Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 01, 2021

Global manufacturing subdued by supply constraints, but pressures from Delta wave show signs of easing

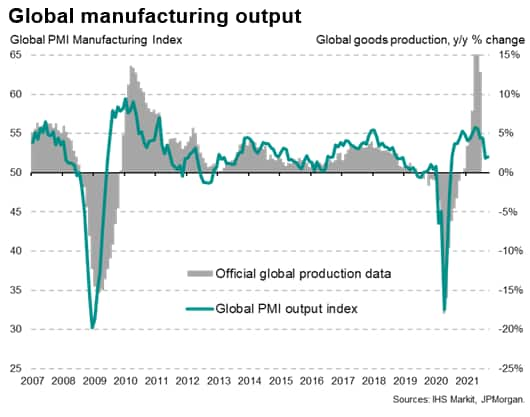

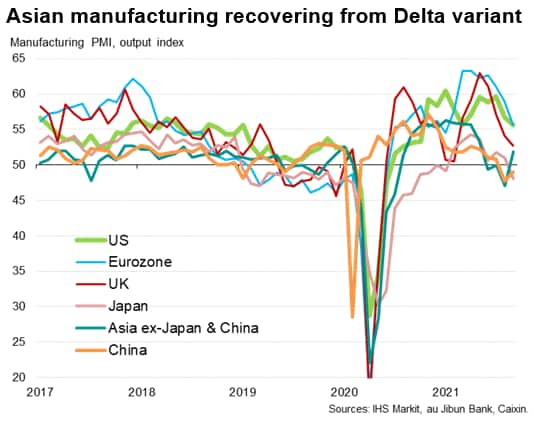

The pace of manufacturing output growth steadied in September after hitting the lowest for over a year in August, though was kept subdued by supply chain delays and labour shortages linked primarily to the pandemic. However, tentative signs of output reviving in parts of Asia that were hard hit by the COVID-19 Delta wave have been evident, and producers' expectations for growth over the coming year remain encouragingly positive, providing hints that underlying demand will support stronger output growth as bottlenecks ease.

Global output growth inches higher…

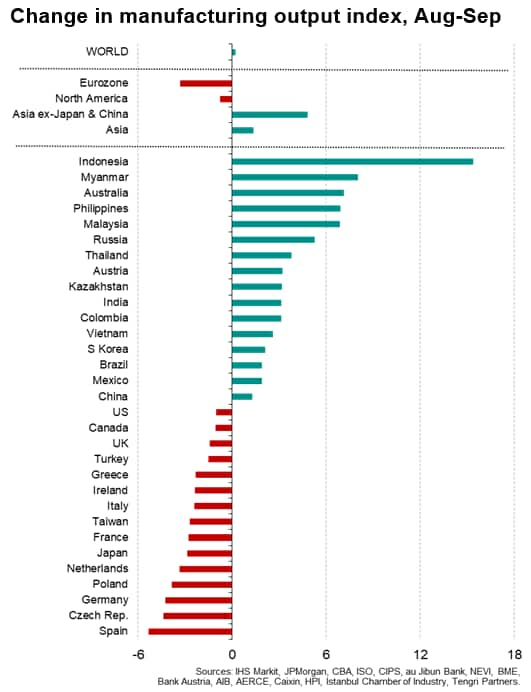

Global manufacturing output growth picked up in September from the 14-month low witnessed in August. Although marginal, the improvement was notable in representing the first acceleration of output growth since April to hint at a possible halting or pausing of the recent slowdown.

… but supply constraints widely reported

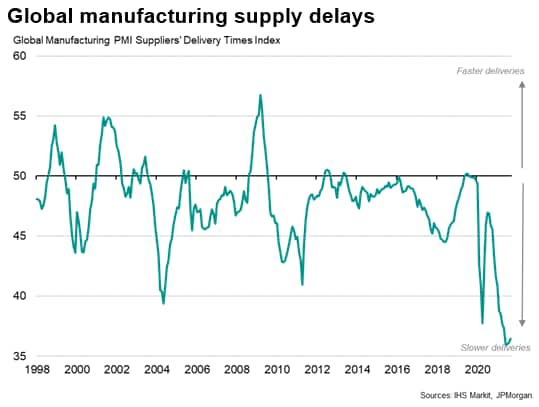

However, the rate of expansion remained below the average seen in the decade leading up to the pandemic, underscoring the ongoing pressures being felt by producers. In particular, suppliers' delivery times continued to lengthen globally at a rate unprecedented over almost a quarter of a century of survey history outside of the prior three months, albeit with the rate of deterioration easing slightly during the month.

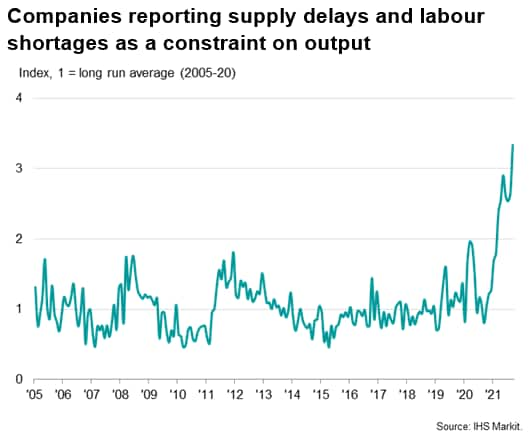

Some firms, notably in the US and the UK, also report output to have been constrained by a lack of labour. Output growth consequently slowed in the US, Canada, Eurozone and the UK, with firms often explicitly citing shortages as the principal or contributing factor to lower production. Globally, the number of firms reporting that production has fallen due to supply chain delays or labour shortages is running at over three times the long run average; a proportion greatly exceeding anything seen before the pandemic.

Asian manufacturing: less of a drag

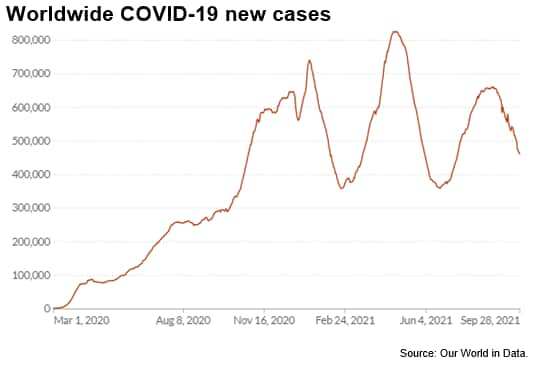

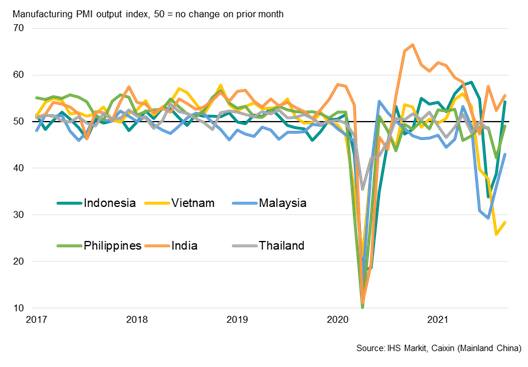

There are signs, however, that some pressure from the supply-side constraints may soon start to ease. COVID-19 case numbers are falling globally after a third wave, caused primarily by the Delta variant, which appeared to have peaked in late August.

This easing in case numbers has allowed some key economies - notably those with low vaccination rates - to relax some onerous pandemic-fighting restrictions, which in turn allowed economic activity to rebound, or at least deteriorate less steeply.

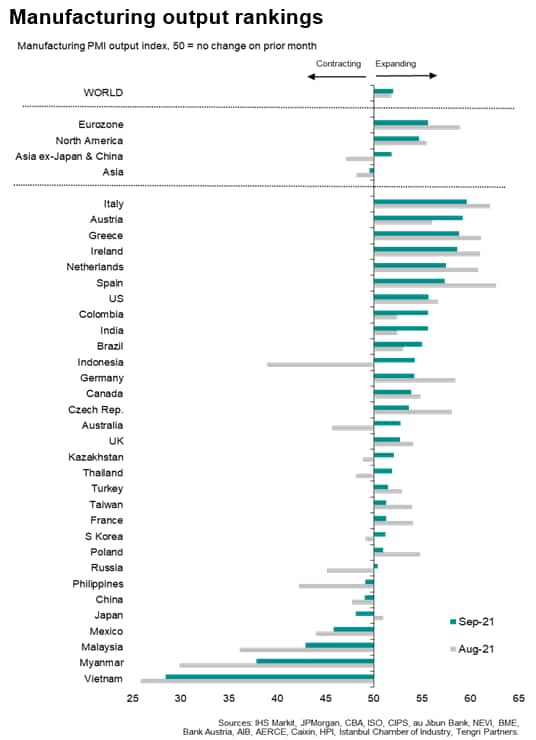

Most notably, manufacturing output growth in Asia excluding China and Japan returned to growth for the first time in four months in September, led by a sharp rebound in activity in Indonesia and marked moderations in rates of contraction in the Philippines, Malaysia and Thailand, and more modest easings in Vietnam and South Korea. Production also fell at a reduced rate in mainland China with a return to growth in Australia adding to a brightening picture across the APAC region.

Unpicking the demand situation

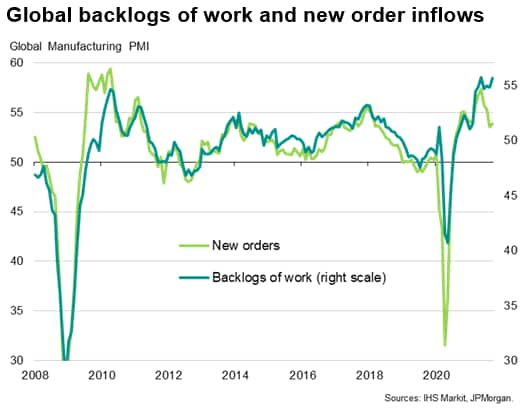

What remains unclear from the available economic data so far, however, is the extent to which underlying demand has remained resilient. While shortages have meant global backlogs of uncompleted orders have risen at unparalleled rates in recent months, with another new survey high seen in September, new order inflows have weakened considerably. New orders rose globally at the slowest rate for a year in August, with the rate of increase picking up only very modestly in September.

Some of this slowdown in demand is due to the shortages - auto producers, for example, faced with a lack of semiconductors are cutting production and hence also buying fewer other components. However, some of the demand slowdown will inevitably reflect a cooling of demand after the initial surge seen in the second quarter as economies reopened, and some of the slowdown will be linked to the switching of consumer spending from goods to services as economies reopen.

Future expectations: down but not out

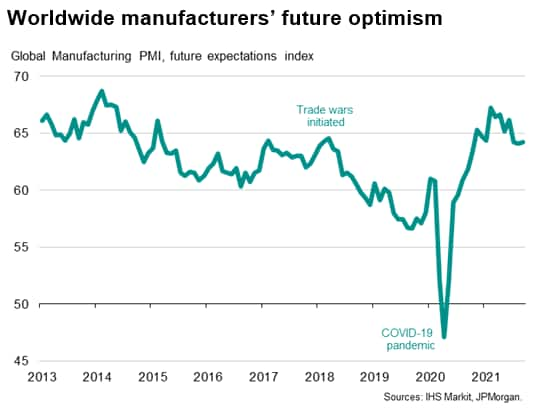

Quantifying the impact of these various factors on demand remains difficult, but some encouragement can be gleaned from manufacturers' expectations about growth in the year ahead, which remains elevated by historical standards (broadly in line with the level of optimism seen globally just prior to the trade war escalation in 2018). Such solid optimism suggested that companies are expecting demand to remain firm in the coming 12 months, allowing production to accelerate again once supply conditions improve.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-subdued-by-supply-constraints-but-pressures-from-delta-wave-show-signs-of-easing-Oct21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-subdued-by-supply-constraints-but-pressures-from-delta-wave-show-signs-of-easing-Oct21.html&text=Global+manufacturing+subdued+by+supply+constraints%2c+but+pressures+from+Delta+wave+show+signs+of+easing+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-subdued-by-supply-constraints-but-pressures-from-delta-wave-show-signs-of-easing-Oct21.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing subdued by supply constraints, but pressures from Delta wave show signs of easing | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-subdued-by-supply-constraints-but-pressures-from-delta-wave-show-signs-of-easing-Oct21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+subdued+by+supply+constraints%2c+but+pressures+from+Delta+wave+show+signs+of+easing+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-subdued-by-supply-constraints-but-pressures-from-delta-wave-show-signs-of-easing-Oct21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}