Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 03, 2017

Japan's economy maintains solid growth momentum in February

Japan's economy continued to expand at a robust pace in February, according to the PMI survey data. Job creation was also the best seen in almost four years, while order book growth remained solid and business optimism moved higher, all auguring well for growth to maintain strong momentum in months ahead. Meanwhile, cost inflation remained at its highest for two years.

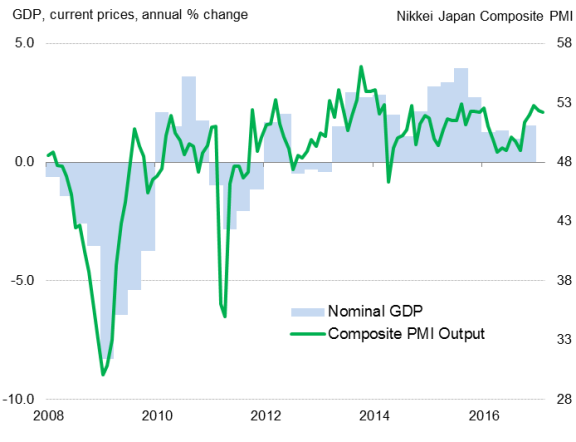

Steady growth

The Nikkei Japan Composite Output PMI, compiled by Markit, dipped from 52.3 in January to 52.2 in February. Though the latest reading indicated a second successive slowdown, the pace of growth remained robust and markedly higher than seen throughout much of last year.

PMI signals stronger Q1 growth

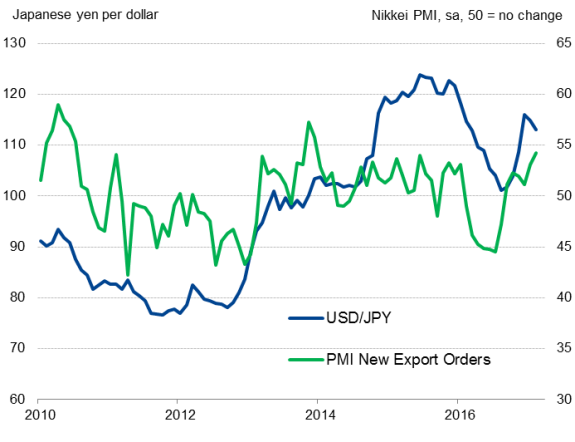

The latest upturn was driven by the manufacturing sector, where output rose to the greatest extent in nearly three years, fuelled by increased export growth. In turn, this was supported by a weak yen and improving global trade flows. The increase in manufacturing export orders was the strongest for over three years.

Rising export orders

Sources: IHS Markit, Nikkei, Datastream

The solid pace of expansion of the Japanese economy is likely to be sustained over the next few months. Growth of new business volumes remained at the highest since January 2014, and corporate optimism about future output hit its highest for over two-and-a-half years in February.

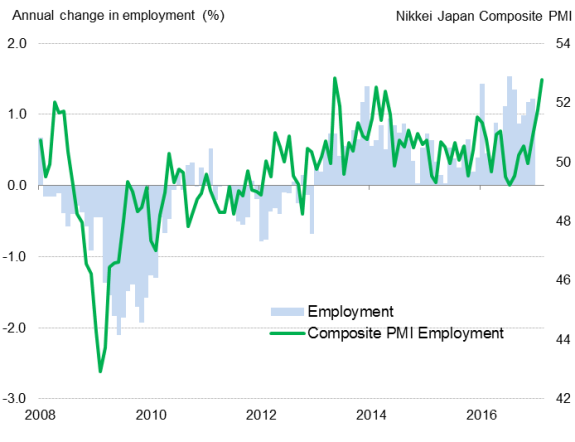

Job creation

A key standout in February was the accelerated rate of job creation. Companies reported the joint-largest monthly rise in employment since November 2007 as rising sales encouraged hiring. Service sector headcounts showed the greatest increase in nearly four years, and manufacturing jobs were created at the fastest rate in almost three years.

Pick up in job creation

Operating capacity, while not severely tested, has come under some pressure in early-2017 on the back of rising client demand. This was evident in higher levels of uncompleted work reported in the first two months of the year after nearly a year of backlog depletion. This additional pressure on capacity is likely to prompt Japanese firms to maintain the recent hiring trend in coming months.

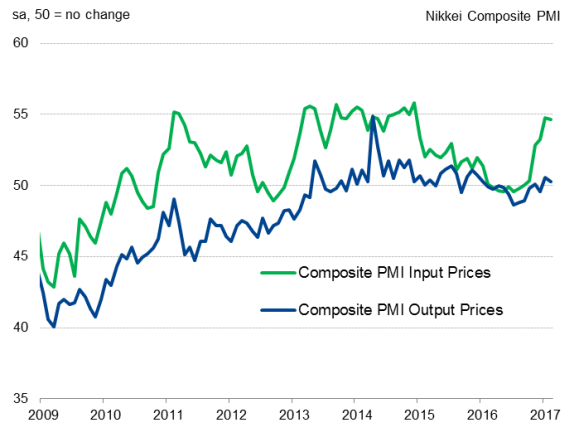

Rising costs

Inflationary pressures meanwhile remained elevated in February. Average cost burdens across Japan's private sector economy rose at an identical rate to January's two-year high. Breakdowns by sector revealed that cost increases were more marked in manufacturing relative to services-related firms, mainly reflecting higher global commodity prices and increased import costs resulting from the weak yen.

Japanese firms appear reluctant or unable to make substantial increases to selling prices despite the stronger demand and cost inflation. This points to greater restraint on the rise of consumer prices. Subdued consumer inflation in turn means that current accommodative monetary conditions will be maintained for a while longer.

Strong cost inflationary pressures

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Economics-Japan-s-economy-maintains-solid-growth-momentum-in-Fe.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Economics-Japan-s-economy-maintains-solid-growth-momentum-in-Fe.html&text=Japan%27s+economy+maintains+solid+growth+momentum+in+February","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Economics-Japan-s-economy-maintains-solid-growth-momentum-in-Fe.html","enabled":true},{"name":"email","url":"?subject=Japan's economy maintains solid growth momentum in February&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Economics-Japan-s-economy-maintains-solid-growth-momentum-in-Fe.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan%27s+economy+maintains+solid+growth+momentum+in+February http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032017-Economics-Japan-s-economy-maintains-solid-growth-momentum-in-Fe.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}