Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 14, 2016

Eurozone producers see unexpectedly strong start to the year

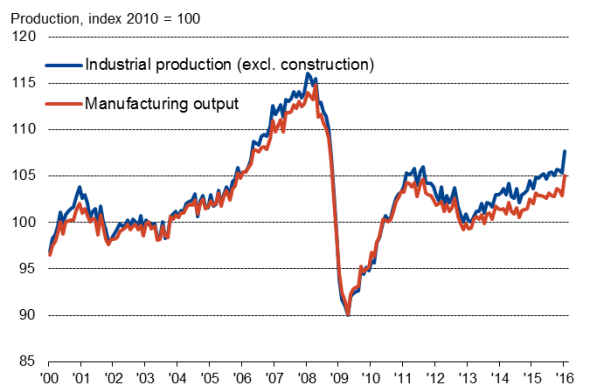

Eurozone industrial production jumped 2.1% in January, its biggest monthly rise since September 2009. Output was 2.8% higher than a year ago, the best year-on-year performance since August 2011.

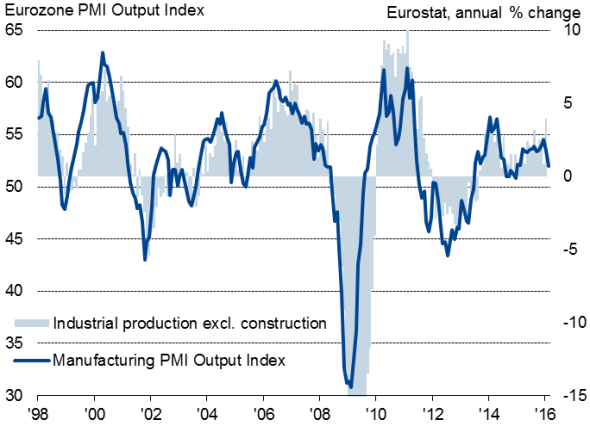

Eurozone industrial production and the PMI

The narrower measure of manufacturing output, which excludes energy, also rose markedly, up 2.2% compared to December to rise 4.0% on a year ago.

It's unlikely, however, that the strong performance sets the tone for the rest of the quarter. The monthly data are volatile, especially around the turn of the year. The January increase followed two months of decline at the end of last year, suggesting the latest rise may have been boosted by pay-back from unusual weakness in the prior numbers.

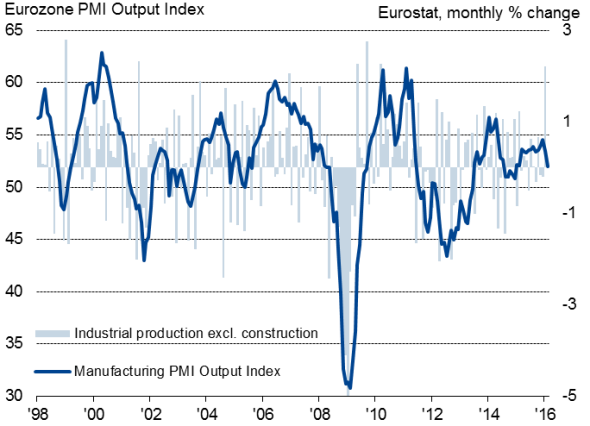

Monthly changes in production v PMI

Furthermore, Markit's Eurozone PMI, which had signalled solid growth in January, fell sharply in February to a 12-month low. The PMI has historically provided an accurate advance indication of official manufacturing output, having the additional benefit of showing far less volatility. The survey data exhibit an 88% correlation with the annual rate of change in official data, with the survey acting with a lead of three months, and suggest that the annual rate of change has slowed to around 1%.

Some brightening of prospects for eurozone producers has come from the announcement of renewed stimulus from the European Central Bank, which unleashed further quantitative easing, additional cheap lending to the region's banks as well as further interest rate cuts. However, after initially falling, the euro has rallied against the US dollar as ECB head Mario Draghi remarked that no further interest rate cuts would be made. While the additional bank lending and extra QE may therefore help producers, a strengthening currency may take some of the sting out of the stimulus punch.

Production levels

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14032016-economics-eurozone-producers-see-unexpectedly-strong-start-to-the-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14032016-economics-eurozone-producers-see-unexpectedly-strong-start-to-the-year.html&text=Eurozone+producers+see+unexpectedly+strong+start+to+the+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14032016-economics-eurozone-producers-see-unexpectedly-strong-start-to-the-year.html","enabled":true},{"name":"email","url":"?subject=Eurozone producers see unexpectedly strong start to the year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14032016-economics-eurozone-producers-see-unexpectedly-strong-start-to-the-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+producers+see+unexpectedly+strong+start+to+the+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14032016-economics-eurozone-producers-see-unexpectedly-strong-start-to-the-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}