Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 08, 2016

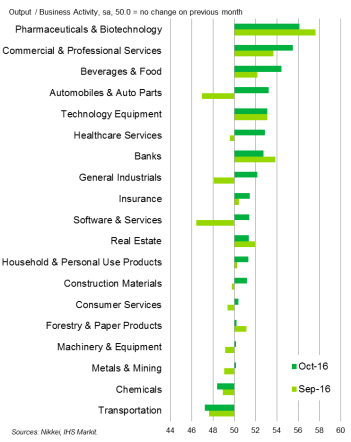

Pharmaceuticals lead Asian upturn, but autos see biggest turnaround in performance

After a mixed performance in September, the majority of Asian business sectors saw an expansion of activity at the start of the fourth quarter. All bar two of 19 monitored sectors reported output growth in October, compared to ten seeing declines in the previous month.

The rise in output for most Asian sectors mirrored the accelerated pace of growth in Asia's manufacturing economy as a whole. The Asia national manufacturing PMI surveys, produced for Nikkei and Caixin by Markit, collectively signalled the fastest growth since August 2014.

Auto sector revives

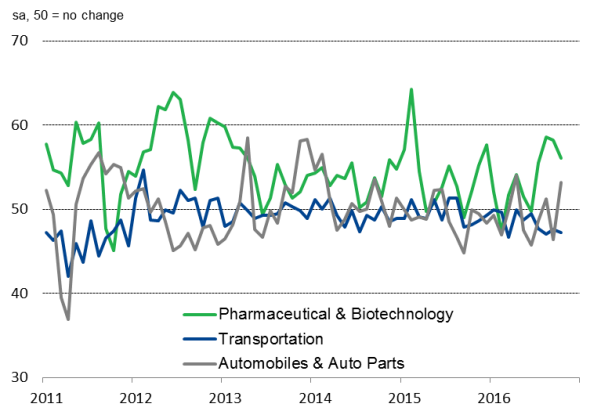

The pharmaceuticals & biotechnology sector remained the top performer in the latest survey month, although a slower pace of expansion was recorded compared to September.

Pharmaceuticals & Biotechnology remains top

However, a key feature of the October data was the revival of the automobiles & auto parts sector. The sector rebounded from September's contraction to report the largest swing in output performance during October.

Moreover, global output growth in the automobiles & auto parts sector quickened to the fastest in over two years, suggesting that the industry enjoyed strong growth momentum in October.

Signs of solid demand for automobiles across Asia drove the improvement in production. Vehicle sales in key markets in the continent such as China, Japan and India registered robust growth in October. This led to auto firms raising production volumes in the month.

Asia: Output in selected sectors

Sources: IHS Markit, Nikkei.

Transportation output declines again

Meanwhile, the contraction of output in the transportation sector continued for the ninth month running in October, as the industry came last in the rankings. With the pace of global exports remaining subdued, business activity in transportation not surprisingly stayed muted. A fall in new orders in the sector further accentuated the challenges faced by transportation companies.

Persistent weakness in the Asian transportation industry is worrying, given its reputation as a leading indicator of economic growth. The good news, however, is that output growth in the global transportation sector remained positive, albeit only moderate.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-Pharmaceuticals-lead-Asian-upturn-but-autos-see-biggest-turnaround-in-performance.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-Pharmaceuticals-lead-Asian-upturn-but-autos-see-biggest-turnaround-in-performance.html&text=Pharmaceuticals+lead+Asian+upturn%2c+but+autos+see+biggest+turnaround+in+performance","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-Pharmaceuticals-lead-Asian-upturn-but-autos-see-biggest-turnaround-in-performance.html","enabled":true},{"name":"email","url":"?subject=Pharmaceuticals lead Asian upturn, but autos see biggest turnaround in performance&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-Pharmaceuticals-lead-Asian-upturn-but-autos-see-biggest-turnaround-in-performance.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Pharmaceuticals+lead+Asian+upturn%2c+but+autos+see+biggest+turnaround+in+performance http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-Pharmaceuticals-lead-Asian-upturn-but-autos-see-biggest-turnaround-in-performance.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}