Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 02, 2017

Global manufacturing growth approaches six-year peak

Worldwide manufacturing business conditions showed the largest improvement for more than five-and-a-half years in February, with global trade expanding at the fastest rate for just under six years and optimism about the future continuing to improve. Manufacturing input prices meanwhile continued to rise markedly, albeit with the rate of increase easing slightly during the month.

Global upturn

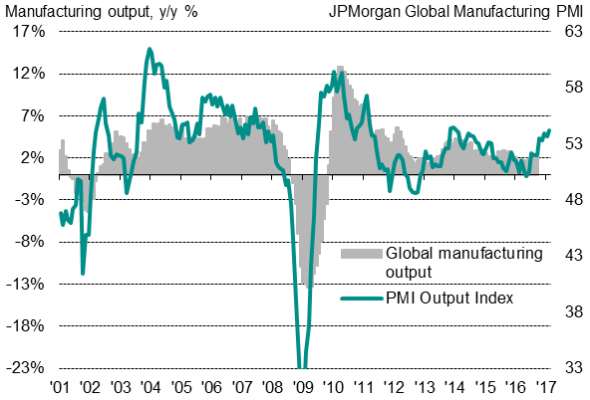

The JPMorgan Global Manufacturing PMI, compiled by Markit, rose from 52.7 in January to 52.9 in February, its highest since May 2011.

The latest reading continues an improving trend that has been evident since the PMI signalled stagnation this time last year. The February index reading is broadly indicative of global manufacturing output growing at a robust annual rate of 4-5%.

Adding to the upbeat picture was news that factory payrolls were added to at a rate not seen for five-and-a-half years. Producers commonly reported the need to expand capacity in line with rising demand and brightened prospects.

A combination of increased inflows of new work and improved optimism suggests growth could pick up further in March. Companies reported that growth of new orders hit a three-year high in February, with export orders growing at the steepest rate since March 2011. Encouragingly, companies' expectations about future production meanwhile hit a near two-year high.

Price hikes

Producers also stepped-up their input buying to meet higher production requirements, with global purchasing activity showing the largest monthly rise since December 2013 as a result.

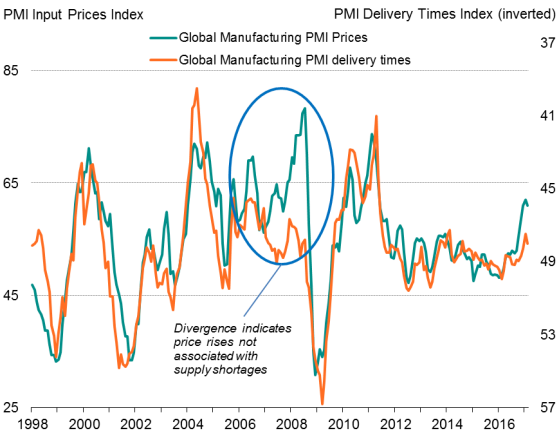

Suppliers' delivery times lengthened again as the increased demand for inputs put additional pressure on supply chains, although the incidence of delays fell modestly compared to January. The extent of the deterioration in vendor performance signalled by the surveys remains indicative of only mild inflationary pressures in global supply chains.

Prices paid for inputs nevertheless continued to rise sharply, reflecting higher energy and commodity costs, with the rate of increase moderating only slightly from January's five-and-a-half year peak.

Higher cost burdens were often passed on to customers. The rate of increase of firms' selling prices remained close to its fastest for five-and-a-half years.

Global manufacturing output

Global manufacturing input prices and supply chains

Sources for charts: JPMorgan, Nikkei, Caixin, IHS Markit.

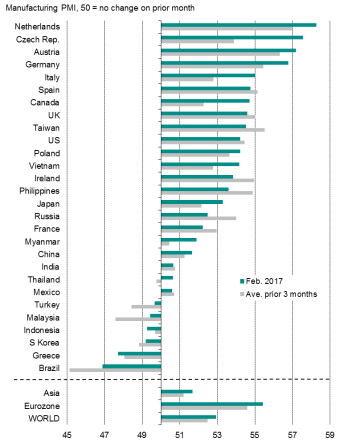

European nations head up PMI rankings

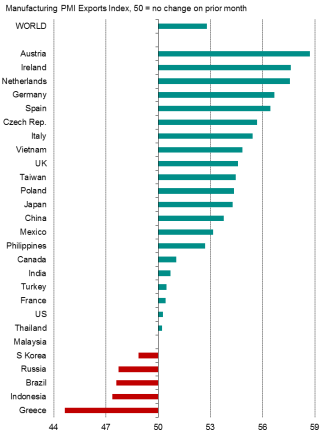

The top six fastest-growing manufacturing economies were all found in Europe, led by the Netherlands. These expansions were commonly aided by exports being boosted by weak currencies: the top five fastest-growing exporters were all found in the euro zone.

The UK was meanwhile eighth placed globally, enjoying the ninth fastest export growth on the back of sterling's weakness.

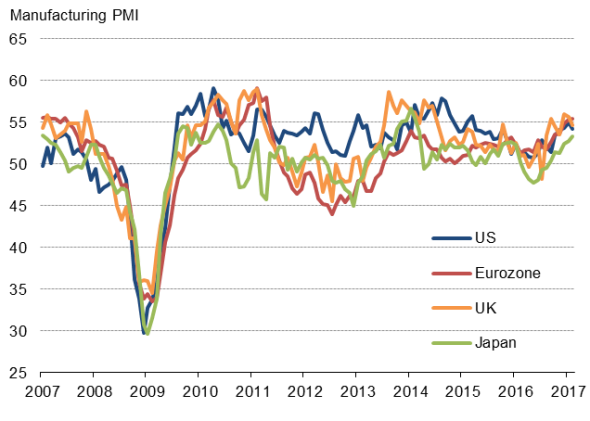

The US saw exports more or less stagnate due to the strong dollar, though robust domestic demand helped sustain strong manufacturing expansion, with the US sitting in tenth place globally.

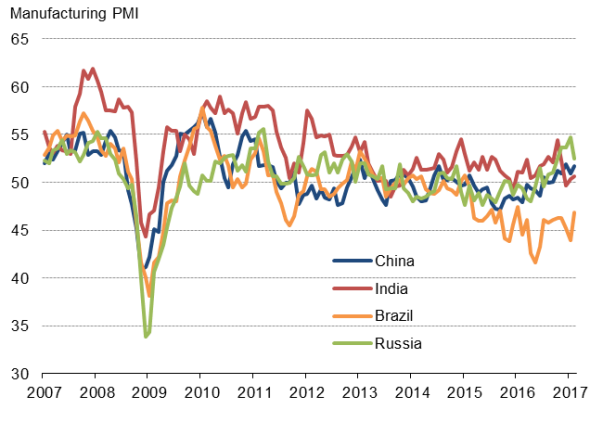

Only six of the 28 countries covered by PMI surveys saw manufacturing conditions deteriorate in February. Brazil once again saw the steepest downturn, followed by Greece. Despite enjoying a weaker currency, Greece also saw the steepest drop in exports of all countries surveyed.

Developed markets

Emerging markets

Sources for charts: JPMorgan, Nikkei, Caixin, IHS Markit.

Worldwide manufacturing PMI rankings

Worldwide manufacturing PMI export orders rankings

Sources: IHS Markit, JPMorgan, Nikkei, Caixin

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032017-Economics-Global-manufacturing-growth-approaches-six-year-peak.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032017-Economics-Global-manufacturing-growth-approaches-six-year-peak.html&text=Global+manufacturing+growth+approaches+six-year+peak","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032017-Economics-Global-manufacturing-growth-approaches-six-year-peak.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing growth approaches six-year peak&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032017-Economics-Global-manufacturing-growth-approaches-six-year-peak.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+growth+approaches+six-year+peak http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032017-Economics-Global-manufacturing-growth-approaches-six-year-peak.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}