Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 01, 2021

Vietnam economy slump persists into September amid worsening supply constraints

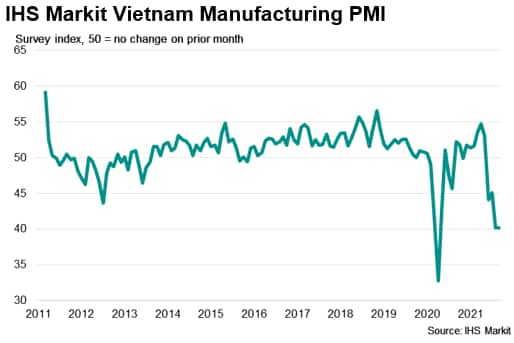

Vietnam GDP contracted sharply at 6.17% in Q3, reflecting the COVID-19 hit to the economy, in line with early signals from the IHS Markit Vietnam Manufacturing PMI. Indications of sustained supply chain pressures amid prolonged COVID-19 disruptions further bear implications for all who depend upon Vietnam manufacturing in the global value chain.

Q3 GDP post sharpest decline on record

Official data from the General Statistics Office (GSO) of Vietnam revealed that GDP declined 6.17% in Q3, the sharpest fall on record. This follows a Q2 GDP expansion of 6.57%, outlining the extent to which the latest COVID-19 wave has adversely affected the Vietnamese economy.

This perhaps come with little surprise given how profound the recent COVID-19 wave has been for the Vietnamese economy, as daily new cases rose to an unprecedented level in September. Furthermore, the IHS Markit Vietnam Manufacturing PMI™ data had also preluded this deteriorating economic trend in the third quarter, with the PMI figures having plunged sharply into contraction since June.

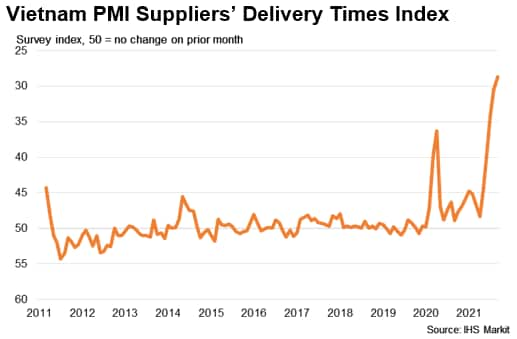

IHS Markit Vietnam Manufacturing PMI points to unprecedented supply-chain disruptions

Over and above implications for demand and output from the spread of the more infectious COVID-19 Delta strain, Asia-Pacific economies had also faced issues of supply constraints into Q3 amid the imposition of virus-fighting mobility restrictions across the region. Vietnam had perhaps been a poignant example in this case, with delivery times lengthening in September at an unprecedented rate since the inception of the survey in 2011. The extent at which lead times lengthened was also far more severe than even the prior peak in 2020 when the COVID-19 pandemic first affected the global economy.

The importance of this is not just for the Vietnam economy but also the global supply chain. The imperative to diversify amid the bout of US-China trade tensions benefitted regional manufacturers including those in Vietnam. While the COVID-19 pandemic is unlikely to diminish Vietnam's role in the global value chain, those who depend upon Vietnam as a key manufacturing node would likewise have to bear the consequences of any prolonged disruptions from the virus spread.

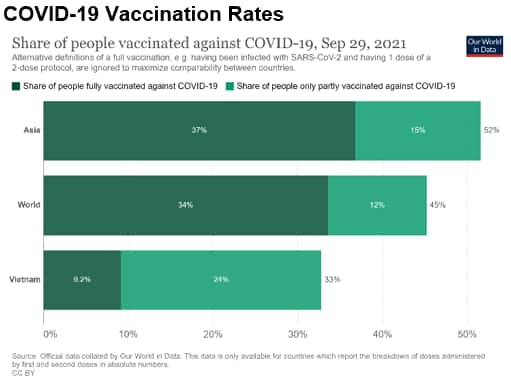

Rising vaccination and lower infection rates in Vietnam

While the latest COVID-19 wave had hit Vietnam hard, there are positive signs that the numbers of daily new cases have receded into the end of Q3. Alongside the continued vaccination efforts noted in the country, recovery is expected for the Vietnam economy post the slump in Q3 GDP.

Indeed, September's PMI sub-indices brought some hints of the situation starting to turn around. Although the headline PMI was unchanged deep in contraction territory at 40.2, the survey's production index lifted from August's 16-month low to signal an easing in the rate of contraction. Future expectations also climbed from August's all-time low.

That said, we have all been humbled in our expectation that the supply chain issues will slowly resolve themselves, as evident by the deterioration in delivery times and persistent price pressures for manufacturers into 2021. One can imagine that the supply situation will persist in the short-term with demand expected to lead in the recovery and contribute to increased imbalances. As such, signals from upcoming manufacturing PMIs, particularly from key Asia manufacturing hubs, will be studied for how soon these supply constraints can ease and where next we will be headed with the global manufacturing supply chain.

Jingyi Pan, Economics Associate Director, IHS Markit

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-economy-slump-persists-into-september-amid-worsening-supply-constraints-oct21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-economy-slump-persists-into-september-amid-worsening-supply-constraints-oct21.html&text=Vietnam+economy+slump+persists+into+September+amid+worsening+supply+constraints+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-economy-slump-persists-into-september-amid-worsening-supply-constraints-oct21.html","enabled":true},{"name":"email","url":"?subject=Vietnam economy slump persists into September amid worsening supply constraints | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-economy-slump-persists-into-september-amid-worsening-supply-constraints-oct21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Vietnam+economy+slump+persists+into+September+amid+worsening+supply+constraints+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-economy-slump-persists-into-september-amid-worsening-supply-constraints-oct21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}