Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 09, 2015

Industrial production and construction falls add to signs of slowing UK economy

Disappointing official data are adding to survey evidence which indicate that the rate of UK economic growth slowed towards the end of last year, meaning policymakers will take an increasingly cautious approach to the timing of the first hike in interest rates.

Looking at all of the official statistics and survey evidence currently available, the data collectively point to the economy growing 0.5% in the fourth quarter, down from 0.7% in the third quarter.

The worry is that, not only is the rate of growth slowing, but the UK economy is also once again showing an unhealthy dependence on domestic consumers to drive growth in 2015. Additionally, the sought-after rebalancing of the economy from domestic consumption to export-led growth remains a hope rather than a reality.

Production falls

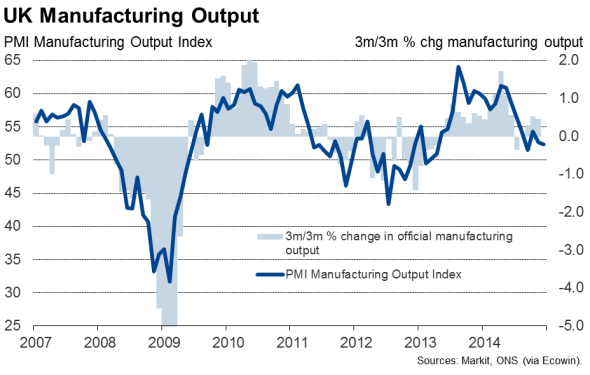

Data from the Office for National Statistics showed industrial production down 0.1% in November while construction sector output slumped 2.0%. The decline in industrial production was due to a drop in oil and gas output, and the scene in manufacturing is more upbeat, with factory output up 0.7% in November, reversing October's decline. However, both industrial production and manufacturing output are so far trending just 0.1% higher in the fourth quarter compared to the third quarter, pointing to a slowdown in the industrial sector.

Further weakness is expected in December, after the PMI surveys signalled the worst performance for the economy for 19 months. Growth slowed in manufacturing, construction and services alike.

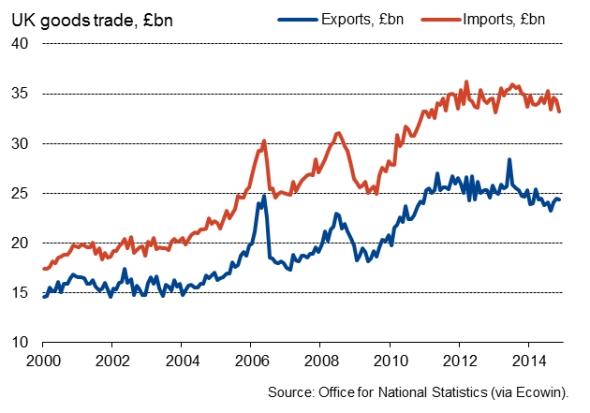

There was some better news on the trade front, as the trade deficit fell to its lowest since June 2013. However, goods exports fell 0.4% during November. The improvement in the deficit was mainly due to lower oil imports, reflecting the recent slump in oil prices. Goods imports fell 3.2% during the month.

UK trade

Deteriorating export markets

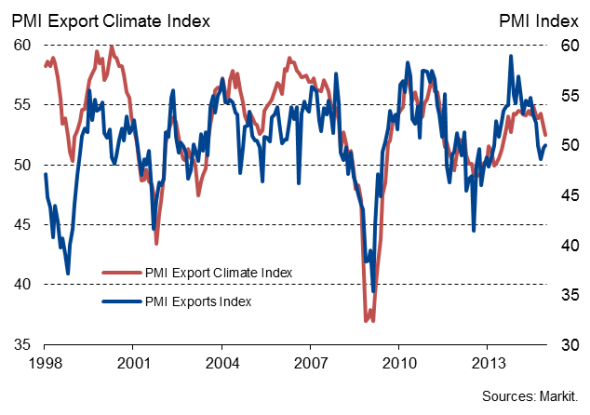

Exports have disappointed due primarily to weak demand in the UK's trade partners. Trade-weighted PMI data for the various economies to which the UK traditionally exports showed the pace of economic growth slowing to the weakest for a year-and-a-half in December. Similarly, official data also released today showed manufacturing output stagnating in both Germany and France, two important export destinations for UK exports, in the three months to November.

Exports and demand in the UK's trading partners

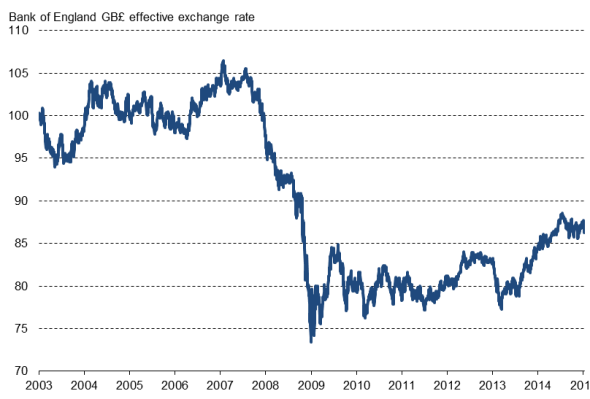

The exchange rate is countering the weakness in overseas demand to some extent. Although sterling remains higher than a year ago in trade weighted terms, the exchange rate has levelled off in recent months as expectations about an early hike in interest rates by the Bank of England have cooled, while at the same time US rates are still expected to have started rising by the middle of next year. Today's data add to the sense that UK policymakers will be in no hurry to start raising interest rates.

Exchange rate

The hope is that the UK's export performance will improve as we move through 2015 as lower oil prices mean consumers and businesses in the UK's major trading partners have more money to spend on other goods, while at the same time additional ECB stimulus should help drive stronger economic growth in the Eurozone. However, the latter is by no means assured.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Economics-Industrial-production-and-construction-falls-add-to-signs-of-slowing-UK-economy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Economics-Industrial-production-and-construction-falls-add-to-signs-of-slowing-UK-economy.html&text=Industrial+production+and+construction+falls+add+to+signs+of+slowing+UK+economy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Economics-Industrial-production-and-construction-falls-add-to-signs-of-slowing-UK-economy.html","enabled":true},{"name":"email","url":"?subject=Industrial production and construction falls add to signs of slowing UK economy&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Economics-Industrial-production-and-construction-falls-add-to-signs-of-slowing-UK-economy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Industrial+production+and+construction+falls+add+to+signs+of+slowing+UK+economy http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Economics-Industrial-production-and-construction-falls-add-to-signs-of-slowing-UK-economy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}