Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 09, 2015

German industrial production falls, but Q4 GDP growth still on the cards

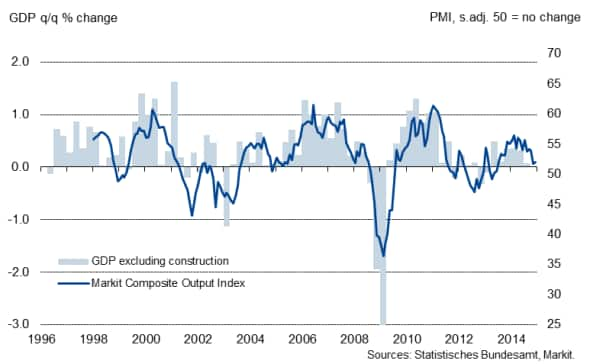

Official data showed industrial output, factory orders and exports all falling in November, while the PMI remains at low levels, but it is likely that the eurozone's largest economy managed to expand in the final quarter of 2014.

Production down marginally

Industrial production disappointed in November and fell 0.1%, according to the Federal Statistical Office (Destatis). Economists polled by Reuters had expected a 0.4% increase. The slight drop in industrial production follows a revised 0.6% increase in October (previously reported as +0.2%).

Although industrial production was flat in the latest three-month period, it is likely that output will have increased in the fourth quarter as a whole, even if it decreases slightly in December. Based on October and November, industrial production excluding construction is running 0.4% higher than in the third quarter (having contracted in the second and third quarters).

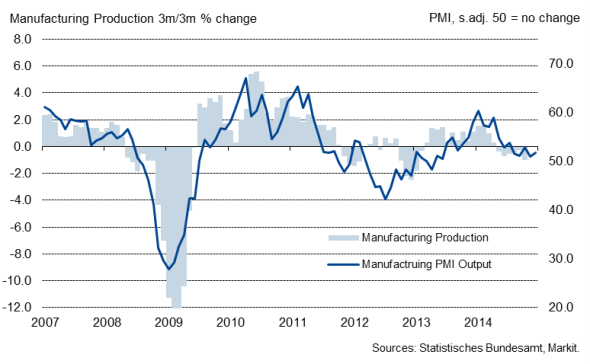

Manufacturing production and the PMI

With the exclusion of construction and energy, manufacturing output was up 0.3%, following a 0.5% rise in October. In the latest three months, manufacturing output was stagnant.

In the detail, Destatis reported that intermediate goods manufacturers saw a 0.1% fall in output during November. Capital goods output meanwhile rose 0.5% and the production of consumer goods increased 0.6%. Energy production fell by 2.4% on the month, and construction was down 0.6%. It is therefore likely that construction will have a negative impact on fourth quarter GDP (currently running 0.4% below the third quarter average), offsetting some of the rise in industrial production.

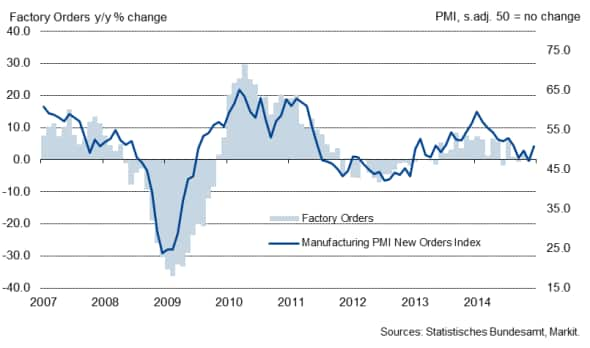

Factory orders down in November, but trend positive

Official data released yesterday had shown factory orders falling 2.4% in November, following a 2.9% increase (revised up from an initial 2.5% rise) in October. Domestic orders were down 4.7% (the steepest drop in 41 months, following the strongest rise in 41 months in October), while new export work declined by 0.7%.

Factory orders rose a mere 0.2% in the third quarter, following an equally modest decline in Q2. The trend for the fourth quarter so far (including October and November data) looks far more positive, with orders up 0.9% on the third quarter. It is therefore likely that the final quarter of the year could be the best one of 2014, unless December's data shows a monthly decline in orders of more than 1.3%.

Factory orders and the PMI

Weak export performance

Trade data meanwhile showed Germany's export-oriented economy struggling in November. Exports fell 2.1% on October, while imports rose 1.5%. The trade surplus consequently narrowed to €17.9bn, down from €20.8bn in the previous month. The Markit/BME Germany Manufacturing PMI New Export Orders Index has been weak in recent months and correctly anticipated the fall in exports in November, which many companies had linked to poor economic conditions in some of their main export destinations, namely France, China, Austria and Italy. However, the index also signalled a slight improvement in new export business in the closing month of 2014.

Manufacturing sector continues to struggle, but Q4 GDP growth likely

The disappointing official data follow weak signals sent by the business surveys. While the Markit/BME Manufacturing PMI returned to expansion territory in December, growth was only modest and followed declines in two out of the previous three months. Furthermore, the headline index is still some six points lower than at the beginning of the year as economic uncertainties, geopolitical unrest and a weak export performance continue to weigh on demand. While it is clear that the German industry lost considerable momentum since the start of the year, the survey data still signal a modest expansion of Germany's goods-producing sector for the fourth quarter. Furthermore, the lower oil price should feed through to manufacturers and help increase output levels and operating margins as prices for some raw materials and transportation costs keep falling.

While the official data for November as a single month disappointed, the trend for the fourth quarter doesn't look as bad and confirm our expectation of marginal GDP growth in the region of 0.2-0.3% for the fourth quarter.

German GDP (excluding construction) and the PMI

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Economics-German-industrial-production-falls-but-Q4-GDP-growth-still-on-the-cards.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Economics-German-industrial-production-falls-but-Q4-GDP-growth-still-on-the-cards.html&text=German+industrial+production+falls%2c+but+Q4+GDP+growth+still+on+the+cards","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Economics-German-industrial-production-falls-but-Q4-GDP-growth-still-on-the-cards.html","enabled":true},{"name":"email","url":"?subject=German industrial production falls, but Q4 GDP growth still on the cards&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Economics-German-industrial-production-falls-but-Q4-GDP-growth-still-on-the-cards.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+industrial+production+falls%2c+but+Q4+GDP+growth+still+on+the+cards http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Economics-German-industrial-production-falls-but-Q4-GDP-growth-still-on-the-cards.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}