Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Our Methodology

Methodology & Participation

Reference Tools

S&P Global

S&P Global Offerings

S&P Global

Agriculture, Rice

November 22, 2024

HIGHLIGHTS

Exporters likely to face financial risks on loading delays, higher local prices

Tepid demand offsets high local prices amid rupee depreciation

Indian local milled white rice prices rose on a shortage of freshly milled supply from the new crop amid millers' negotiations with the government in major rice-growing states, such as Odisha and Chhattisgarh, sources told S&P Global Commodity Insights on Nov. 21.

Millers have stopped processing freshly milled rice and are negotiating with the government to increase custom milled rice rate and support millers with the storage of rice.

Despite rising milled white rice prices and supply shortage, the WR 5% market remains stable to soft on staggered demand and international buyers expecting lower prices. Hence, Indian exporters are likely to face financial losses due to delays in loading vessels, the sources added.

Millers have raised various concerns with the government, an Odisha-based miller said. Odisha millers are demanding the government raise milling charges for custom milling, provide Fair Average Quality (FAQ) standard paddy to improve yield and support with the storage amid the slow government procurement process of custom milled rice.

"It's been three months since we gave advance notice to the government, forewarning about the prolonged period of storage amid slow procurement process. Because of the minimum support price of Rupees 31,000/mt ($367/mt) to the farmers, the local market paddy market has risen. On top of it, the government reduced milling charges by Rupees 100/mt for millers, leaving no parity for millers in custom milling job as well," the miller said.

In Chhattisgarh, where the millers are supported by the state government for storage and get FAQ standard paddy, their main issue with the government is the pending custom milling payments valuing around "Rupees 4,000 crores," or $472.27 million, according to a Chhattisgarh-based miller and exporter, while their inventory/mills cost pile up on a daily basis.

"Millers will restart milling of paddy once the government resolves pending payments and increase custom milling charges that they have recently cut down by Rupees 600/mt. Most rice millers who mill paddy to white rice are small-sized businesses and are the most affected, as opposed to millers who have better and larger mills to produce parboiled rice," they added.

Mirroring similar sentiments, an exporter based in Kakinada said the custom milled rice rates for millers in Chhattisgarh have been reduced to Rupees 600-800/mt, down from the previous rate of Rupees 1,200/mt. This reduction has upset the millers, who are now demanding that the new government restore the Rupees 1,200/mt rate.

"The government is asking millers to complete the supply of all the pending milled rice from last year before they get paid, which some millers have not. However, from millers' perspective, the government was slow on procurement and had asked millers to store rice with them due to space storage," a Delhi-based exporter said.

With major rice growing states restricting supply of white rice, sources noted delays in loading vessels already present at load port.

"Delayed loading of the vessels already stationed is costing exporters on an everyday basis," an exporter said.

Another exporter said, because of supply restrictions and rising local milled rice prices, buyers were shying away from giving firm offers.

Local milled rice prices for WR 5% increased 3% in two weeks to Rupees 36,000/mt ($426/mt) from Rupees 35,000/mt ($414/mt), sources said.

The restricted supply led to short covering in the market, boosting bullish sentiments in the domestic market.

Parboiled 5% local milled rice prices jumped to Rupees 36,000/mt ($426/mt) from Rupees 34,500/mt ($408/mt), up 4% on the week, according to a source.

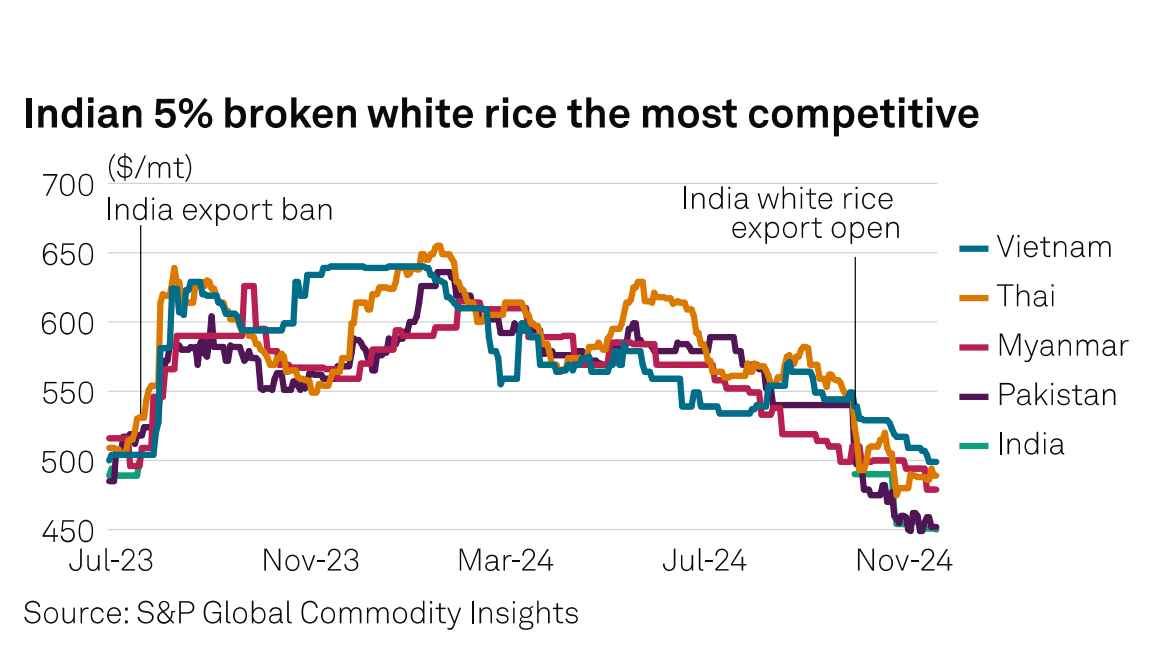

Despite restricted supply, India's WR 5% is the most competitive among other origins, with exporters noting subdued demand for white rice amid depreciating Indian rupees against the dollar.

The Chhattisgarh-based source said supply from other rice growing states, such as Uttar Pradesh and Bengal, are pressuring WR 25% prices.

Platts, part of Commodity Insights, assessed Indian WR 5% at $450/mt FOB on Nov. 21, down $1/mt on the week, and WR 25% at $432/mt FOB, $7/mt lower on the week.

However, the parboiled market firmed on increased local prices and supply cut from the Chhattisgarh market due to millers' strike.

An Andhra Pradesh-based exporter said, with Chhattisgarh not supporting freshly milled parboiled rice supply, the market has overall firmed. Despite rising prices, sources noted international demand for Indian parboiled rice.

Platts assessed Indian Parboiled 5% at $450/mt Nov. 21, up $5/mt on the day and $18/mt higher from Nov. 7.

Market participants anticipate supply pressure from the new crop harvest in full force by the end of November, indicating bearish sentiments in the coming weeks.

India is forecast to export 20.5 million mt of rice in the marketing year 2024-25 (October-September), up 38.5% year over year, according to Commodity Insights data.