Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 08, 2015

Week Ahead Economic Overview

The week sees the release of industrial production numbers and inflation data for the eurozone and the US, with the latter also seeing the publication of retail sales figures. Meanwhile, consumer price and house price inflation numbers are updated in the UK, while China sees the release of trade data.

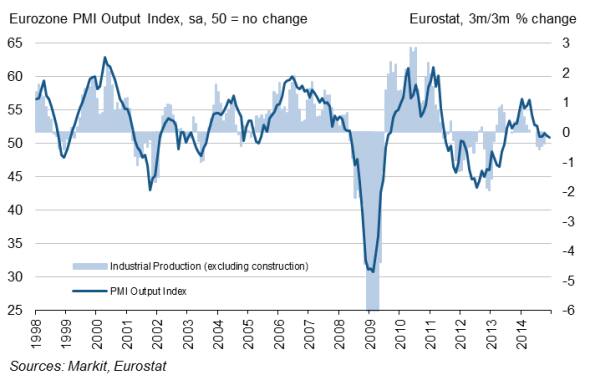

Data watchers will keep a close eye on industrial production data for the eurozone, after PMI data signalled near-stagnation in the currency union's manufacturing sector in December amid ongoing downturns in France and Italy. The latest official data had shown industrial production rising a mere 0.1% in October, confirming the disappointing picture that has been painted by the business surveys.

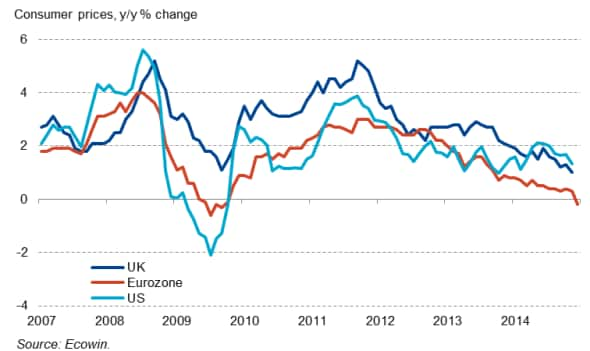

Final inflation numbers for December are also updated in the euro area, after a flash estimate showed consumer prices falling for the first time since 2009. With oil prices having more than halved in price over the last six months, it is likely that consumer prices will fall further in coming months. The combination of weak survey data, disappointing industrial production numbers and deflation add to pressure on the ECB to announce full-scale quantitative easing, including the purchase of government debt, at its policy meeting on 22 January.

Consumer prices

Eurozone industrial production and the PMI

There have been mixed signals about the health of the US economy in recent months. On the one hand, third quarter GDP was revised higher and retail sales rose in October and November. On the other hand, PMI data showed private sector business activity in the world's largest economy expanding at the slowest pace in over a year in December, factory orders are falling and trade numbers have weakened.

The combination of weak inflation and subdued growth as signalled by the business surveys therefore support the release of the latest FOMC minutes which revealed that a rise in interest rates before late April is unlikely. However, updates to industrial production, retail sales and inflation will be closely watched for further insight into the performance of the US economy.

US manufacturing output and the PMI

Inflation numbers are also updated in the UK and are expected to fall further below the Bank of England's target amid lower oil prices. An inflation rate below 1.0% would force the Bank of England's governor to write an open letter of explanation to the Chancellor. In November, consumer price inflation fell to 1.0%, the weakest increase since 2002 and the latest business survey results showed cost pressures easing further in December.

In China, trade data for December are out and policymakers are looking for any signs that the country's trade performance has improved, after November data showed exports up just 4.7% compared to a year ago. However, December's HSBC China Manufacturing PMI" signalled new export orders rising for an eighth successive month.

Monday 12 January

The week kicks off with the release of Markit's England & Wales Regional PMI and Irish construction PMI data.

In India, trade data for December, consumer price figures and industrial output numbers are out.

Russia sees the release of trade data and inflation numbers.

Meanwhile, wholesale prices are issued in Germany.

Manufacturing output data are published in South Africa.

The latest Labour Market Conditions Index is meanwhile issued in the US.

Tuesday 13 January

The UK Commercial Development Activity Report is released by Savills and Markit.

Trade balance information are published in China, while Japan sees the release of current account data.

Inflation numbers are out in Greece and the UK, with the latter also seeing the release of the BRC/KPMG Retail Sales Monitor.

In Italy, industrial output data are issued by Istat.

Eurostat publishes the second release of the currency union's quarterly balance of payments for Q3 2014.

The National Federation of Independent Business issues its latest Business Optimism Index for the US.

Wednesday 14 January

Wholesale price inflation numbers are released in India.

Consumer price inflation figures are meanwhile released in Italy and France, with the latter also seeing the publication of current account data.

Industrial production numbers are out for the eurozone.

Retail sales data are out in Brazil, South Africa and the US, with the latter also seeing the release of export and import price numbers.

Thursday 15 January

The UK Bellwether Report is published by Markit.

Machinery orders numbers are released in Japan, while employment data are issued in Australia.

The Royal Institution of Chartered Surveyors releases its latest Housing Price Balance for the UK.

Inflation figures are meanwhile published in Spain.

Eurostat issues trade data for the currency union.

Payroll job growth data are meanwhile released in Brazil.

In the US, the NY Empire State Manufacturing Index is published alongside initial jobless claims and producer price numbers.

Friday 16 January

Final inflation numbers for December are released for the eurozone.

November's budget balance is published in France.

In the US, inflation numbers, industrial production data and the Reuters/Michigan Consumer Sentiment Index are all out.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}