Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 10, 2025

US equity market investor sentiment reaches one-year high as policy optimism improves

The latest S&P Global Investment Manager Index (IMI) indicated that risk sentiment further improved among US equity investors at the start of December. Optimism regarding both fiscal and monetary policy picked up while concerns over the political environment and valuations eased. Notably, positive sentiment returned for the global macroeconomic environment for the first time in one-and-a-half years, hinting at the rising expectation for stronger global economic growth in the near-term.

The uplift in risk sentiment also led to higher expectations regarding near-term equity returns and strengthened optimism for a number of sectors, although bullish sentiment eased for the IT sector.

US equity investor risk appetite improves for third straight month

The December S&P Global Investment Manager Index survey, which tracks views from a panel of just under 300 participants employed by firms that collectively represent approximately $3,500 billion assets under management, revealed that risk sentiment improved to the highest in a year.

The IMI's Risk Appetite Index rose to +34% from +18% in November. This marks the third consecutive month in which the index has moved higher. While November's improvement had been accompanied by almost no change in the IMI's Equity Returns Index, which tracks equity investors' near-term expectations regarding market performance, a significant uplift of the Equity Returns Index was observed in December to the joint-highest level in just over a year. This suggests that we will likely see an improvement in US equity market performance into the end of 2025.

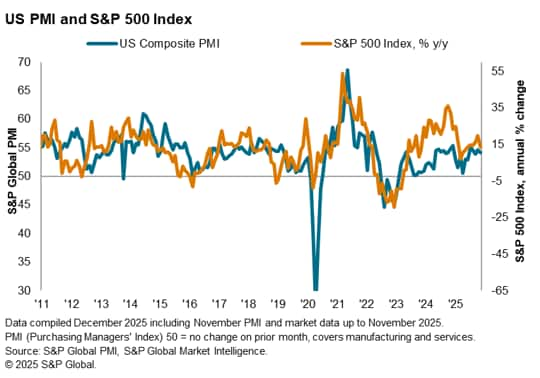

US PMI and the S&P 500 index

A comparison of the S&P 500 index and the US PMI meanwhile revealed that convergence was seen into November, as the year-on-year change of the former lowered into the fourth quarter particularly with the pullback in market performance in the penultimate month of the year.

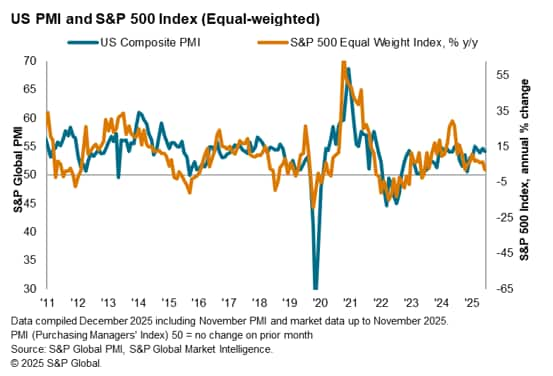

Cross-comparison of the US PMI and the equal-weighted S&P 500 index revealed greater divergence, however, as the year-on-year change of the equal weighted S&P 500 index slipped lower in trend compared to the relatively solid performance of the US Composite PMI in the penultimate month of the year.

The November assessment of the S&P 500 index with economic fundamentals previously outlined the concentration risks among a handful of stocks. Moving into December, we are seeing a relatively broad-based pullback earlier that went beyond just the large-capitalized technology stocks. This retreat therefore supports the increased optimism beyond the large-capitalization technology stocks going into the final month of 2025 as detailed below.

Broad-based uplift in sentiment across sectors

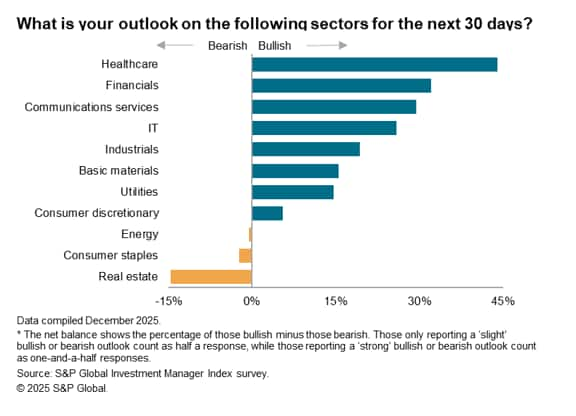

Looking at sector preferences among US equity investors, net bullishness was observed for eight of the 11 sectors tracked, the highest proportion in just over a year. The real estate sector was the only sector to see any substantial negative net balance as both the consumer staples and energy sectors recorded only mildly bearish sentiment on balance. Even so, all three 'out of favor' sectors saw the level of bearish sentiment soften from November.

On the other hand, the eight sectors with net bullish sentiment were led by the healthcare, financials and communication services sectors in December, with the majority seeing improved optimism from November and sentiment regarding the consumer discretionary sector notably turning positive for the first time since January.

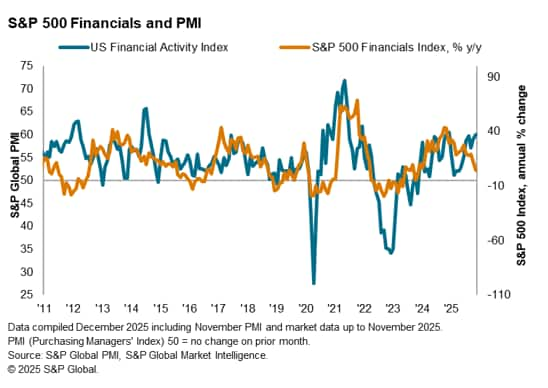

Focusing on the financial sector, which has a relatively positive track record this year, a growing divergence can be observed between the S&P 500 financial sector index and the US Financial Services PMI, with financial stocks underperforming compared to the trend for the financial sector PMI in November. This indicates that financial stocks may be underperforming relative to the economic fundamentals for the sector, with further upside potential, thereby reinforcing the bullish sentiment among US equity investors.

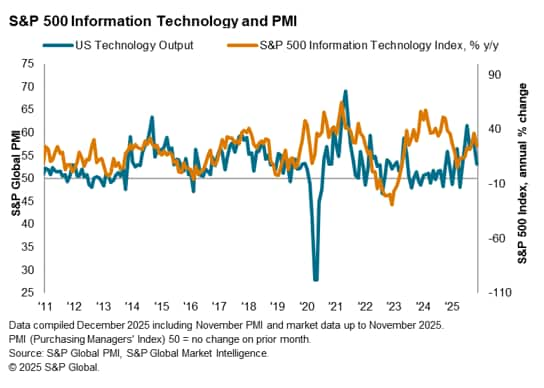

Meanwhile, the only sectors where bullish sentiment retreated were the information technology (IT), utilities and industrials sectors. The IT sector is now ranked only fourth in December after falling from being most favored back in November. The comparison between the S&P 500 technology sector index and the US Technology Sector PMI has also reinforced the likelihood of more moderate near-term growth, as the trend for year-on-year gains in the S&P 500 technology sector has been falling since November amid greater convergence.

Optimism regarding the global macroeconomy at near four-year high

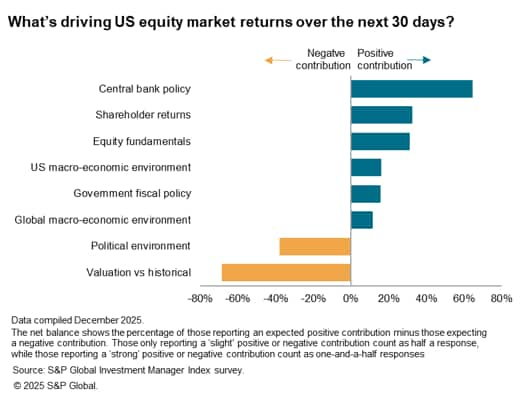

In assessing the key factors underpinning improved risk sentiment in November, the latest IMI survey revealed that optimism rose almost across the board for the key market drivers tracked. This was while concerns over the drag to equity performance from the political environment and valuations eased, reflecting the conclusion of the US government shutdown in November and the pullback in equity prices respectively.

Meanwhile, positive sentiment towards shareholder returns continued to improve following the earnings season, boosted by improved optimism towards both the monetary and fiscal policy outlooks. Investors were the most upbeat towards the outlook for central bank policy since April 2021 amid expectations for the Fed to further lower interest rates just ahead of the final Federal Open Market Committee (FOMC) meeting of the year.

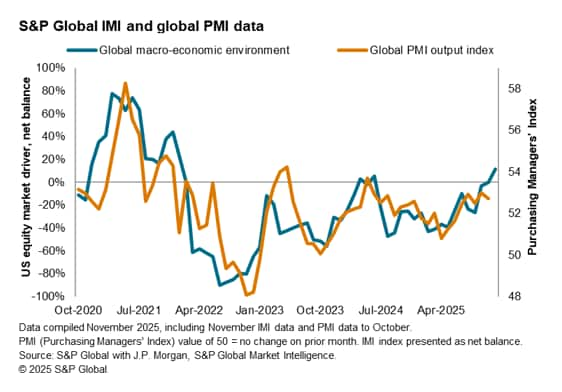

Hopes for greater policy support also contributed to optimism towards both the US and global macroeconomic environments in lifting near-term market performance. Notably, sentiment towards the global macroeconomic environment turned positive for the first time in one-and-a-half years.

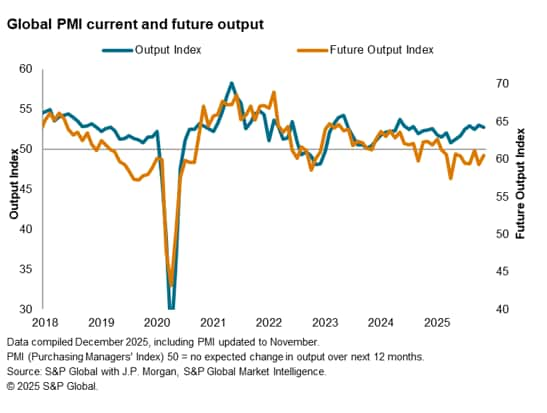

Given the high correlation between the net balance for the global macroeconomic environment and the J.P. Morgan Global Composite PMI Output Index, the latest sentiment data from U.S. equity investors hint at the continued likelihood of global growth picking up pace from the already robust expansion in November. This is despite lingering concerns regarding the gap between current output and future output expectations, with the latter carrying worrying implications for both hiring and investments by businesses that could determine the macro picture in the coming year.

With the above in mind, we will be looking closely to the final flash PMI releases for 2025 across major economies on December 16th for confirmation of the growth trend and the insights into economic conditions.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-market-investor-sentiment-reaches-oneyear-high-as-policy-optimism-improves-Dec25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-market-investor-sentiment-reaches-oneyear-high-as-policy-optimism-improves-Dec25.html&text=US+equity+market+investor+sentiment+reaches+one-year+high+as+policy+optimism+improves+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-market-investor-sentiment-reaches-oneyear-high-as-policy-optimism-improves-Dec25.html","enabled":true},{"name":"email","url":"?subject=US equity market investor sentiment reaches one-year high as policy optimism improves | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-market-investor-sentiment-reaches-oneyear-high-as-policy-optimism-improves-Dec25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+equity+market+investor+sentiment+reaches+one-year+high+as+policy+optimism+improves+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-equity-market-investor-sentiment-reaches-oneyear-high-as-policy-optimism-improves-Dec25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}