Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 03, 2017

UK PMI surveys show stronger current growth, but waning future optimism

The latest PMI surveys brought mixed news on the UK economy at the start of the fourth quarter, and highlight the uncertain path for future central bank policy. While an upturn in business activity growth to the fastest for six months adds some justification to the Bank of England's decision to hike interest rates for the first time in a decade, a deeper dive into the numbers highlights downside risks for the outlook.

With the rate of job creation waning to its lowest for seven months amid a downturn in business optimism about the year ahead, further rate hikes any time soon are by no means assured.

News on prices was also varied. Selling prices rose at an increased rate, but input cost pressures eased, the latter suggesting selling future price inflation may cool.

Solid start to fourth quarter

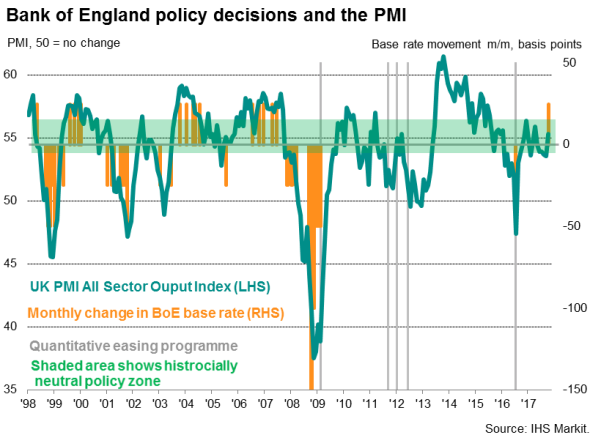

Businesses reported an encouragingly solid start to the fourth quarter, with output rising in October at the fastest rate since April. The "all-sector' IHS Markit/CIPS PMI Output Index rose for the first time in six months, up from 53.6 in September to 55.3. The current reading is indicative of the economy growing at a quarterly rate of 0.5%, representing an encouragingly solid start to the final quarter.

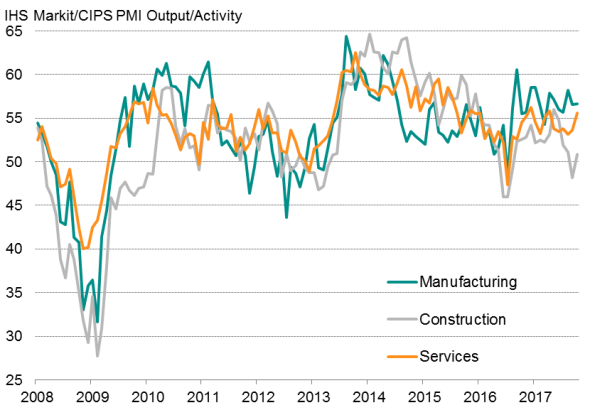

The upturn was mainly due to faster growth of service sector business activity, which hit a six-month high, as well as a return to modest growth in the construction sector after a brief slide into decline in September. However, manufacturing continued to record the strongest pace of expansion of the three sectors, albeit with the rate of increase unchanged on September.

The upturn in current business activity was driven by increased inflows of new work, which showed the largest monthly rise since May, gathering pace in both manufacturing and services and returning to modest growth in construction.

Output of the three main sectors

Sources: IHS Markit, CIPS.

Increased amounts of new work reflected resilient demand, notably from domestic markets. Goods export growth slowed to a four-month low, suggesting the strengthening of sterling since earlier in the year hampered overseas sales.

While indicators of current activity improved in October, forward-looking indicators deteriorated. Business optimism about the year ahead slipped to a 15-month low, running at a subdued level by historical standards as firms reported increased concern about the economic and political outlook, with Brexit uncertainty dominating. Such a weak degree of sentiment has commonly only been seen prior to a downturn in the economy.

Hiring at seven-month low

Despite the increase in new orders during the month, backlogs of work fell for the second time in the past four months. Although only slight, the decline was the largest since February and suggests that current operating capacity in both manufacturing and services is more than sufficient to cope with current demand growth.

Given the drop in backlogs of work and deterioration in optimism about the future, it was not surprising to see job creation slow in October to its lowest since March. Net job gains were recorded in all three sectors, but only manufacturing saw increased hiring.

Mixed price trends

Slower employment growth also in part reflected difficulties finding suitable staff, and was likewise a symptom of the need to offset higher input costs. Average input cost inflation remained elevated in October, largely on the back of higher manufacturing raw material costs.

Higher costs were again pushed on to customers. Average prices charged for goods and service rose at the steepest rate for six months in October, with an especially strong increase again seen in manufacturing.

However, although still high by historical standards, the overall rate of cost inflation dipped to a four-month low, driven by slower growth of costs in the services and construction sectors. Weaker growth of input costs should take some pressure of future selling price inflation.

Policymakers pulled in different directions

The October upturn keeps the all-sector PMI in broadly neutral territory as far as Bank of England policy is concerned, albeit with a tightening - rather than loosening - bias. In this respect, the November rate hike looks unusual, as past interest rates hikes (since 1999) have not occurred when the all-sector PMI has been below 56.5.

Furthermore, the drop in future optimism to its lowest for over a year highlights the fragility of business confidence, and underscores the vulnerability of the economy amid the heightened uncertainty surrounding the Brexit process. Anecdotal evidence highlighted how companies were worried that customer spending will be increasingly hit as Brexit uncertainty intensifies, all of which suggests there are downside risks to the economic outlook. Such risks add significant uncertainty to the timing of any further rate hikes.

Bank of England governor Mark Carney has hinted that at least two more rate hikes will be needed in 2018 to ensure its inflation target is met; a scenario which assumes the economy grows by 1.6% in 2018.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112017-Economics-UK-PMI-surveys-show-stronger-current-growth-but-waning-future-optimism.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112017-Economics-UK-PMI-surveys-show-stronger-current-growth-but-waning-future-optimism.html&text=UK+PMI+surveys+show+stronger+current+growth%2c+but+waning+future+optimism","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112017-Economics-UK-PMI-surveys-show-stronger-current-growth-but-waning-future-optimism.html","enabled":true},{"name":"email","url":"?subject=UK PMI surveys show stronger current growth, but waning future optimism&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112017-Economics-UK-PMI-surveys-show-stronger-current-growth-but-waning-future-optimism.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+surveys+show+stronger+current+growth%2c+but+waning+future+optimism http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112017-Economics-UK-PMI-surveys-show-stronger-current-growth-but-waning-future-optimism.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}