Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 04, 2018

Chinese economic growth loses momentum at end of first quarter

- Caixin Composite PMI Output Index slips to 51.8 in March, down from 53.3 in February

- Employment falls as services jobs growth slows

- Mixed outlook with slower new business growth but strong confidence towards the 12-month outlook

March PMI survey data signalled a noticeable loss of momentum in China’s economic growth, raising questions over whether business activity will expand at a slower pace in coming months after a stronger than expected start to the year. The latest upturn was also accompanied by a renewed fall in employment.

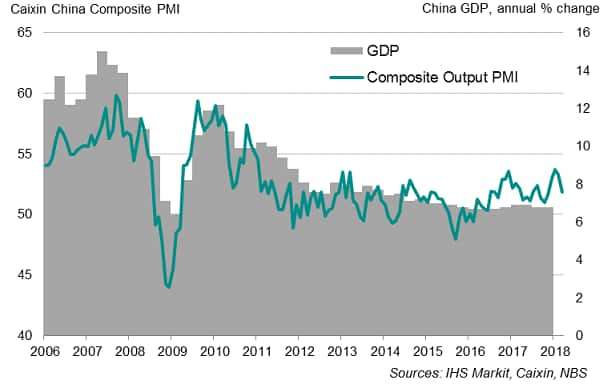

Best quarter since Q4 2016

The Caixin Composite PMI™ Output Index fell from 53.3 in February to 51.8 in March, signalling a modest improvement in the health of the economy. Despite the decline, the strong performance in the previous two months means the average PMI reading for the first quarter was the highest for over a year. However, the latest data paint a markedly different picture to prior months, suggesting growth momentum has been lost to a significant extent.

China PMI and economic growth

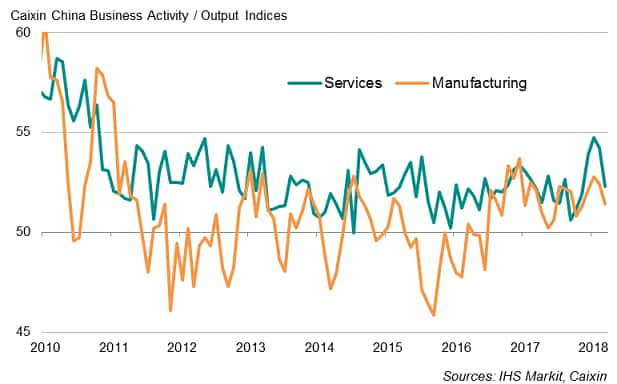

While growth remained broad-based, the pace of expansion in both manufacturing output and services activity slowed in March. Softer increases in business activity coincided with weaker new business growth in both monitored sectors, calling into question whether further momentum could be lost in the months ahead.

Broad-based upturn

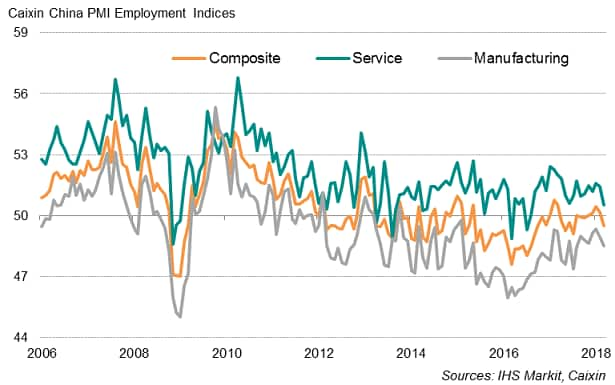

Weak employment

Additional concerns about the outlook are flagged by the deteriorating labour market. March survey data showed the first drop in overall employment numbers since last October, contrasting with the broad stabilisation seen in prior months. While mild, the pace of contraction was the fastest since July last year. Services job gains were insufficient to offset a steeper rate of job shedding in the manufacturing sector. Employment in the service sector rose at the weakest pace for 19 months.

China employment

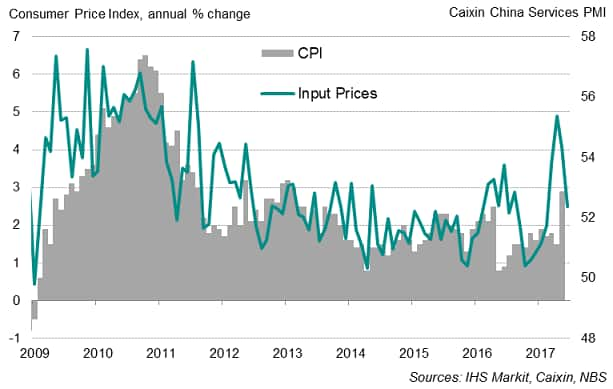

Cooling inflation

There were further signs of easing cost pressures at the end of the first quarter. March saw a marked slowdown in the growth of input costs, with inflation running at the weakest for eight months. With a steady rise in average selling prices reported during the month, slower cost inflation placed less pressure on companies’ profit margins, which ought to bolster their ability to service debts.

Higher costs were mainly linked to increased prices for raw materials, in particular metals.

China PMI and consumer inflation

Outlook

The outlook appears mixed. Growth in composite new orders softened to a six-month low, but business expectations of output in the year ahead improved to the highest since June 2017.

The government recently announced a GDP growth target of around 6.5% this year, down from the actual expansion of 6.9% in 2017. It also reaffirmed commitments to further cut industrial overcapacity and reduce pollution, both of which are widely expected to weigh on output from the heavy industrial sector.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economic-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economic-growth.html&text=Chinese+economic+growth+loses+momentum+at+end+of+first+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economic-growth.html","enabled":true},{"name":"email","url":"?subject=Chinese economic growth loses momentum at end of first quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economic-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+economic+growth+loses+momentum+at+end+of+first+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinese-economic-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}