Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 23, 2015

US flash PMI signals weakest manufacturing expansion for a year

Business conditions continued to improve among US factories at the start of the year, though the rate of growth continued to cool from the scorching pace seen in the summer months in a further sign of the economy slowing. Markit's Flash U.S. Manufacturing PMI" fell from 53.9 in December to a 12-month low of 53.7 in January.

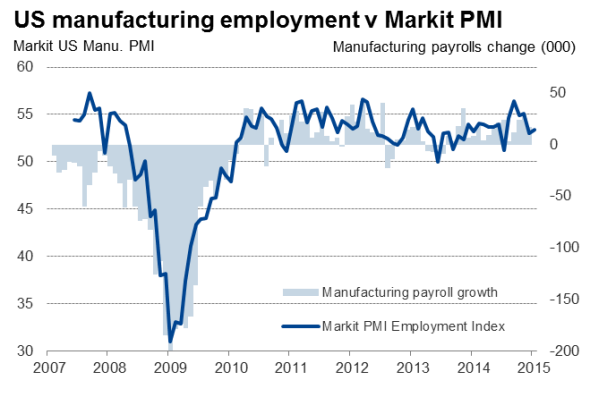

The slowdown is being led by a weakening inflow of new orders, which also hit a 12-month low, but the good news is that demand remained strong enough to drive yet another month of robust job creation.

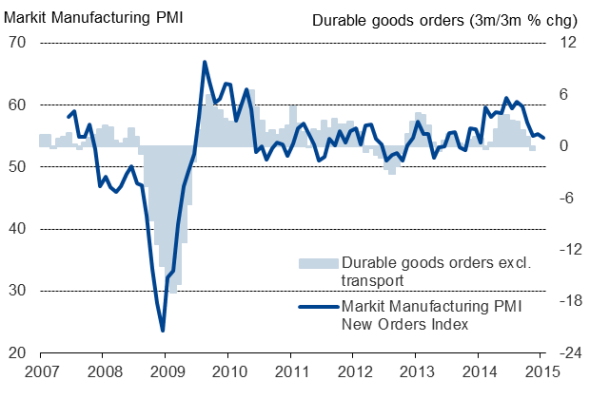

The recent descent of the PMI's New Orders Index has been followed by a similar deterioration in the official data on durable goods orders, which is one of the few official indicators (alongside retail sales) that is currently flashing a warning light on a potential slowdown in the US economy.

Factory orders

Employment growth, on the other hand, has been more resilient, though is likewise showing signs of beginning to cool. Official non-farm payroll data recorded a robust 23k average monthly rise in the fourth quarter, a rate of growth that was anticipated by the PMI's Employment Index. The index suggests the rate of job creation will have slowed slightly at the start of the year, but remained in the order of 10k.

Prices fall

Producers are meanwhile benefitting from the recent oil price slide, which helped reduce overall input costs for the first time for two-and-a-half years in January. Selling prices continue to rise, but only modestly, with the rate of increase down considerably compared to that seen in the Fall, and further downward pressure is likely in coming months as lower input costs feed through the production chain.

Rate rises could be pushed back

Ongoing growth of output and employment signalled by the survey suggest that the process of gradually raising interest rates to more normal levels could be underway by mid-year, as markets are currently anticipating.

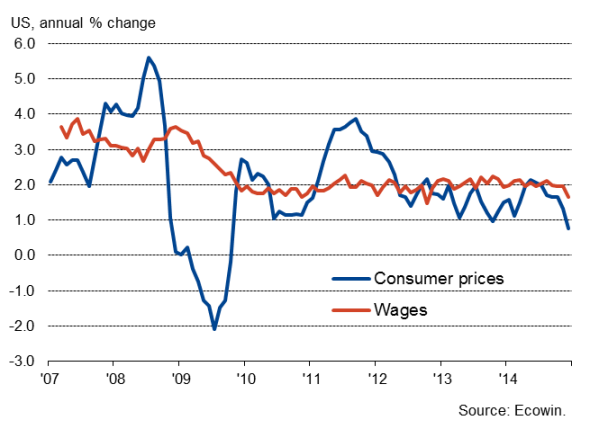

However, lower manufacturing costs resulting from the recent oil price rout should drive inflation (already at a five-year low of 0.8% in December) down further in coming months, providing policymakers with greater leeway to ensure the process of tightening policy is very gradual, keeping interest rates low for longer.

Furthermore, with wage growth also showing a surprise slide to 1.7% in December, it may not take much in the way of a further slowdown in the economy to cause markets to start pricing in later rate rises.

Wages and inflation

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012015-Economics-US-flash-PMI-signals-weakest-manufacturing-expansion-for-a-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012015-Economics-US-flash-PMI-signals-weakest-manufacturing-expansion-for-a-year.html&text=US+flash+PMI+signals+weakest+manufacturing+expansion+for+a+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012015-Economics-US-flash-PMI-signals-weakest-manufacturing-expansion-for-a-year.html","enabled":true},{"name":"email","url":"?subject=US flash PMI signals weakest manufacturing expansion for a year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012015-Economics-US-flash-PMI-signals-weakest-manufacturing-expansion-for-a-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+PMI+signals+weakest+manufacturing+expansion+for+a+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23012015-Economics-US-flash-PMI-signals-weakest-manufacturing-expansion-for-a-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}