

Measured across both goods and services, S&P Global's flash PMI data showed output rising in all four largest developed economies for an eighth successive month in December. The strongest expansion was reported by the US, as has been recorded in all bar two of the past 20 months, despite its rate of expansion moderating for a second successive month to the lowest since June.

Growth rates also slowed in the eurozone and Japan, albeit merely to three- and two-month lows respectively. However, eurozone growth notably remained one of the strongest seen over the past two and a half years, and Japan's expansion remained above than the average seen over the past two years. Growth meanwhile accelerated in the UK to second-highest recorded over the past 15 months.

As a result, the gap between the US and the next best performer in the G4 - the UK - closed to the narrowest for eight months, and the US's outperformance relative to the G4 weighted average is now down to the lowest for eight months.

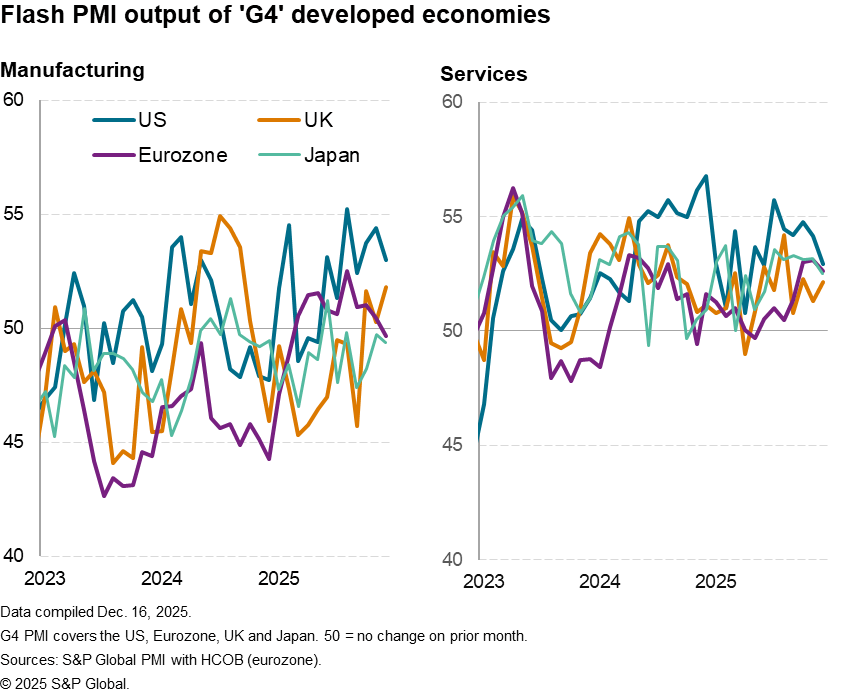

Helping to close the gap with the US was a slowing of manufacturing output growth in the US combined with the fastest rise in UK manufacturing output for 15 months. However, factory output fell marginally in both the eurozone and Japan, the former dropping for the first time since February. This renewed weakening was in part attributable to the fading impact of European exporters seeking to front-run US tariffs, which had buoyed US imports earlier in the year.

The fading of the US' outperformance was even more noticeable in the services economy, where US business activity growth cooled to a six-month low to now run only marginally higher than the rates seen in both the eurozone and Japan. While the UK lagged in terms of service sector performance in the G4, it nonetheless was the only economy to report faster growth.

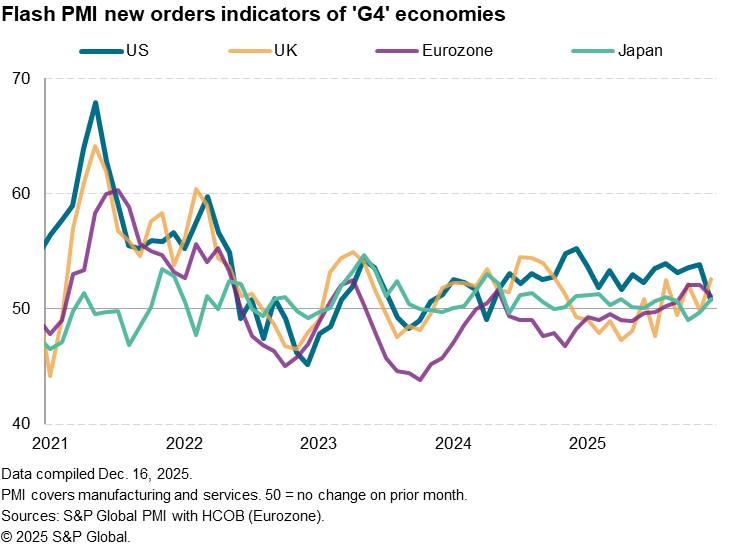

US now lags G4 in terms of new orders growth

The slowdown in the US was fueled by a steep cooling in new orders growth. Across goods and services, new business inflows in the US during December were the lowest since a drop in orders had been reported back in April 2024.

Although new orders likewise grew at a reduced rate in the eurozone during December, renewed upturns were seen in both the UK and Japan. The US consequently reported the smallest improvement in new orders of the G4 economies for the first time since that drop in orders recorded back in April 2024.

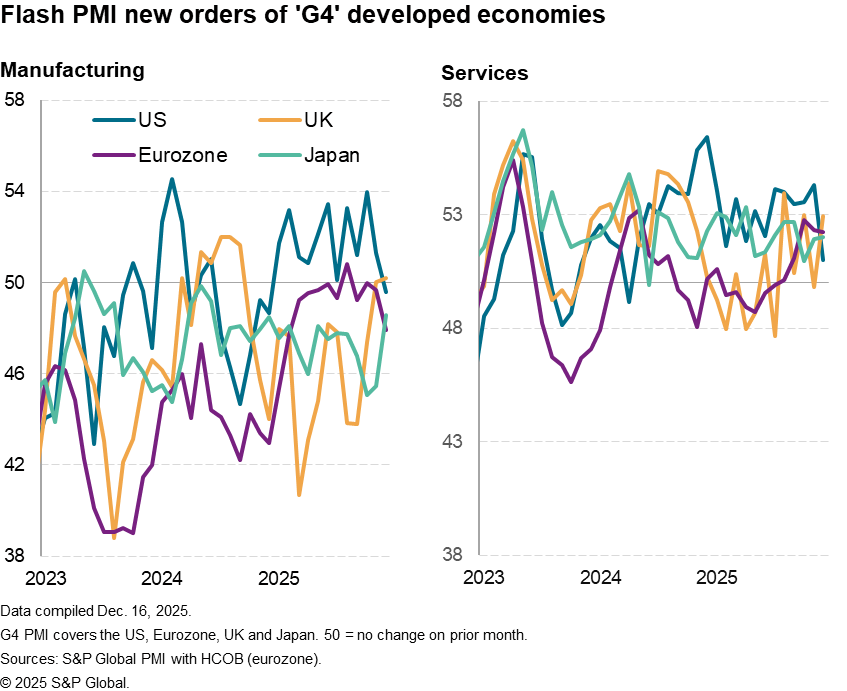

While the US had stood out in reporting robust manufacturing order book growth over the first 11 months of 2025, that changed in December with the first drop in new orders since late 2024. In contrast, UK factory new orders rose, albeit only marginally, for the first time since September 2024. Further declines, however, were reported in Japan and the eurozone.

In terms of service sector new business inflows, US companies reported a steep slowing of growth to the weakest since April 2024, dropping below rates of increase being reported in the UK, eurozone and Japan.

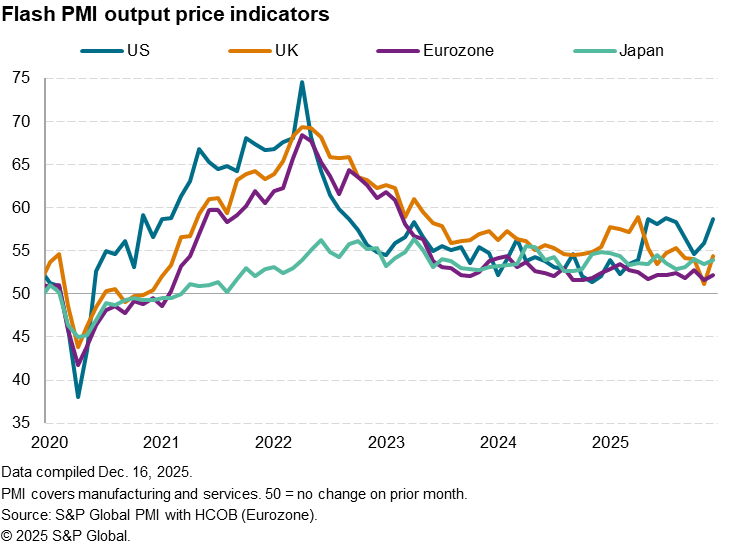

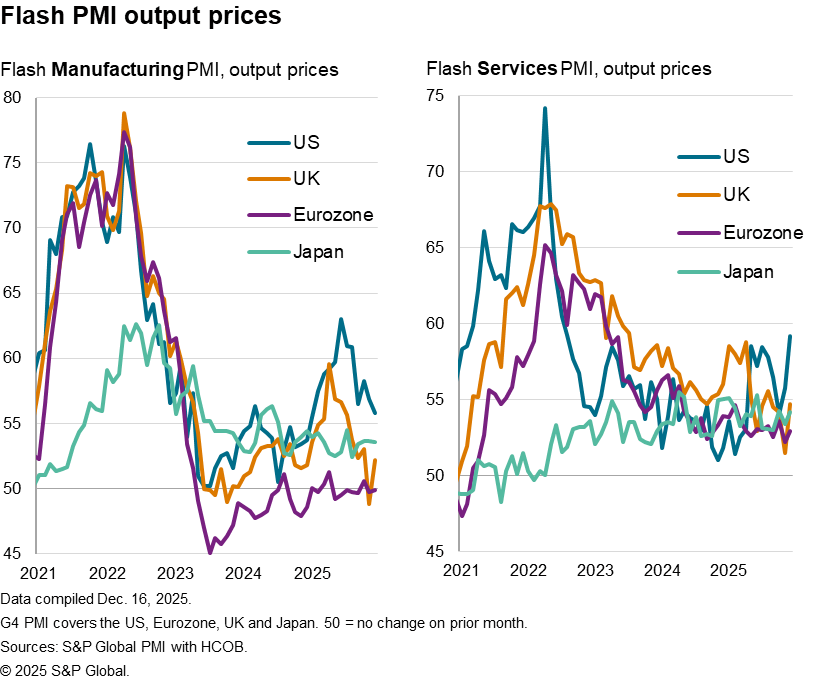

US demand hit by affordability

Part of the deterioration in demand growth for US goods and services could be attributed to higher prices, according to anecdotal evidence collected in the December surveys. This corresponded with a steep increase in average prices charged by manufacturers and service providers during the month. Measured overall, US prices rose at a one of the fastest rates recorded since the pandemic price surge seen in 2022. In contrast, price rises were far more muted in the other G4 economies, albeit ticking higher in all cases.

US prices have risen at a far greater rate than in the other major developed economies over the past eight months. Anecdotal reporting from PMI respondents shows that tariffs have been cited as the principal cause of these higher US prices over this period, with an initial impact on manufacturing prices now feeding through to prices charged for US services.

Access the US, UK, Eurozone and Japan Flash PMI press releases.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-show-us-demand-growth-falling-behind-Dec25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-show-us-demand-growth-falling-behind-Dec25.html&text=Flash+PMIs+show+US+demand+growth+falling+behind+all+other+major+developed+economies+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-show-us-demand-growth-falling-behind-Dec25.html","enabled":true},{"name":"email","url":"?subject=Flash PMIs show US demand growth falling behind all other major developed economies | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-show-us-demand-growth-falling-behind-Dec25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMIs+show+US+demand+growth+falling+behind+all+other+major+developed+economies+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-show-us-demand-growth-falling-behind-Dec25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}