Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 03, 2018

Thailand PMI survey shows deteriorating manufacturing conditions in March

- Manufacturing PMI falls to 49.1 in March from 50.9 in February, first deterioration since last October

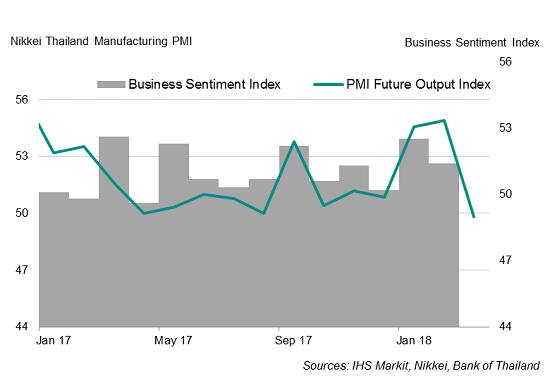

- Business sentiment turns negative for first time in survey history

- Export growth weakens further

Thailand’s manufacturing economy ended the first quarter on a low, with the Nikkei PMI data signalling a deterioration in business conditions for the first time since last October. Perhaps more concerning was that business confidence turned negative for the first time in the survey history.

Poor end to first quarter

The Nikkei Thailand Manufacturing PMI™ fell to 49.1 in March from 50.9 in February, marking the first deterioration in the health of the sector for five months. The headline PMI provides a single-figure snapshot of the health of the manufacturing sector, deriving its reading from questions on output, new orders, employment, inventories and supply chains.

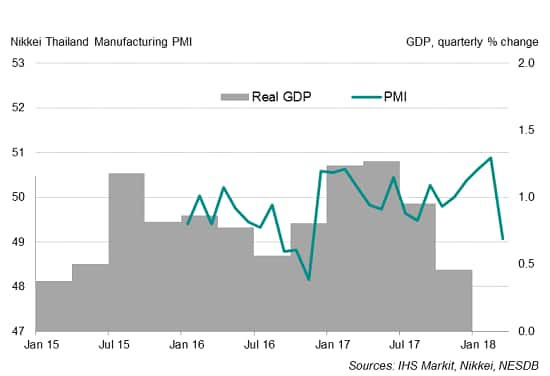

Thailand PMI and economic growth

Although the survey data showed Thai factories enjoying the best quarter in a year based on the average PMI reading for the first three months of 2018, the March dip in the index suggests the sector has lost momentum as it heads into the second quarter.

Gloomy outlook

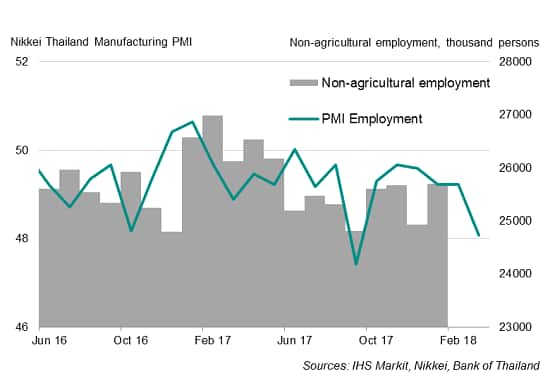

Other survey indicators point to gloomy prospects on the horizon. Output, new orders and employment all fell. Inventories were also depleted for the first time this year, with anecdotal evidence revealing cost cutting measures and efforts to boost sales by selling off inventories cheaply.

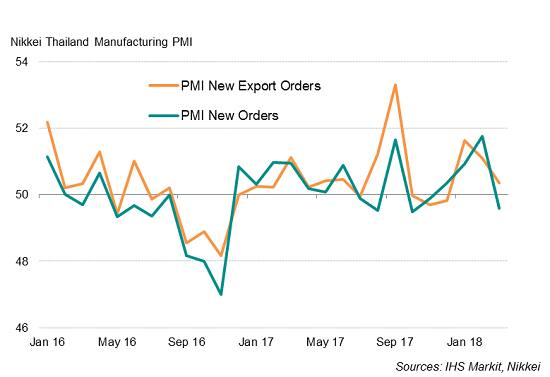

Weakening demand for Thai goods

Thailand PMI and employment

The renewed downturn dented business confidence. March saw the number of firms turning negative about the outlook outnumbering the optimists, suggesting firms on balance anticipating lower output in the year ahead. Part of that pessimism is likely due to slower export growth.

Thailand PMI v business sentiment

March data showed a softer increase in export sales for a second month running, with the pace of growth now only marginal.

Furthermore, the recent appreciation of the baht could affect future export sales. The government’s trade policy and strategy office cautioned that Thai exporters’ income could come under pressure if the baht continues to strengthen. Thai baht has risen around 4% against the US dollar since the start of the year, strengthening 0.6% in the first three weeks of March.

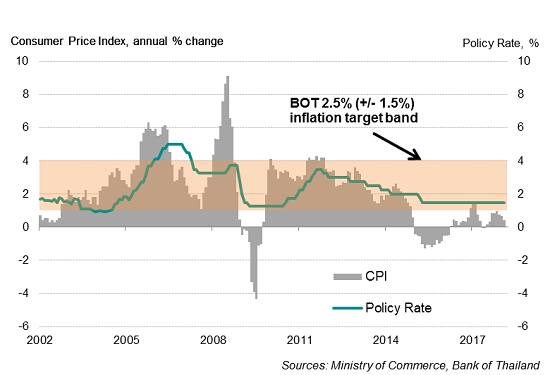

Monetary policy

Inflationary pressures in the manufacturing sector also cooled noticeably in March, following solid increases in February. The strength of the baht is likely suppressing imported inflation, suggesting that any increases in consumer prices will remain subdued in coming months.

While headline inflation, at 0.4%, is running below the central bank’s target range of 1.0–4.0%, further monetary easing is widely thought to be unlikely as the Bank of Thailand expects fiscal policy to play a larger role in stimulating the economy.

Thailand monetary policy and inflation

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-survey-deteriorating.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-survey-deteriorating.html&text=Thailand+PMI+survey+shows+deteriorating+manufacturing+conditions+in+March","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-survey-deteriorating.html","enabled":true},{"name":"email","url":"?subject=Thailand PMI survey shows deteriorating manufacturing conditions in March&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-survey-deteriorating.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Thailand+PMI+survey+shows+deteriorating+manufacturing+conditions+in+March http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-survey-deteriorating.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}