Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 23, 2017

Week Ahead Economic Overview

Worldwide PMI survey releases will provide important clues as to economic growth and inflation trends in February, while also offering a steer on monetary policy at the major central banks.

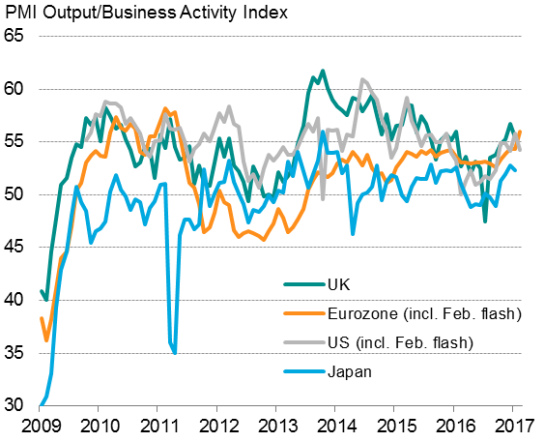

January's PMI releases showed global growth at a 22-month high, indicating a solid start to the year for the developed world economies in particular. February's data will be eyed for signs of whether political uncertainties continue to be largely shrugged off, and if inflationary pressures continue to build.

Developed World (composite) PMIs

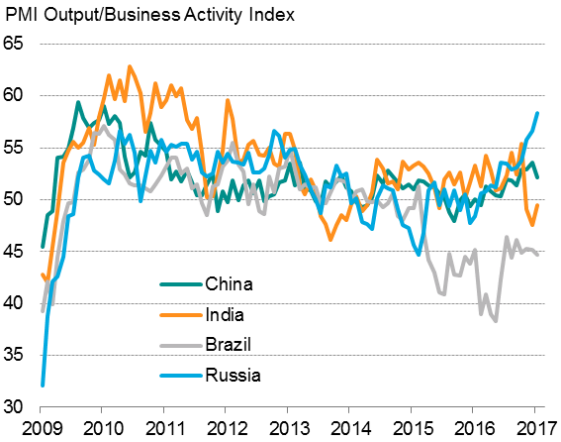

Emerging Market (composite) PMIs

Sources: IHS Markit, Nikkei, Caixin.

With speculation mounting on the possibility of a rate hike by the US Fed as soon as March, all data will potentially be market moving. Updated survey results from Markit's PMIs and the ISM on the health of the US manufacturing and service sectors, as well as durable goods orders and a more detailed cut of fourth quarter GDP numbers, will all therefore be important steers to policymakers and the markets. Flash PMI data from Markit have already shown a steady, robust pace of US economic growth and hiring in February, though also hinted at some slowing as businesses showed less optimism about the outlook.

In the UK, the January PMI surveys had likewise signalled a strong start to the year, but also suggested the pace of growth may have started to wane. Any further slowing will take pressure off the Bank of England from tightening policy, though any renewed strength could see the Bank deploy a more hawkish stance and show less reluctance to look through this year's projected rise in inflation.

The final eurozone PMI surveys will meanwhile add a national breakdown to the stronger-than-expected flash numbers for February, with struggling Greece in particular under the spotlight. With the surveys showing employment rising at the steepest rate for almost a decade, there's also scope for official unemployment figures to show improvement. If a variety of official inflation releases for the region also paint a hawkish picture, as is suggested by the surveys, expectations will mount that the ECB may soon start to ramp-up its tapering rhetoric.

Japan's Nikkei PMI surveys, alongside industrial production, CPI, unemployment and retail sales data, will give a comprehensive steer on the economy's start to 2017, and help determine whether the Bank of Japan's upgraded outlook is justified.

Elsewhere in Asia, the China PMI surveys will be important gauges of economic growth in the first quarter, while also showing the extent of the economy's successful transition towards services-driven growth. In India, the Nikkei PMI and fourth quarter GDP releases will meanwhile highlight the degree to which the economy has been disrupted by demonetisation.

Other key releases include fourth quarter GDP for Australia and eurozone retail sales.

Monday 27 February

Eurozone sentiment indicators are made available.

Spanish inflation figures are published.

The US Census Bureau releases latest durable goods data.

Tuesday 28 February

In Japan, industrial output and retail sales figures are issued, alongside housing starts data.

Thailand's manufacturing output figures are published.

Detailed GDP figures for both India and the US are released.

Latest German retail sales numbers are made available.

Revised GDP data are issued in France, alongside latest consumer spending trends and inflation figures.

Italy's consumer price index is issued.

The Gfk consumer confidence indicator for the UK is published.

Wednesday 01 March

Worldwide manufacturing PMI results are published by IHS Markit.

The Australian Bureau of Statistics provides an update on fourth quarter GDP figures.

Indonesia and Thailand release latest consumer price indexes.

Germany's unemployment rate and consumer price index are both updated.

Thursday 02 March

Eurostat issues its latest producer prices index and unemployment rates for the eurozone.

Final GDP numbers for Spain are published.

Manufacturing PMI data for South Korea and Brazil are released, along with updated UK Construction PMI results.

Canadian GDP numbers are announced.

Initial jobless claims data for the US are made available.

Friday 03 March

IHS Markit releases its latest set of worldwide services data for February.

Japan issues an update on both its consumer price index and unemployment rates.

Euro area retail sales data are issued by Eurostat.

In Italy, final GDP figures for Q4 2016 are made available.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022017-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23022017-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}