Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 08, 2016

Economic growth in Indonesia slows as exports and public spending fall

Indonesia's economy lost some growth momentum in the third quarter, with GDP data signalling a rate of expansion that is likely to undershoot the 5.2% target for 2016 set by the government. The year-to-date GDP expansion now stands at 5.0%.

Consumer spending continued to provide a major support to the economy, alongside an upward inventory adjustment. However, a decline in government spending and continued weakness in export growth caused the overall economic expansion to slow.

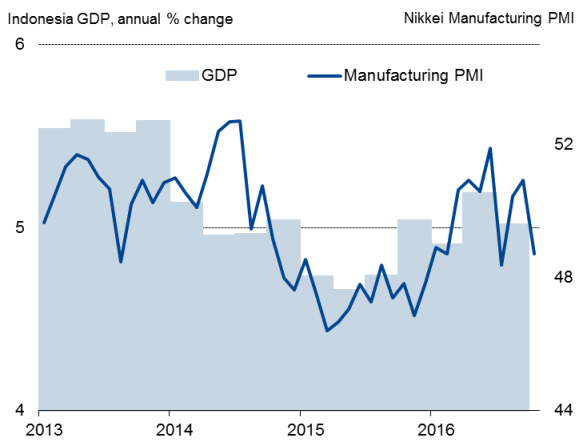

The slowdown occurred despite Bank Indonesia (BI) having cut its main policy rate six times this year (a cumulative 150 basis points) in an effort to stimulate growth. Whether BI is going to lower its benchmark policy rate further depends on future data flow. The latest Nikkei Indonesia Manufacturing PMI suggests that the deceleration in growth momentum continued at the start of the fourth quarter.

Nikkei Indonesia PMI v GDP

Sources: IHS Markit, Nikkei, Statistics Indonesia.

Weaker momentum

Gross domestic product rose 3.2% (not seasonally adjusted) in Q3 from the previous quarter, according to data from Statistics Indonesia (Badan Pusat Statistik). On an annual basis, the economy recorded 5.0% growth in the third quarter, down from 5.2% in Q2. The annual print was consistent with the softer third quarter PMI result from IHS Markit. The PMI averaged 49.9 in Q3 against 51.1 in Q2.

Weak commodity prices have negatively impacted tax revenue collection leading to a budget shortfall, which in turn prompted fiscal budget cuts. Therefore, it is not surprising to see public spending having fallen in the third quarter. Meanwhile, soft global demand continued to weigh on export receipts.

On a brighter note, these headwinds do not seem to have prompted a dramatic fall in employment numbers. The labour market in Indonesia's manufacturing sector remained stable, which helped to support household expenditure. Lower inflation and fuel prices also encouraged consumers to continue spending.

Personal consumption expenditure rose at a quarterly rate of 3.5% in Q3, its strongest quarter-on-quarter increase in a year, highlighting the key role that domestic demand continues to play in sustaining robust economic growth. However, on an annual basis, it was marginally slower in Q3 than in Q2.

Slowdown to persist in Q4

If Indonesia is to achieve its 2016 GDP target of 5.2%, the economy needs to grow 5.8% in the last quarter of 2016. This currently looks unlikely. So far, early indicators of the fourth quarter point towards a further slowdown in growth momentum. At 48.7 in October, the manufacturing PMI fell back into contraction, signalling a deterioration in operating conditions at the start of Q4.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-Economic-growth-in-Indonesia-slows-as-exports-and-public-spending-fall.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-Economic-growth-in-Indonesia-slows-as-exports-and-public-spending-fall.html&text=Economic+growth+in+Indonesia+slows+as+exports+and+public+spending+fall","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-Economic-growth-in-Indonesia-slows-as-exports-and-public-spending-fall.html","enabled":true},{"name":"email","url":"?subject=Economic growth in Indonesia slows as exports and public spending fall&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-Economic-growth-in-Indonesia-slows-as-exports-and-public-spending-fall.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Economic+growth+in+Indonesia+slows+as+exports+and+public+spending+fall http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-Economic-growth-in-Indonesia-slows-as-exports-and-public-spending-fall.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}