Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 08, 2016

Disappointing German industry data add to signs of modest economic growth in third quarter

German industrial production suffered its largest drop for over two years in September, but there are signs that industry is in fact picking up strength again at the start of the fourth quarter.

Official statistics body Destatis reported a 1.8% fall in output, following an upwardly revised and unusually strong 3.0% increase in August (previously reported as a 2.5% rise). Analysts expected a more modest decline of 0.5%. A separate report showed that exports declined 0.7%, while Germany's trade balance shrank.

The monthly data are notoriously volatile, so it is important to look at the trend in production. Over the three months to September, industrial output rose 0.2%, therefore making a mildly positive contribution to economic growth in the third quarter, rebounding after industry acted as a drag on the wider economy in the second quarter.

Industrial production and factory orders

Similarly, Destatis reported that factory orders fell 0.6% during the month, but over a three-month period increased 0.5% (from -0.4% over the second quarter).

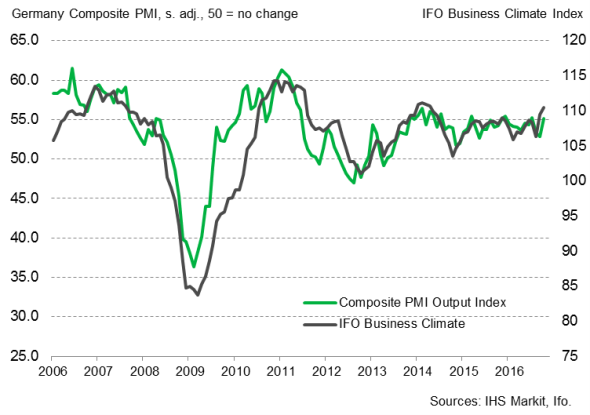

Encouragement can also be sought from the latest PMI and Ifo survey results, with both pointing to a solid start to the fourth quarter.

September downturn weather-related?

Destatis reported that capital goods output fell 2.4% during September, while consumer goods production was down 1.9%. Intermediate goods output decreased a more modest 0.5%. However, energy production was down 3.4%, likely a result of warmer-than-usual weather. The "Deutscher Wetterdienst" reported that September 2016 was one of the four hottest since 1881.

Moreover, it is likely that the weak September reading was at least in part related to payback from an exceptionally strong August reading. The 3.0% increase in industrial output in August was the strongest since March 2010.

Trade balance shrinks

A separate report showed that Germany's trade balance narrowed to "21.3bn in September. This was down from "21.6bn and much weaker than an expected increase to "23.0bn. Exports were down 0.7%, while imports decreased 0.5%. In the first nine months of the year, exports (unadjusted for seasonal and calendar effects) rose 0.9%, mainly driven by higher demand from countries within the European Union.

Steady GDP growth signalled for third quarter

The official industry and trade data add to signs that economic growth in Germany has again failed to match the impressive 0.7% expansion seen in the first quarter, when industrial production rose 1.8%. It is nonetheless expected that industry will have a positive contribution to GDP growth in the third quarter.

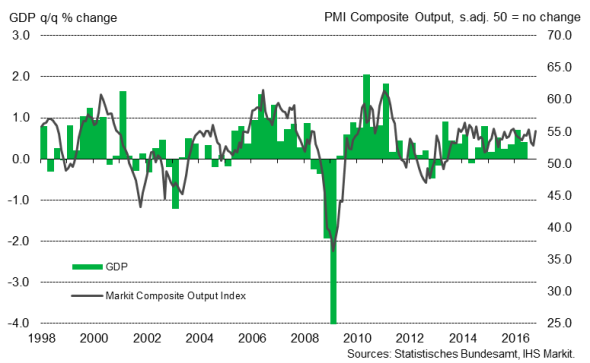

Recent PMI results signalled a weakening of economic growth at the end of the third quarter, as a struggling service sector acted as a major constraint on the overall performance of the German economy. The Composite PMI (which combines the output of the manufacturing and service sectors) fell to a 16-month low in September, and, despite signalling economic growth of around 0.4%, there remain some downside risks for third quarter GDP. Destatis publishes preliminary third quarter results on November 15th.

German GDP and the PMI

Outlook for Q4 looks bright

Although it is unlikely that third quarter GDP growth has accelerated from the 0.4% pace of expansion seen in the second quarter, survey data for October point to an encouraging start to the fourth quarter: the PMI recovered from September's low and reached its second-highest level in 2016 so far, while the Ifo Business Climate Index climbed to a two-and-a-half year high. The survey data are generally less volatile than official data and highlight that the eurozone's largest member state remains in good shape. Both IHS Markit and the German government expect GDP growth of 1.8% for 2016, which would be the strongest in five years.

PMI and Ifo point to solid start to Q4

Flash PMI data for November are released on November 23rd and will provide important information on economic trends in Germany.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-Disappointing-German-industry-data-add-to-signs-of-modest-economic-growth-in-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-Disappointing-German-industry-data-add-to-signs-of-modest-economic-growth-in-third-quarter.html&text=Disappointing+German+industry+data+add+to+signs+of+modest+economic+growth+in+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-Disappointing-German-industry-data-add-to-signs-of-modest-economic-growth-in-third-quarter.html","enabled":true},{"name":"email","url":"?subject=Disappointing German industry data add to signs of modest economic growth in third quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-Disappointing-German-industry-data-add-to-signs-of-modest-economic-growth-in-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Disappointing+German+industry+data+add+to+signs+of+modest+economic+growth+in+third+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08112016-Economics-Disappointing-German-industry-data-add-to-signs-of-modest-economic-growth-in-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}