Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 26, 2015

Flash PMI surveys paint downbeat picture of global manufacturing

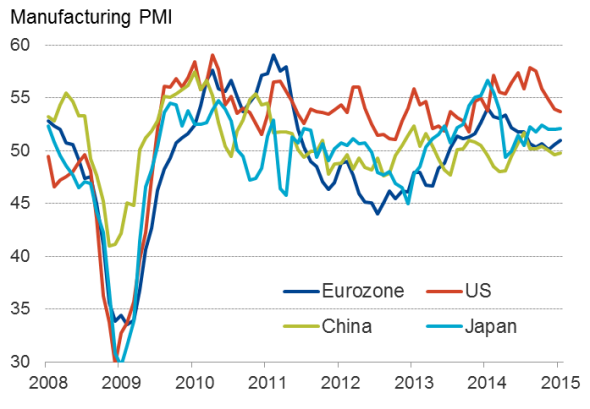

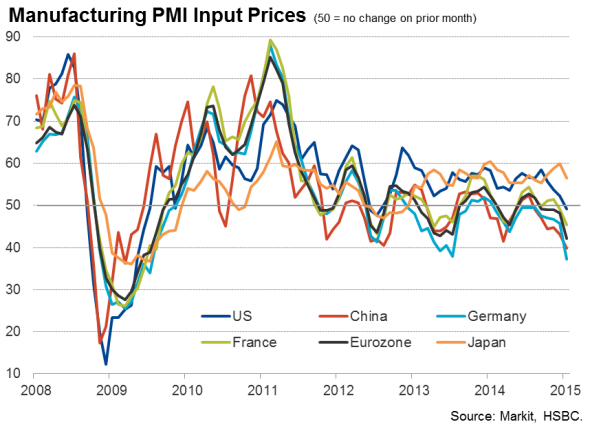

Markit's flash manufacturing PMI data for January revealed the first insight into global economic trends at the start of the year, and provided little cause for celebration. Alongside recent falls in inflation rates globally, the downbeat picture of the global economy painted by the surveys suggests that policymakers in the US and UK will be in no rush to tighten policy, and that policymakers elsewhere will be worried about further malaise sinking in.

Signs of life in the euro area

The ongoing weakness of the eurozone PMI in January added further validation to the European Central Bank's decision on 22 January to announce full-scale quantitative easing. Although the survey data showed a slight gain in momentum in the eurozone, adding to hopes that the recent oil price slide and weakening of the euro are already filtering through to the benefit of manufacturers, the rate of expansion remained disappointingly modest. The flash manufacturing PMI read just 51.0, up from 50.6.

Eurozone growth should continue to pick up, however, following the bolder than expected action from the ECB. The central bank announced €60bn of asset purchases per month, to include mainly government bonds, until inflation expectations had returned to more normal levels and at least until September 2016.

China's factories stuck in low gear

A further marginal contraction of China's manufacturing economy meanwhile fuelled expectations that Beijing may also need to do more to achieve a growth target of even 7.0% in 2015. China's factories reported a marginal deterioration in business conditions for a second month running in January.

Flash Manufacturing PMI

At 49.8, the HSBC Manufacturing PMI mustered only a marginal rise from December's seven-month low of 49.6. New orders rose marginally during the month, improving on the slight decline seen in December but remaining weaker than the prior six months and suggesting little likelihood of stronger production trends in the near term.

Sluggish recovery in Japan

In Japan where the printing presses are already working hard to double the size of the country's monetary base to help defeat deflation, the PMI survey provided welcome signs of ongoing growth in January. The headline PMI edged up from 52.0 to 52.1. The data added to indications that the economy has returned to steady growth after falling into recession following last year's sales tax rise.

However, the rate at which Japan's export orders are increasing remained somewhat disappointing given the extent of the yen's slide over the past year (and the boost to competitiveness this has supposedly provided). Similarly, factory output growth is far from stellar, suggesting the authorities may yet seek further stimulus in coming months, especially if inflation (down from 2.9% in October to 2.4% in November) continues to fall. Japan's inflation numbers for December are published on 30 January.

Uncertainty over US outlook

With policy being loosened in the eurozone, and the potential for further stimulus likely in China and Japan, while at the same time the Bank of England's 'hawks' have withdrawn their calls for rate hikes, the big outlier in terms of policy is the US.

Markets are still pricing in the first interest rate hike by the FOMC for mid-2015. The PMI data do not contradict this: although slowing, the overall rate of expansion signalled by the flash manufacturing PMI in the US remained relatively robust and well above that seen in other major economies. Importantly, it was also strong enough to generate another month of solid job creation. However, growth continued to weaken in January, with the manufacturing PMI falling from 53.9 to 53.7, its lowest for a year. With growth in new order inflows also hitting a one-year low, a further slowdown appears to be on the cards in February.

The surveys therefore suggest that the main engine of the global economic recovery is losing some power. More will become clear this week, with three important US releases. First, Markit published its flash services PMI for January on 27 January, which will provide a more comprehensive picture of the health of the economy at the start of the year.

The slowing in the economy indicated late last year should start to show up in the GDP data for the fourth quarter (published 30 January), though the impact may not become fully apparent until the first quarter of this year. Any signs of the official data confirming the slowdown as signalled by the PMI surveys will inevitably cause the FOMC members to push back their rate calls, and it will be interesting to see if any signs of the slowdown are already feeding through to FOMC sentiment when it releases its policy statement on 28 January.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26012015-Economics-Flash-PMI-surveys-paint-downbeat-picture-of-global-manufacturing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26012015-Economics-Flash-PMI-surveys-paint-downbeat-picture-of-global-manufacturing.html&text=Flash+PMI+surveys+paint+downbeat+picture+of+global+manufacturing","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26012015-Economics-Flash-PMI-surveys-paint-downbeat-picture-of-global-manufacturing.html","enabled":true},{"name":"email","url":"?subject=Flash PMI surveys paint downbeat picture of global manufacturing&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26012015-Economics-Flash-PMI-surveys-paint-downbeat-picture-of-global-manufacturing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMI+surveys+paint+downbeat+picture+of+global+manufacturing http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26012015-Economics-Flash-PMI-surveys-paint-downbeat-picture-of-global-manufacturing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}