Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 22, 2018

Eurozone PMI slides to 14-month low as economy loses growth momentum

- Flash PMI slides to lowest since January 2017 in broad-based easing

- Supply-side constraints curb output growth

- Export order book growth slumps

Eurozone business activity grew at its slowest rate for over a year in March, according to the flash IHS Markit Eurozone PMI. At 55.3, down from 57.1 in February, the headline output index reading was the lowest since January of last year and signalled a second successive monthly easing in the rate of expansion. The reading was below all analysts’ estimates polled by Reuters.

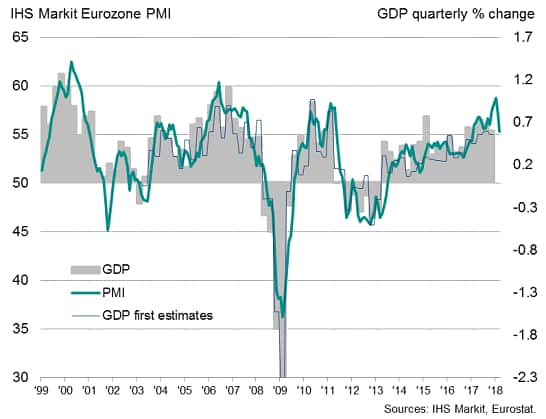

Eurozone PMI v GDP estimates

Although it should be remembered that January’s reading had been the highest since June 2006, and the first quarter average PMI reading remains relatively robust, indicative of GDP rising by 0.7-0.8%, the loss of momentum since the buoyant start to the year has been dramatic.

Broad-based slowdown

Services saw business activity grow at the slowest rate for five months, while factory output increased at the weakest rate since January 2017. Both sectors also saw new order inflows wane, with goods export orders showing the smallest rise since November 2016. Measured overall, inflows of new orders showed the smallest monthly increase seen over the past 14 months.

By country, output growth slowed to a seven-month low in France and to an eight-month low in Germany, while the rest of the single currency area as a whole registered the weakest increase for five months.

Growing pains

At least some of the slowing may be ascribed to bad weather in some northern regions and, perhaps more importantly, ‘growing pains’ resulting from the strength of the recent growth spurt. Supply chain delays and raw material shortages were often reported to have stymied production in manufacturing (delays in German supply chains are currently more widespread than at any time in the survey’s 22-year history).

Despite employment continuing to rise at one of the fastest rates seen over the past 17 years in March, both manufacturing and services sectors also saw activity being curtailed by growing incidences of skill shortages. Backlogs of work continued to rise as a result of these growth constraints.

Price hikes

A consequence of supply shortages has been upward price pressures. Sharply rising input costs, linked to increasing raw material prices and higher wages, again led to a historically marked rise in average selling prices for goods and services. Although rates of inflation cooled for a second month in a row, in part linked to cheaper imports arising from the euro’s strength, both costs and selling prices continued to rise at some of the fastest rates seen over the past seven years. In some cases, higher prices are likely to have stymied demand.

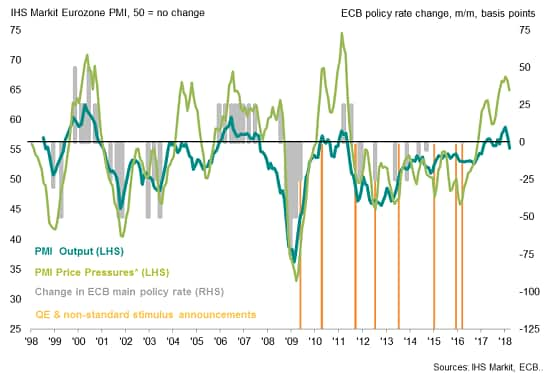

Eurozone PMI and ECB policy changes

* A blended index of input price and supply chain pressures.

Export strain

However, when seeking explanations for the sharp growth slowdown, other factors are clearly at play. The fact that the survey’s measure of export order book growth has more than halved since the end of last year suggests the stronger euro is taking an increasing toll on export performance. Survey responses also highlighted how political uncertainty also appears to have intensified, dampening demand.

Disentangling the interplay of the various factors reported to have led to the steeper-than-expected slowdown in March is of course difficult and open to interpretation. April’s data will therefore be crucial in determining the extent to which underlying growth and demand have waned, and will therefore provide a clearer policy prescription to the European Central Bank.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-pmi-slides-to-14-month-low-as-economy-loses-growth-momentum.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-pmi-slides-to-14-month-low-as-economy-loses-growth-momentum.html&text=Eurozone+PMI+slides+to+14-month+low+as+economy+loses+growth+momentum","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-pmi-slides-to-14-month-low-as-economy-loses-growth-momentum.html","enabled":true},{"name":"email","url":"?subject=Eurozone PMI slides to 14-month low as economy loses growth momentum&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-pmi-slides-to-14-month-low-as-economy-loses-growth-momentum.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+PMI+slides+to+14-month+low+as+economy+loses+growth+momentum http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-pmi-slides-to-14-month-low-as-economy-loses-growth-momentum.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}