Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 21, 2017

February flash US PMI surveys point to slower economic growth and hiring

The drop in the flash PMI numbers for February suggests that the post-election upturn has lost some momentum. Growth of business output, new orders and hiring all waned, as did inflationary pressures. Despite the dip, the pace of growth and hiring remained solid. But the worry is that a drop in business optimism about the outlook suggests that companies are expecting growth to ease further in coming months.

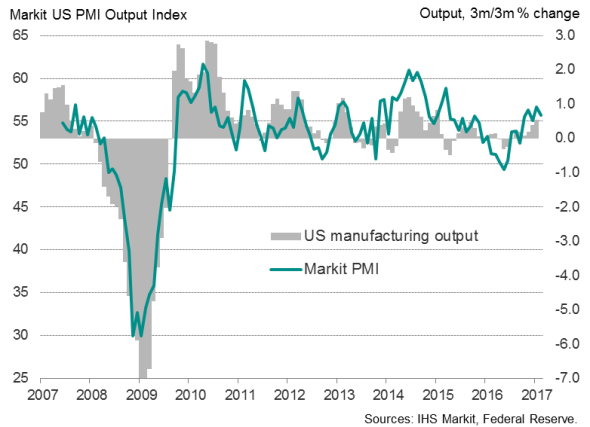

Slower (but still solid) growth

At 54.3 in February, the Markit Composite PMI Output Index dropped from 55.8 in January, according to the flash estimate. The latest reading signalled that private sector output growth moderated from the 14-month high recorded at the start of 2017 but still indicates a solid pace of economic growth overall.

Taken together, the PMI readings for the first two months of the year suggest that the GDP should rise by 2.5% in the first quarter, assuming no further change in momentum is seen in March.

Economic growth

However, latest survey data indicated that business optimism dipped to its lowest since September 2016, which suggests companies have become more cautious about spending, investing and hiring. A drop in new business growth to a five-month low adds to the risk that the upturn could slacken further in March.

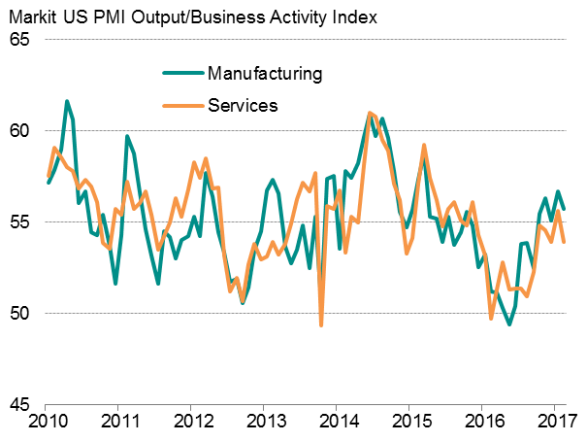

The drop in the flash February PMI was caused by a broad-based weakening of business activity growth. The services 'flash' index fell to 53.9 from 55.6 in January, while the manufacturing 'flash' output index dipped to 55.7 from 56.7.

Manufacturing continued to be restrained by subdued exports, which once again barely rose in February. Producers blamed the strong dollar as a main cause of poor foreign sales, leaving domestic demand as the key source of new orders.

Manufacturing output

Manufacturing and services growth

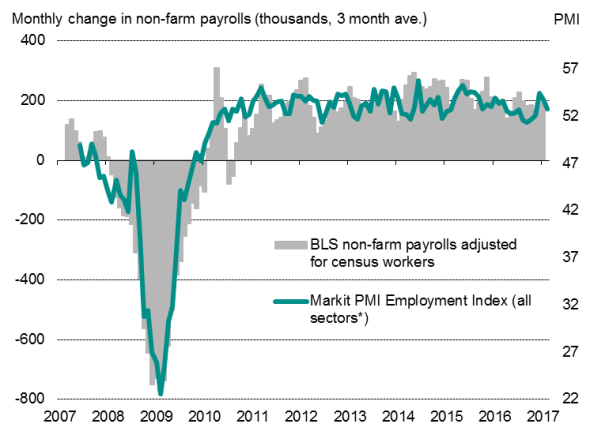

Slower hiring

The survey's employment index fell to a three-month low, though continued to run at a level broadly indicative of a respectable 165,000 jobs being added to the economy in February.

Although manufacturing hiring was sustained at the same pace seen in January, albeit down from December's 18-month high, the rate of service sector job creation slipped for a second month running.

Employment

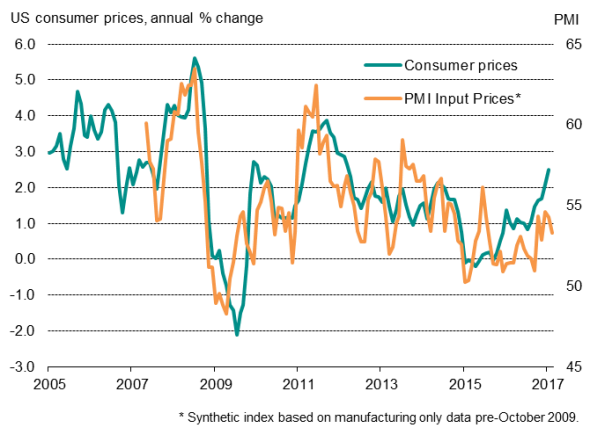

Subsiding inflationary pressures

The February survey also found inflationary pressures to have subsided for a second successive month. Firms' average input prices and average selling prices both rose at the slowest rates for three months, with the latter showing an especially modest increase.

The slower growth of companies' costs suggests that there's some scope for consumer price inflation to moderate from the 2.5% annual rate of increase seen in January.

Inflationary pressures

Sources for charts: IHS Markit, Datastream.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21022017-Economics-Fe.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21022017-Economics-Fe.html&text=February+flash+US+PMI+surveys+point+to+slower+economic+growth+and+hiring","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21022017-Economics-Fe.html","enabled":true},{"name":"email","url":"?subject=February flash US PMI surveys point to slower economic growth and hiring&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21022017-Economics-Fe.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=February+flash+US+PMI+surveys+point+to+slower+economic+growth+and+hiring http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21022017-Economics-Fe.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}