Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 27, 2015

UK economic growth slows at year-end

The pace of economic growth slowed at the end of 2014, but remained encouragingly robust. There are lots of reasons to believe that growth could pick up again in a favourable environment of rising wages, low inflation and low interest rates, meaning the UK should enjoy another year of solid economic growth in 2015.

However, there are several key risks to the outlook which could cause growth to disappoint. Policymakers will need to be watching these risks closely and the concern is that, with interest rates already at a record low, options to effectively stimulate the UK economy are limited if further action is required.

Fourth quarter slowdown

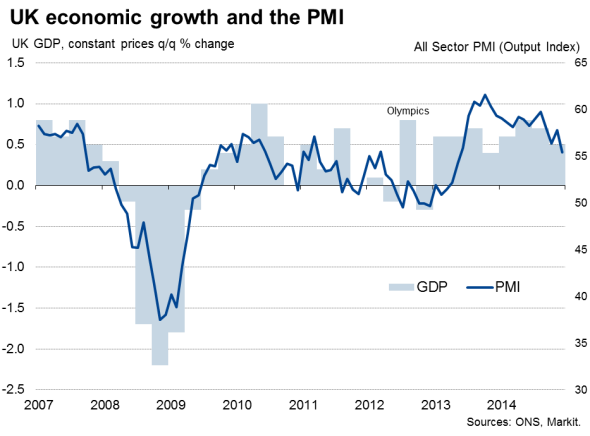

Gross domestic product rose 0.5% in the final quarter of 2014, according to the Office for National Statistics. The increase was the smallest seen since the final quarter of 2013, but is nevertheless a reasonably robust rise by historical standards. The increase means the UK enjoyed a 2.6% expansion of the economy for the year as a whole, which is the best performance since 2007 and up from 1.7% in 2013.

The slowing in the rate of expansion was widely expected following downbeat business surveys late last year. The December Markit/CIPS PMI surveys collectively signalled the weakest rate of expansion of business activity since May 2013, flagging up a 0.5% increase in fourth quarter GDP, though the consensus among economists polled by Thomson Reuters was for a 0.6% expansion.

Favourable outlook

There are good reasons to believe that growth could pick up as we move through 2015. First, wage growth, a key missing ingredient to the recovery in previous years, is showing signs of picking up and unemployment continues to fall.

With inflation down to a fourteen-and-a-half year low of 0.5%, wages are also rising in real terms at the fastest rate since 2008.

Low inflation also means expectations of when the Bank of England will start to raise interest rates have been pushed back. Until recently, 2015 was widely expected to be the year in which rates start to rise, but it is now looking increasingly likely that hikes could be delayed until 2016, especially after previously 'hawkish' policymakers on the Monetary Policy Committee withdrew their calls for rate hikes at their January meeting.

The favourable environment of rising incomes, falling inflation, low oil prices and low interest rates has pushed household financial optimism to a post-crisis high at the start of the year, which should boost the economy via further increases in consumer spending.

Meanwhile, the outlook for the eurozone economy has improved following recent ECB action, which should in turn foster greater business and consumer confidence globally. Overseas trade should therefore also pick up this year, benefitting UK exporters.

Unbalanced growth

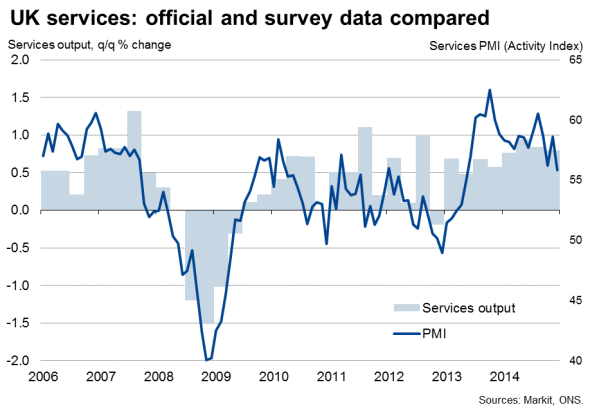

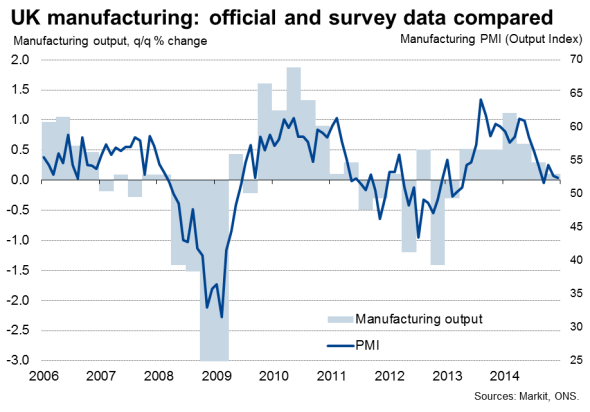

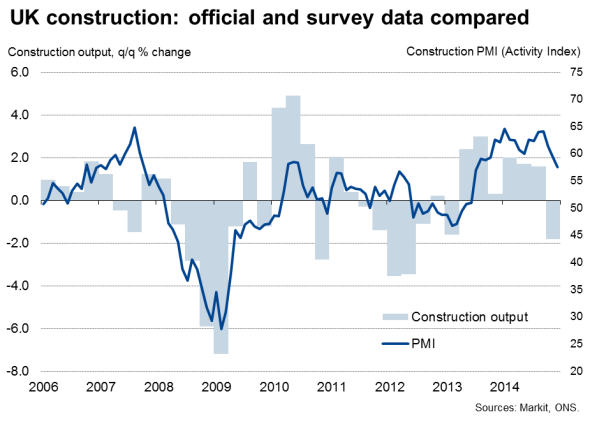

However, until exports pick up, growth is looking unbalanced, and once again all-too dependent upon the consumer. Retail sales rose at the fastest rate for a decade in the fourth quarter, helping the domestically-focused service sector enjoy a 0.8% expansion in the three months to December, the pace of expansion showing no signs of waning compared to the third quarter. Industrial production, in contrast, fell 0.1%, registering its first decline since late-2012. Manufacturing mustered a mere 0.1% increase in output. Construction output meanwhile fell, dropping 1.8%. However, the latter is notoriously volatile and little weight should be put on this downturn at present, especially as the decline conflicts with more buoyant survey data.

Key risks

There are also risks to the outlook which could cause growth to disappoint this year. The eurozone is potentially entering a new phase of political uncertainty arising from the anti-austerity Syriza party victory in Greece. The upcoming General Election in the UK also poses a threat to stability in the event of an inconclusive outcome. There's also the possibility of financial market stress if the US starts to hike interest rates later this year, and geopolitical risks such as the escalation of the Russian-Ukraine crisis likewise pose a threat to global stability.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-Economics-UK-economic-growth-slows-at-year-end.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-Economics-UK-economic-growth-slows-at-year-end.html&text=UK+economic+growth+slows+at+year-end","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-Economics-UK-economic-growth-slows-at-year-end.html","enabled":true},{"name":"email","url":"?subject=UK economic growth slows at year-end&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-Economics-UK-economic-growth-slows-at-year-end.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+economic+growth+slows+at+year-end http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27012015-Economics-UK-economic-growth-slows-at-year-end.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}