Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 03, 2017

China PMI surveys signal first upturn in employment for nearly two years as growth momentum improves

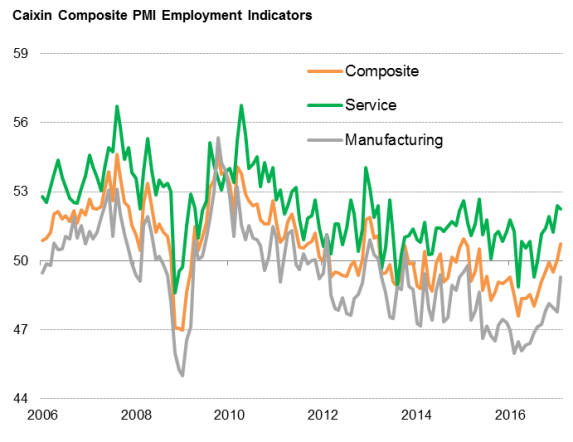

The Chinese economy strengthened in February, with overall employment increasing for the first time in 21 months and confidence about the future continuing to improve. Input price inflation meanwhile rose at a slower rate but the pace of increase remained marked.

Steady expansion

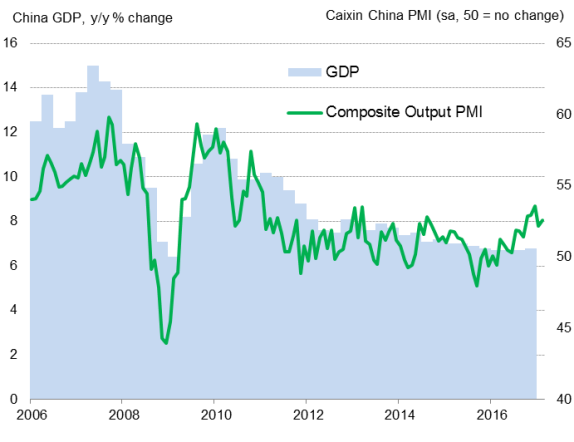

The Caixin China Composite Output Index, compiled by Markit, rose from 52.2 in January to 52.6 in February, reversing the slowdown that had been indicated at the start of the year.

PMI signal steady expansion

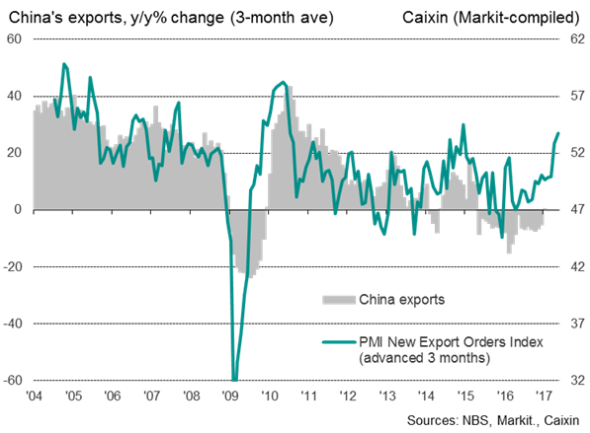

The latest reading puts the PMI surveys, and the economy, back on an improving trend that started in the middle of last year. A recovery in manufacturing sector growth offset a slowdown in services, which was supported by the strongest increase in manufacturers' new export orders for nearly two-and-a-half years amid improving global trade.

Rising export orders at manufacturers

Growth could accelerate further in March on the back of increased inflows of new business and improved optimism. The increase in composite new business reported in February was the second-largest in nearly four years, exceeded only by the upturn seen in December.

Firms' expectations about future output meanwhile reached the highest for 21 months in February, with improving market conditions, planned business expansions and new product developments highlighted as reasons for optimism.

Employment growth

Stronger overall business activity growth was accompanied by the first increase in composite employment since May 2015. Growth in service sector jobs remained moderate, with companies reporting the need to increase capacity in line with planned business expansions. However, manufacturing payrolls continued to be cut, albeit at the slowest rate in two years. Sustained pressure on capacity, as highlighted by a further rise in backlogs, and expectations for higher production may further stem manufacturing job losses in March.

Employment increases slightly

Sources: IHS Markit, Caixin, Datastream.

Easing inflationary pressures

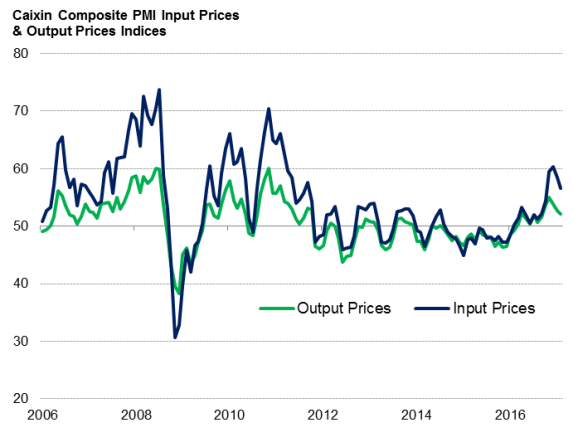

While inflationary pressures continued to build in the economy, price increases have been substantially more pronounced in the manufacturing sector, reflecting higher oil and commodity costs (especially for metals and rubber). Increased demand for inputs put additional pressure on supply chains, which in turn contributed to upward price pressures amid reports of stock shortages. Meanwhile, input prices among service-related firms rose at a modest rate that was the weakest seen in three months. Overall, the February surveys signalled a moderation of composite input price inflation to a four-month low.

Reflective of the trend for input costs, firms raised prices charged at a slower rate in February. However, the rise in input prices continued to run above that for firms' selling prices, especially among manufacturers, indicating an ongoing squeeze on profit margins.

Softer inflationary pressures

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Economics-China-PMI-surveys-signal-first-upturn-in-employment-for-nearly-two-years-as-growth-momentum-improves.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Economics-China-PMI-surveys-signal-first-upturn-in-employment-for-nearly-two-years-as-growth-momentum-improves.html&text=China+PMI+surveys+signal+first+upturn+in+employment+for+nearly+two+years+as+growth+momentum+improves","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Economics-China-PMI-surveys-signal-first-upturn-in-employment-for-nearly-two-years-as-growth-momentum-improves.html","enabled":true},{"name":"email","url":"?subject=China PMI surveys signal first upturn in employment for nearly two years as growth momentum improves&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Economics-China-PMI-surveys-signal-first-upturn-in-employment-for-nearly-two-years-as-growth-momentum-improves.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+PMI+surveys+signal+first+upturn+in+employment+for+nearly+two+years+as+growth+momentum+improves http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Economics-China-PMI-surveys-signal-first-upturn-in-employment-for-nearly-two-years-as-growth-momentum-improves.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}