Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 08, 2017

Global economy hits speed bump, as PMI dips from 22-month high

The following is an extract from Markit's monthly economic overview. For the full report please click the link at the bottom of the article.

Global economic growth lost a little momentum in February, according to PMI survey data, but remained robust.The JPMorgan Global PMI", compiled by Markit, fell for the first time in six months, down from January's 22-month high of 53.9 to a three-month low of 53.5.

Global PMI* & economic growth

Sources: IHS Markit, JPMorgan

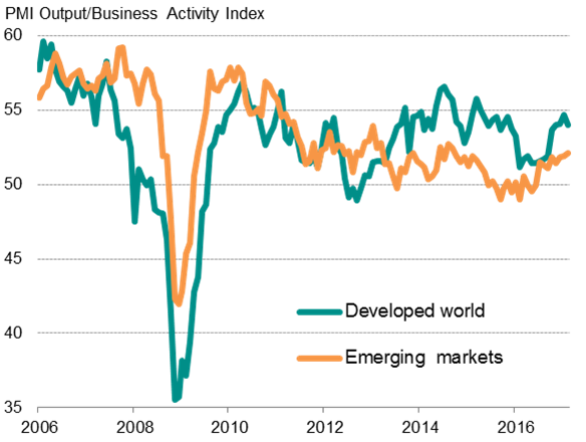

Despite the slight slowing, the survey data are consistent with global GDP rising at an annual rate of 2.5% in the first quarter, assuming no major change in momentum during March. Emerging market growth edged up to a 29-month high, but continued to under perform relative to the rich world, despite the latter recording the weakest expansion for three months.

Developed & emerging market output

* PMI shown above is a GDP weighted average of the survey output indices

Source: IHS Markit.

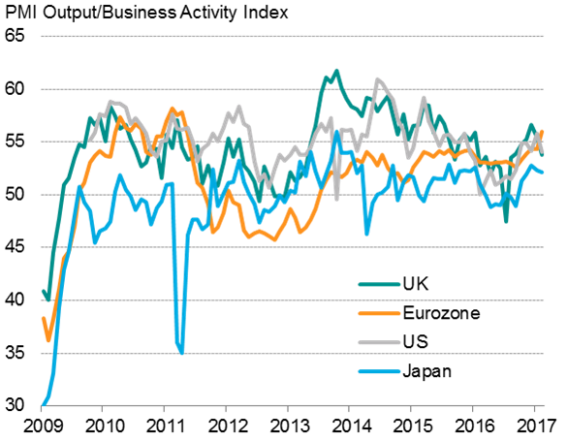

Eurozone leads developed world expansion

Developed world growth was led by the eurozone, where growth hit a near six-year high. Growth meanwhile slowed in the US, UK and Japan, albeit remaining robust in all cases by recent standards to suggest broad-based expansions among the four largest rich-world economies.

Main developed markets*

Source: CIPS, IHS Markit, Nikkei.

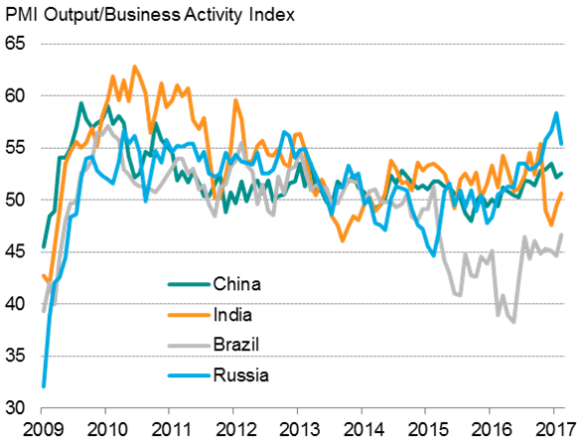

Russia continued to lead the emerging market upturn, recording the highest PMI of the BRIC nations for the fourth successive month. Growth accelerated in China, and India returned to expansion for the first time since October, suggesting the economy is recovering from the disruptions of demonetisation. Brazil remained firmly in decline, though the contraction was the shallowest for almost two years.

BRIC nations*

* PMI shown above is a GDP weighted average of the survey output indices.

Sources: IHS Markit, Caixin, Nikkei.

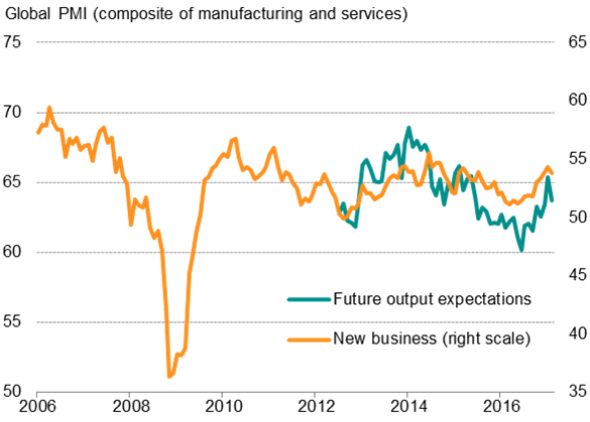

Global business optimism wanes, costs rise sharply

Other global indicators also pulled back from highs at the start of the year but remain consistent with steady growth of business activity. Business optimism about future output dipped from January's 20-month high. This was partly due to reduce expectations in the developed world, though overall optimism remained at the second-highest level for over 1" years. Growth in new business likewise eased back from January's 28-month record.

Future expectations & new orders

Source: IHS Markit, JPMorgan.

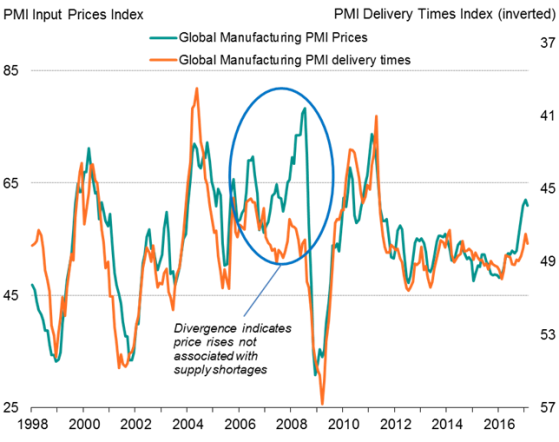

While manufacturers continued to signal longer delivery times, the surveys remain indicative of only mild inflationary pressures in global supply chains. Prices paid for manufacturing inputs nevertheless continued to rise sharply due to higher energy and commodity costs, with the rate of input price inflation holding close to January's 5" year peak.

Global inflation pressures

Source: IHS Markit, JPMorgan.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Economics-Global-economy-hits-speed-bump-as-PMI-dips-from-22-month-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Economics-Global-economy-hits-speed-bump-as-PMI-dips-from-22-month-high.html&text=Global+economy+hits+speed+bump%2c+as+PMI+dips+from+22-month+high","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Economics-Global-economy-hits-speed-bump-as-PMI-dips-from-22-month-high.html","enabled":true},{"name":"email","url":"?subject=Global economy hits speed bump, as PMI dips from 22-month high&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Economics-Global-economy-hits-speed-bump-as-PMI-dips-from-22-month-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economy+hits+speed+bump%2c+as+PMI+dips+from+22-month+high http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032017-Economics-Global-economy-hits-speed-bump-as-PMI-dips-from-22-month-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}