Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 16, 2025

Inflationary pressures intensify in December amid a fresh rise in new orders for Japanese firms

Business activity in Japan continued to grow in the final month of 2025, according to the flash PMI data by S&P Global. While the rate of output growth decelerated from November, fresh increases in new and backlogged orders pointed to the likelihood for business activity growth to be sustained into the new year. This brighter picture was further reinforced by the quickest rise in headcounts in just over one-and-a-half years and still-elevated confidence regarding future output.

Additionally, while growth in activity was again driven by services, manufacturing has shown signs of stabilising over the course of the fourth quarter.

Meanwhile improvements in demand brought about higher price pressure at the end of 2025. Both input costs and output prices rose at quicker rates compared to November, hinting at higher inflation in the coming months.

The positive output growth performance, coupled with intensifying price pressures, therefore adds to the tightening bias of the Bank of Japan as we watch for their next move and forward guidance at the December meeting.

Japan's flash PMI signals modest growth in December

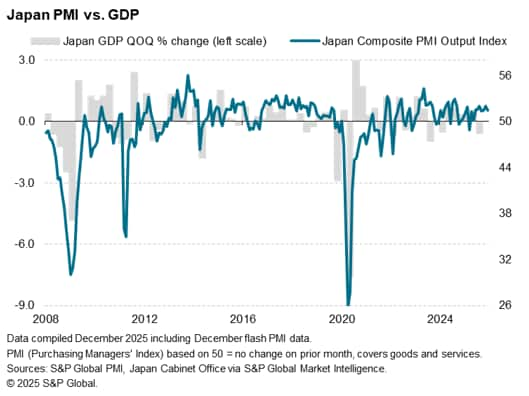

The S&P Global Flash Japan PMI Composite Output Index posted above the 50.0 neutral mark for the ninth month in a row in December to signal another expansion in business activity. That said, at 51.5, down from 52.0 in November, the latest reading pointed to a more modest rise in output in the final month of the year. Nevertheless, the pace of business activity growth was above the 2025 average, indicating a positive end to the year.

At current levels, the latest PMI reading is indicative of GDP growing at a quarterly rate of around 0.5% in December, which is above the 0.2% average seen over the past decade. The fourth quarter average PMI reading was also the highest seen since the third quarter of last year.

In line with S&P Global Market Intelligence's forecasts for Japan's real GDP growth to rebound, the latest PMI continued to exhibit resilience at the end of the fourth quarter, contrasting with the economic contraction shown for the three months to September.

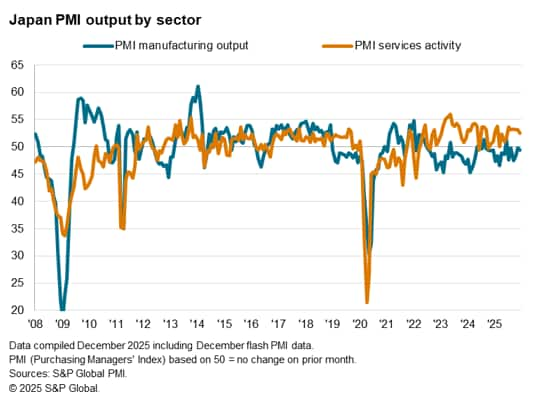

Growth remains services driven with another fall in goods output

Business activity growth remained limited to the service sector for a sixth consecutive month in December, albeit with the gap between manufacturing and services closing in the latest survey period. The convergence was mainly due to a softening of services activity growth while the contraction in manufacturing output remained only marginal.

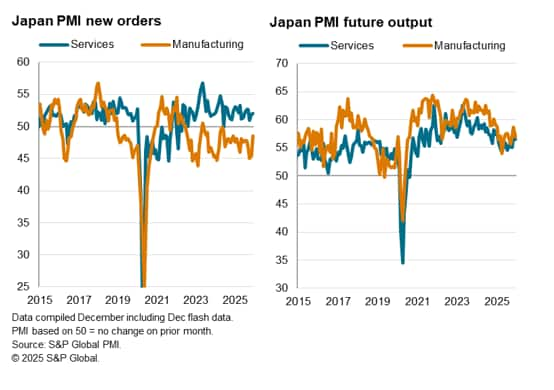

Despite having eased to the lowest since June, the rate at which services activity rose in Japan remained solid. Factors including reductions in efficiency and labour shortages were mentioned as reasons in instances where output growth fell, thus suggesting that the softening of services activity growth pace may be temporary. This was further confirmed by a slight acceleration in new business growth in December, with backlogs having accumulated at the quickest pace in three months due to the slowdown in business activity growth. Notably, external demand rose fractionally after five consecutive months of decline, with anecdotal evidence pointing to higher numbers of inbound tourists from Taiwan, Hong Kong SAR, and Southeast Asian countries. The improvement in demand, coupled with above-average confidence regarding future output and solid hiring, therefore pointed to the likelihood of continued growth in services activity going into 2026.

In contrast to the trend for services, manufacturing output contracted for a sixth straight month in December, remaining the sector of concern. That said, the rate of contraction for goods new orders eased for a third straight month to the softest since June 2024 to suggest more stable conditions at the end of the year. A subdued climate for the goods producing sector, coupled with a sustained fall in foreign demand amid reduced orders from Europe, mainland China and other Asian economies, were mentioned as reasons for the continued downturn in new work inflows by goods producers.

Further signs of stabilisation were also seen from a quicker rise in manufacturing headcounts and slower depletion in the backlogged orders, though optimism regarding future output was subdued by historical standards.

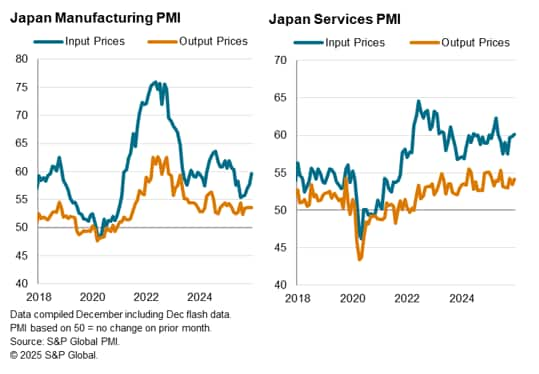

Cost pressure at eight-month high

Turning to prices, average input costs continued to increase for Japanese businesses in December. Moreover, the rate of input price inflation was the highest since April amid a broad-based intensification of cost pressures among both manufacturers and service providers. Greater input raw material, labour and utility costs, aggravated by a worsening exchange rate, led to the latest rise in input price inflation, according to panellists.

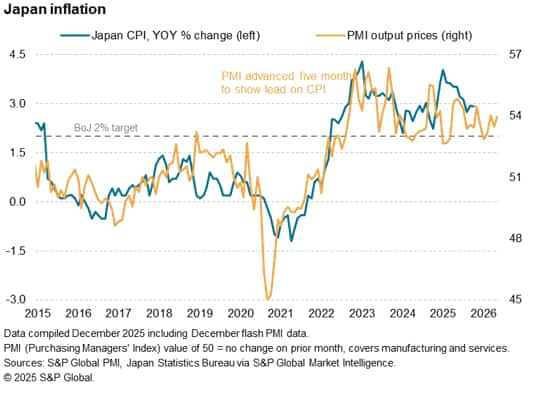

Although services firms were able to pass their additional cost burdens onto clients, subdued goods demand curbed manufacturers' ability to raise output prices at a quicker pace. Overall, however, output charges still rose at a pace that was quicker than in November and above the 12-month average. The latest rate of output price inflation was also indicative of consumer price inflation continuing to run above the Bank of Japan's 2% target into the start of 2026, with greater potential to rise if companies opt to further pass on their increasing cost burdens to customers.

The elevated price inflation trend and potential growth in 2026, as signalled by PMI data, therefore adds to the possibility of the Japanese central bank further tightening policy in 2026 beyond the imminent hike expected in December. Certainly, the weak export condition remains a trend to monitor, though the latest PMI also reflected an easing in the pace of contraction amid a stabilization in new export business for services firms.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finflationary-pressures-intensify-in-december-amid-a-fresh-rise-in-new-orders-for-japanese-firms-Dec25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finflationary-pressures-intensify-in-december-amid-a-fresh-rise-in-new-orders-for-japanese-firms-Dec25.html&text=Inflationary+pressures+intensify+in+December+amid+a+fresh+rise+in+new+orders+for+Japanese+firms+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finflationary-pressures-intensify-in-december-amid-a-fresh-rise-in-new-orders-for-japanese-firms-Dec25.html","enabled":true},{"name":"email","url":"?subject=Inflationary pressures intensify in December amid a fresh rise in new orders for Japanese firms | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finflationary-pressures-intensify-in-december-amid-a-fresh-rise-in-new-orders-for-japanese-firms-Dec25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Inflationary+pressures+intensify+in+December+amid+a+fresh+rise+in+new+orders+for+Japanese+firms+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finflationary-pressures-intensify-in-december-amid-a-fresh-rise-in-new-orders-for-japanese-firms-Dec25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}