Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 08, 2016

UK official manufacturing data confirm PMI survey's signs of renewed life

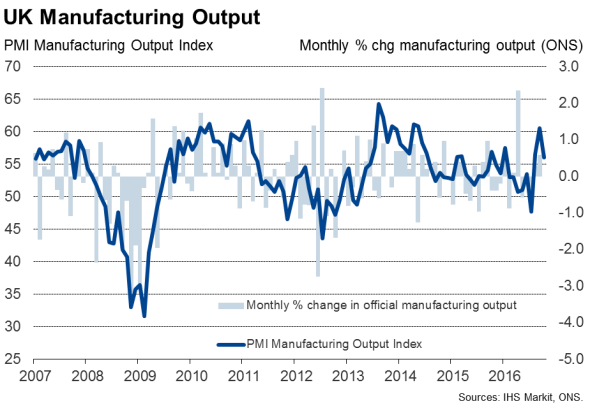

UK manufacturing enjoyed a strong uplift in production in September, confirming earlier upbeat survey evidence which suggests that the sector is faring well since the UK's vote to leave the EU. The survey data also indicate that the good times persisted into October. However, the brighter picture from factories was tarnished by news that the wider measure of industrial production fell for a second successive month.

Manufacturing output rose 0.6% in September, according to the Office for National Statistics, building on a 0.2% rise in August. Despite the upturn, manufacturing ended the third quarter 0.9% down on the second quarter, though there are clear signs that weakness was confined to the start of the quarter, when production slumped 0.9% in July.

The overall measure of industrial production was far more disappointing, falling 0.4% for a second successive month, dragged down by another steep decline in oil and gas extraction, which dropped 4.5% in September. The decline was attributed to maintenance in the North Sea, but nevertheless means that total industrial production fell a larger-than-previously-thought 0.5% in the third quarter. Reassuringly, the ONS does not see this as leading to any downward revision to the recent estimate of GDP, which showed the economy growing 0.5% in the third quarter.

The ONS saw little evidence of the manufacturing gains being linked to the weaker pound, but survey evidence clearly indicates that exporters are enjoying life with a more competitive exchange rate.

Like the official data on manufacturing output, the Markit/CIPS Manufacturing PMI survey has improved markedly since slumping in July, with the survey data showing production and order books buoyed in particular by rising exports in recent months. A sustained solid performance in October means the survey suggests that the good times have persisted into the start of the fourth quarter, aided by the weaker pound.

However, the October survey also saw one of the steepest rises in producers' purchasing costs in the near 25-year PMI history. Most manufacturers offering a reason for increased costs blamed the exchange rate to some extent.

The steep rise in costs suggests that, while manufacturers may be winning new exports, the profitability of producing those goods is coming under pressure.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-UK-official-manufacturing-data-confirm-PMI-survey-s-signs-of-renewed-life.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-UK-official-manufacturing-data-confirm-PMI-survey-s-signs-of-renewed-life.html&text=UK+official+manufacturing+data+confirm+PMI+survey%27s+signs+of+renewed+life","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-UK-official-manufacturing-data-confirm-PMI-survey-s-signs-of-renewed-life.html","enabled":true},{"name":"email","url":"?subject=UK official manufacturing data confirm PMI survey's signs of renewed life&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-UK-official-manufacturing-data-confirm-PMI-survey-s-signs-of-renewed-life.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+official+manufacturing+data+confirm+PMI+survey%27s+signs+of+renewed+life http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-UK-official-manufacturing-data-confirm-PMI-survey-s-signs-of-renewed-life.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}