Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 11, 2025

Emerging markets new export orders rise at fastest pace since US tariff announcements

November PMI data showed a renewed expansion of new export orders among emerging markets companies. Moreover, the rise was the most pronounced since February, just prior to the beginning of widespread tariff announcements by the US, which led to a period of trade disruption. The data suggest that firms in emerging markets could be set for better international demand conditions as we enter 2026.

Business activity also increased in November, while inflationary pressures remained relatively muted. That said, business confidence was subdued and firms were reluctant to commit to the hiring of additional staff despite rising workloads.

Renewed rise in new business from abroad

The PMI surveys compiled globally by S&P Global signalled a renewed rise in new export orders across emerging markets in November. The expansion reversed a modest fall seen in October and was the second in the past three months.

The rate of growth in new export orders was modest, but the fastest since February, prior to April's announcement of widespread tariffs by the US which led to a period of falling new export orders between April and August, driven by the manufacturing sector.

Renewed increases in new business from abroad were registered across both the manufacturing and services sectors. In each case, the rate of growth was the sharpest in nine months, with services posting the steeper expansion of the two categories.

The rise in new export orders in emerging markets compared favourably with the picture in developed markets, where new business from abroad decreased again in November, extending the current sequence of monthly declines to three-and-a-half years.

A greater number of emerging markets saw manufacturing new export orders increase in November. India again posted the sharpest expansion, although here the pace of growth eased to the lowest in a year-and-a-half. Notably, mainland China posted a renewed expansion of new export orders, as did Czechia and Poland. At the other end of the scale, manufacturing new business from abroad decreased sharply in Brazil, with survey respondents highlighting the adverse impact of US tariffs.

Services lead solid growth of output

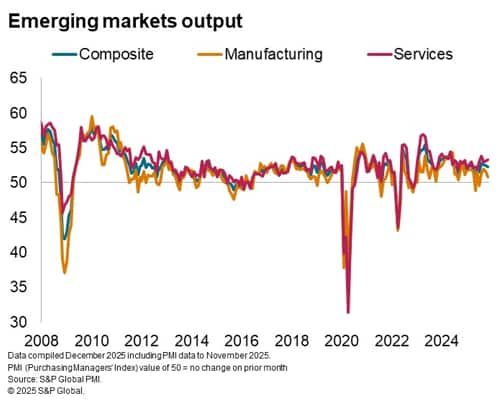

The renewed expansion in new export orders supported a further solid increase in total new business among emerging markets companies. In turn, business activity also rose, the thirty-fifth consecutive month in which this has been the case. The rate of expansion was solid and broadly in line with the average for the year-to-date, despite easing slightly from that seen in October.

The rise in business activity was led by the services sector, where the rate of expansion quickened to a three-month high. Manufacturing production, meanwhile, increased only slightly and at the slowest pace in the current four-month sequence of growth.

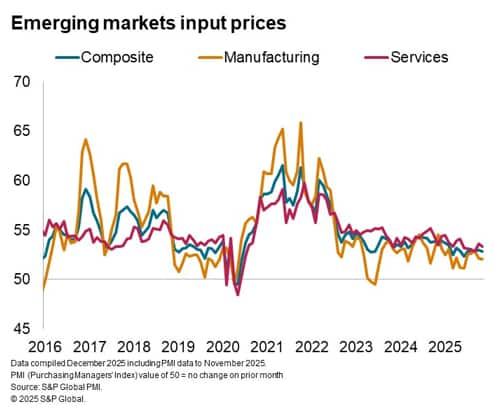

Inflationary pressures remain muted

Companies in emerging markets were helped in their efforts to secure new business by inflationary pressures remaining muted in the penultimate month of the year. The latest increase in input costs was the slowest in five months, and the respective index is on course to post its lowest annual average since at least 2019. Muted cost pressures were seen across both manufacturing and services.

The muted cost environment in emerging markets stands in marked contrast to the picture in developed markets, where input costs increased rapidly in November and at the fastest pace since May, led by rising US prices.

With cost pressures remaining muted, companies based in emerging markets were able to restrict the pace at which they raised their selling prices, thus helping to support customer demand. Charges increased marginally, and to the least extent since June. In fact, manufacturers in emerging markets kept their output prices unchanged for a second month running.

Despite the generally positive signs with regards to demand and business activity, plus a muted inflationary environment, confidence among emerging markets companies remained relatively subdued, having failed to recover much ground following the initial announcement of widespread US tariffs in April.

Firms were therefore reluctant to commit to hiring, cutting staffing levels marginally for the third time in the past four months. The average PMI index reading for employment so far in 2025 implies stable workforce numbers over the course of the year.

Outlook

An improvement in business sentiment in the months ahead would be central to confidence around hiring and potentially lead to an accelerated growth picture more generally. Further improvements in new export orders, and new business volumes more widely, will be key in supporting optimism among companies, with greater stability in trade conditions also providing an economic environment more conducive to expansions.

Andrew Harker

Economics Director

andrew.harker@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-new-export-orders-rise-at-fastest-pace-since-us-tariff-announcements-Dec25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-new-export-orders-rise-at-fastest-pace-since-us-tariff-announcements-Dec25.html&text=Emerging+markets+new+export+orders+rise+at+fastest+pace+since+US+tariff+announcements+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-new-export-orders-rise-at-fastest-pace-since-us-tariff-announcements-Dec25.html","enabled":true},{"name":"email","url":"?subject=Emerging markets new export orders rise at fastest pace since US tariff announcements | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-new-export-orders-rise-at-fastest-pace-since-us-tariff-announcements-Dec25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+markets+new+export+orders+rise+at+fastest+pace+since+US+tariff+announcements+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-new-export-orders-rise-at-fastest-pace-since-us-tariff-announcements-Dec25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}