Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Agriculture, Rice

December 04, 2024

By Tanya Rana and Namarita Kathait

HIGHLIGHTS

India removed minimum export price for non-basmati white rice in October

India set to export 20.5 mil mt in 2024-25, up 42% on year: Commodity Insights

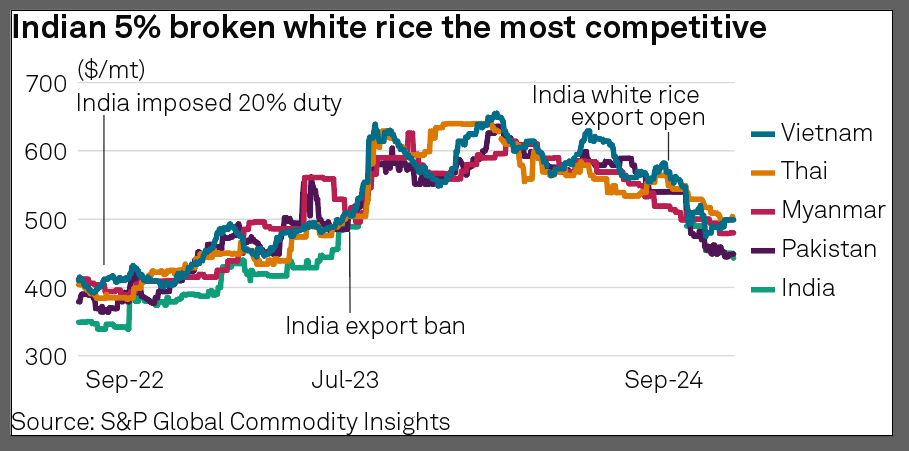

India 5% broken white rice prices have slumped to an 18-month low at $443/mt FOB on Dec. 4, down $13/mt on the month and $57/mt lower since July 20 last year, highlighting a downtrend in the country's rice market, according to assessments from Platts, part of S&P Global Commodity Insights.

This steep price slide is likely to make Indian-origin rice very competitive in the region, market sources said.

Last year on July 20, India imposed a ban on the export of white rice. On Sept. 28, 2024, the country lifted the ban on non-basmati white rice exports but introduced a minimum export price of $490/mt. Subsequently, on Oct. 23, 2024, the Ministry of Commerce and Industry announced the removal of this minimum export price for non-basmati white rice.

In September 2022, India restricted the exports of white rice by putting a 20% duty on exports.

As of Dec. 4, the prices for 5% broken white rice from various major origins are as follows: Thai rice is priced at $499/mt FOB, Vietnamese rice is also at $499/mt, Pakistani rice is at $449/mt, and Myanmar rice is at $480/mt FOB FCL, according to data from Commodity Insights.

"White rice prices are lower than the previous year as the government levied a 20% export duty on white rice in 2022, which went away in 2024 after they opened the ban on white rice exports. However, the white rice market would remain stable to soft for new crop ahead due to Minimum Support Price on paddy, that would not let local prices crash," an exporter said.

Low demand and new crop supply pressure are likely to weigh on prices. A Chhattisgarh-based exporter said that demand for Indian rice from Vietnam and China is expected to decline after December due to the upcoming Lunar New Year holidays. The source also indicated that white rice prices might drop by $20/mt starting February due to rising supply. They noted weak demand from Africa, as the region has already secured shipments for December. While there has been some buying interest from Sri Lanka, overall demand remains sluggish.

Recent congestion at ports like Kakinada and Kandla has led to slow buying interest. "Demand currently is also low due to high congestion at ports like Kakinada and Kandla. There's a waiting time of 15-20 days at these ports due to which buyers are not interested in purchasing more and are more focused on completing pending shipments for trades done in October and early November. There is speculation of a further downtrend in prices, which is halting buying interest," Jatin Mahajan, the trading manager at Adani Wilmar Limited said.

Despite all the challenges hampering Indian rice trade, the projection for next year looks promising for the sector.

India is forecast to export 20.5 million mt of rice in the marketing year 2024-25 (October-September), up 42.36% year over year, making it the largest exporter in the world, according to S&P Global Commodity Insights.