Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 09, 2016

Official inflation data confirm China PMI survey's signs of inflationary pressure

Chinese producer prices picked up in October, confirming earlier survey evidence pointing to stronger inflationary pressures. The latest Caixin China Manufacturing PMI highlighted how price hikes are being driven by the need to pass higher costs on to customers.

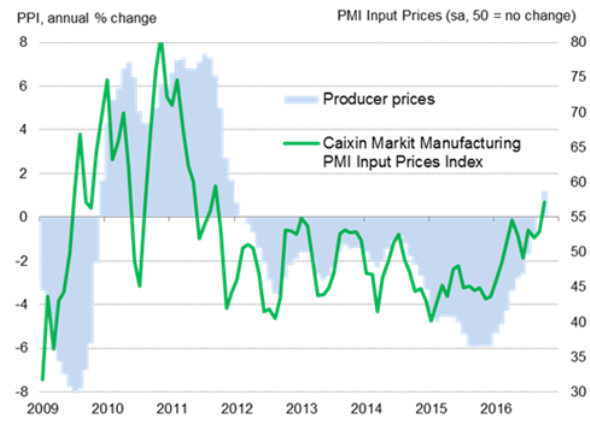

Costlier raw materials drive up producer prices

Sources: IHS Markit, Caixin, NBS.

The annual rate of producer price inflation accelerated to 1.2% in October, according to the National Bureau of Statistics of China, building on a very slight 0.1% uptick in September. The latest pace of increase exceeded expectations and was the highest since December 2011. However, the increase had been signalled well in advance by PMI data, with the October survey showing input prices jumping to the greatest extent since September 2011.

Higher commodity prices

Much of the increase was fuelled by higher commodity prices, especially oil, steel and coal.

However, the rise in commodity prices was not supported by greater demand. The PMI Suppliers' Delivery Times Index, a useful gauge of the extent to which price hikes are driven by demand-and-supply imbalance, showed few signs of demand outpacing supply in China. This suggested that speculative buying has provided a major lift to raw material prices.

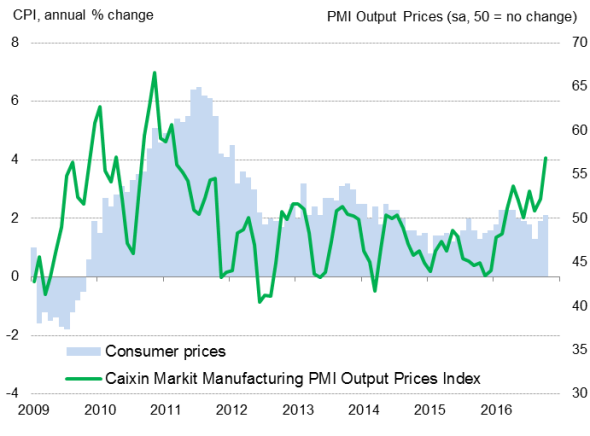

While consumer inflation rose in October for a second successive month to the highest since April, the annual rate of increase of 2.1% remained below the upper tolerance limit of 3% set by the government. The statistical bureau attributed the rise in consumer prices to higher food and fuel costs.

Nonetheless, consumer inflation pressures may intensify in the coming months if commodity prices continue to rise and producers pass higher input costs on to consumers. October PMI survey data revealed that average prices charged by producers showed the largest monthly rise since February 2011.

Manufacturing upturn and inflation

If this situation materialises, the People's Bank of China (PBOC) will have less scope to ease monetary policy to support economic growth. That said, the improvement in the health of the manufacturing economy, as shown by the latest Caixin China Manufacturing PMI, suggested that there may not be any need for further stimulus as earlier pump-priming measures take effect.

China inflation

Sources: IHS Markit, Caixin, NBS.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112016-Economics-Official-inflation-data-confirm-China-PMI-survey-s-signs-of-inflationary-pressure.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112016-Economics-Official-inflation-data-confirm-China-PMI-survey-s-signs-of-inflationary-pressure.html&text=Official+inflation+data+confirm+China+PMI+survey%27s+signs+of+inflationary+pressure","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112016-Economics-Official-inflation-data-confirm-China-PMI-survey-s-signs-of-inflationary-pressure.html","enabled":true},{"name":"email","url":"?subject=Official inflation data confirm China PMI survey's signs of inflationary pressure&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112016-Economics-Official-inflation-data-confirm-China-PMI-survey-s-signs-of-inflationary-pressure.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Official+inflation+data+confirm+China+PMI+survey%27s+signs+of+inflationary+pressure http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112016-Economics-Official-inflation-data-confirm-China-PMI-survey-s-signs-of-inflationary-pressure.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}