Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 09, 2016

European company margins under pressure as costs rise

IHS Markit European PMI survey data point to a growing squeeze on corporate profit margins, with potentially significant implications for corporate earnings and dividends, albeit with substantial variation by sub-sector.

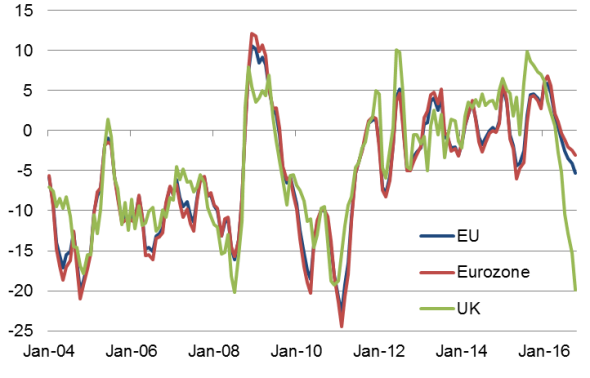

Manufacturers' profit margins, as measured by the differential between the rates of inflation of input costs and selling prices, are being squeezed across the EU to the greatest extent for four-and-a-half years. While the squeeze for Eurozone manufacturers is worsening, it is merely the tightest since July of last year. UK producers, however, are seeing the fiercest tightening of margins since mid-2008.

IHS Markit Manufacturing PMI margin indicator

Output Prices Index minus Input Prices Index

Input prices paid by EU manufacturers surveyed have been increasing for the past five months. After the rate of decline touched bottom in February 2016, the EU Manufacturing Input Prices PMI index has risen to its highest since March 2012. The equivalent index for the service sector has also risen markedly, up to its highest since December 2011.

Input prices paid by EU manufacturers surveyed have been increasing for the past five months. After the rate of decline touched bottom in February 2016, the EU Manufacturing Input Prices PMI index has risen to its highest since March 2012. The equivalent index for the service sector has also risen markedly, up to its highest since December 2011.

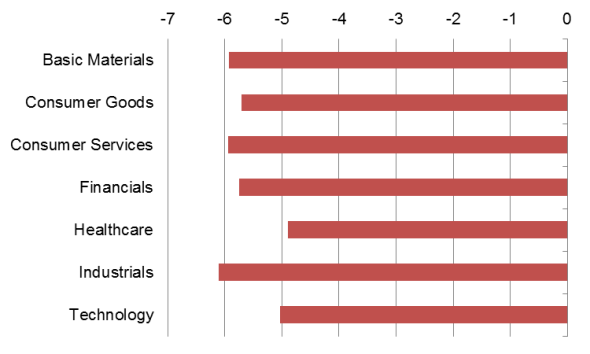

European Union PMI Margin Indicators

Output Prices Index minus Input Prices Index

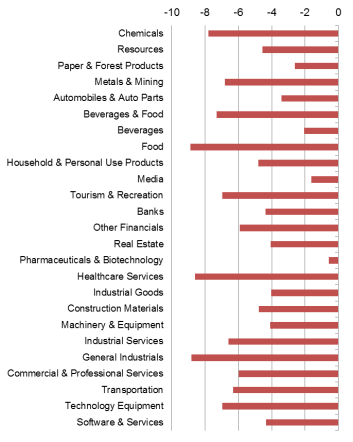

Detailed sectors

Overall, the trend represents a certain risk to company margins and therefore to their future results, but some sub-sectors are more impacted than others and are having greater success in transferring the rise in input prices to their customers.

Key sectors

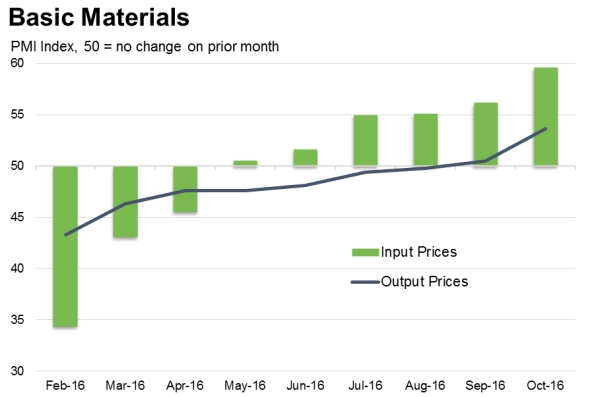

The Basic Materials sector is the one of the most impacted. The EU Input Prices PMI index has moved from signalling the fastest fall since 2009 in February, to its highest level in four-and-a-half years during October. The trend has been greatly pushed by both Metals & Mining and Chemicals companies, where the Input Prices PMI index has risen respectively to 16- and 66-month highs.

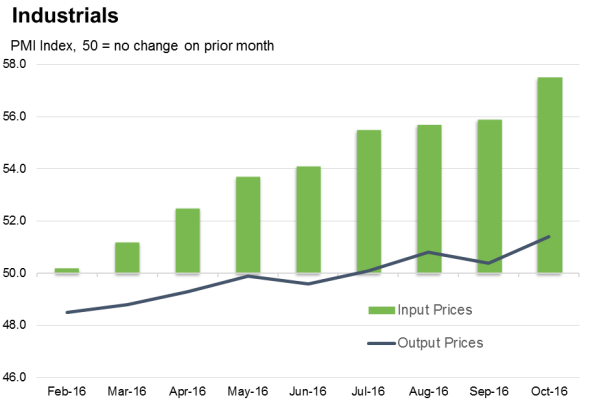

For the Industrials sector, the trend has been largely pushed by General Industrials, where the Input Prices PMI index went from signalling a marked decline in February to sharp inflation in the latest period.

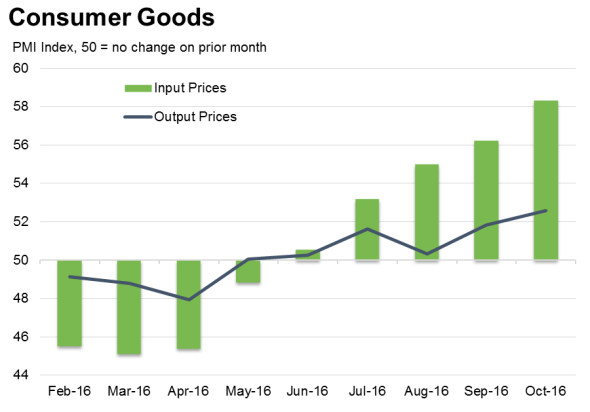

The trend in Consumer Goods has also been mainly influenced by one sub sector in particular. The Food sub sector has seen its Input Prices PMI index move from comfortably below the neutral 50.0 mark in February to a four-year high in October. The other sub sectors have also been impacted by the rise, but to a lesser extent than Food.

Negative accelerator

At the moment, the positive outlook for European manufacturing companies, in terms of new orders and business activity, is likely mitigating the impact of margin contraction from higher costs. However, the rise in input prices represents a real risk if manufacturing activity starts to show signs of slowing again. If companies are unable to pass higher costs on in the form of higher selling prices and the global economy weakens, then the trend could develop into a negative accelerator, squeezing corporate profits even further.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112016-Economics-European-company-margins-under-pressure-as-costs-rise.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112016-Economics-European-company-margins-under-pressure-as-costs-rise.html&text=European+company+margins+under+pressure+as+costs+rise","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112016-Economics-European-company-margins-under-pressure-as-costs-rise.html","enabled":true},{"name":"email","url":"?subject=European company margins under pressure as costs rise&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112016-Economics-European-company-margins-under-pressure-as-costs-rise.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+company+margins+under+pressure+as+costs+rise http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112016-Economics-European-company-margins-under-pressure-as-costs-rise.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}