Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 22, 2017

UK economy sees strong end to the year, but cracks appear

News of faster than previously estimated growth at the end of last year confirmed the economy's overall resilience after the summer Brexit vote. But cracks are appearing to suggest that growth will slow in 2017.

Strong end to 2016

The UK economy grew 0.7% in the final quarter of 2016, according to data from the Office for National Statistics, revised higher from a prior estimate of 0.6%. However, revisions mean the economy now grew 1.8% in 2016, less than the 2.0% previously thought.

The news of faster than previously thought growth at the end of last year is marred by worrying signs about the durability of the upturn. A slowdown in consumer spending and a drop in business investment raise questions about the extent to which such strong growth can be sustained. Consumer spending rose by 0.7%, making the weakest contribution to the economy for a year, while business investment fell 1.0%.

We should bear in mind that the investment data are often subject to heavy revision, and businesses generally remain upbeat about the year ahead. Surveys show business optimism about the year ahead running at its highest in one and a half years, suggesting companies are clearly expecting the good times to continue.

Cracks appearing

On the other hand, there are cracks developing: households appear to be pulling back on spending as higher inflation bites and Brexit remains a major source of uncertainty.

PMI survey data already indicate that, although robust economic growth has been maintained at the start of 2017 (indicating that 0.5% GDP growth could be seen in the first quarter if no further loss of pace is seen in February and March), there was some slight loss of momentum in January.

There's also evidence that households are beginning to feel the strain from rising prices, which looks set to cool consumer spending growth in coming months. Retail sales fell for a third successive month in January, representing the worst trading period for three years. IHS Markit's monthly survey of households has meanwhile shown finances to have been squeezed to one of the greatest extents for over two years in February as households reported the sharpest increase in their living costs for almost four years, suggesting the downward spending trend looks set to continue.

The worry is that consumer spending will continue to come under pressure from rising prices and a cooling of the labour market. With imported input prices jumping higher due to the weak pound, employers are likely to seek to reduce overheads either by cutting staff or asking for wage restraint. At the same time, there's a real risk that the business mood will be dampened as Brexit-related uncertainty intensifies.

It therefore seems very likely that 2017 will see the UK economy struggle to achieve anything like the performance seen in 2016, and it will need a skilfully-managed Brexit process to limit any slowdown and help the economy grow by the 2.0% expected by the Bank of England.

Manufacturing-led upturn

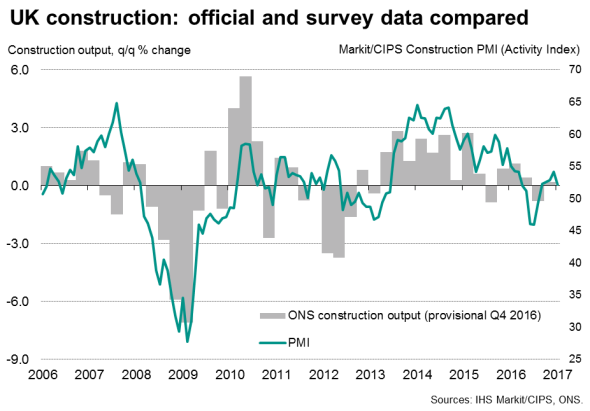

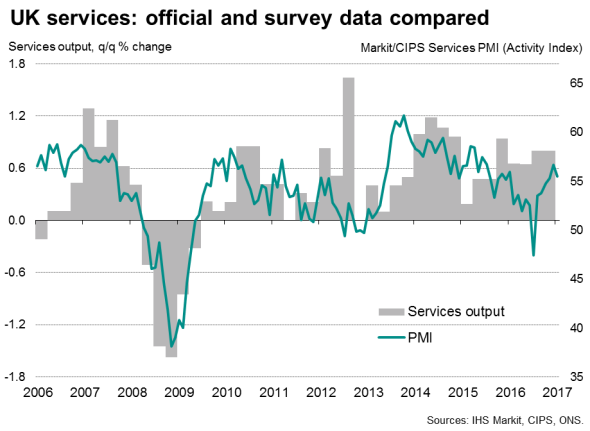

The detail of the ONS release confirmed the manufacturing-led picture of growth indicated by the PMI surveys. In fact, the improvement in GDP growth in the final quarter of the year was mainly due to better than previously estimated growth within manufacturing. Manufacturing output rose 1.2% (revised up from 0.7%), an upturn which survey data suggest has been aided by the fall in the value of sterling. Services sector output meanwhile grew 0.8% (unrevised). However, construction eked out a mere 0.2% expansion, albeit revised up from 0.1%.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022017-Economics-UK-economy-sees-strong-end-to-the-year-but-cracks-appear.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022017-Economics-UK-economy-sees-strong-end-to-the-year-but-cracks-appear.html&text=UK+economy+sees+strong+end+to+the+year%2c+but+cracks+appear","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022017-Economics-UK-economy-sees-strong-end-to-the-year-but-cracks-appear.html","enabled":true},{"name":"email","url":"?subject=UK economy sees strong end to the year, but cracks appear&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022017-Economics-UK-economy-sees-strong-end-to-the-year-but-cracks-appear.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+economy+sees+strong+end+to+the+year%2c+but+cracks+appear http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22022017-Economics-UK-economy-sees-strong-end-to-the-year-but-cracks-appear.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}