Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 09, 2018

European manufacturing supply capacity stretched but not broken

- Two years of accelerating growth in Europe, led by manufacturing sector

- Pressure builds on supply capacity

- Technology equipment capacity utilisation at survey high

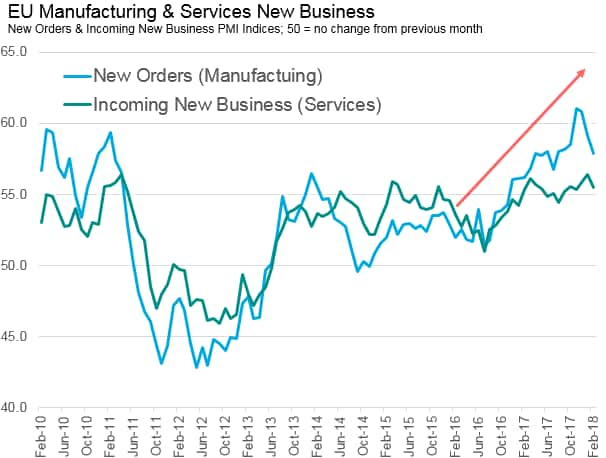

For the last two years, IHS Markit PMI indicators have been signalling an acceleration of the European economy. The manufacturing sector in particular has contributed to the current expansion. One of the consequences is an increased level of pressure on productive capacity, pushing firms to increase their staff numbers to handle the inflows of new business. In this environment, technology equipment makers appear to be the most stretched sector, and also have the greatest appetite for new hires.

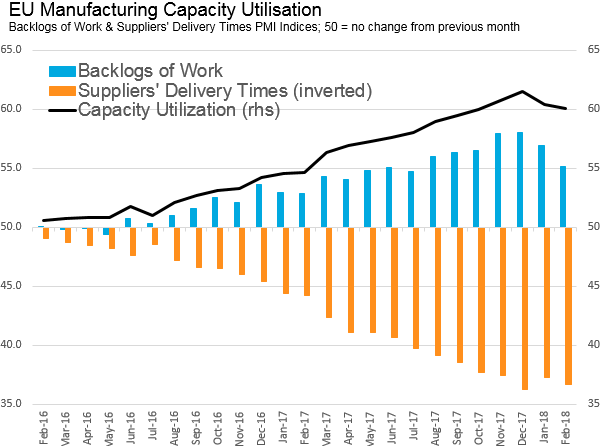

EU manufacturing capacity is tightening

From a PMI perspective, capacity utilisation is proxied by a weighted average of backlogs of work and suppliers’ delivery times indicators. The two series provide indications on the extent to which companies and their suppliers are able to cope with demand. For the European economy, manufacturing capacity utilisation has constantly increased for the last two years, following a steady rise in new orders. The trend is positive, but also brings its own set of challenges by putting stress on company supply chains.

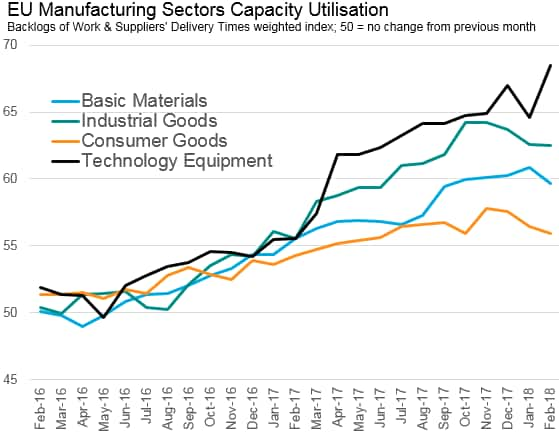

Technology equipment is currently the most stretched sector with a capacity utilisation index reading of 68.5, the highest since the series began in January 2003. During the last year, the tech industry has seen capacity utilisation increase more sharply than its manufacturing peers, while the consumer goods has remained almost flat, experiencing only slight bumps along the way. The different trends were particularly disparate during 2017, following little variation in capacity utilisation across sectors in 2016, making PMI sector data even more appropriate in order to measure the discrepancies.

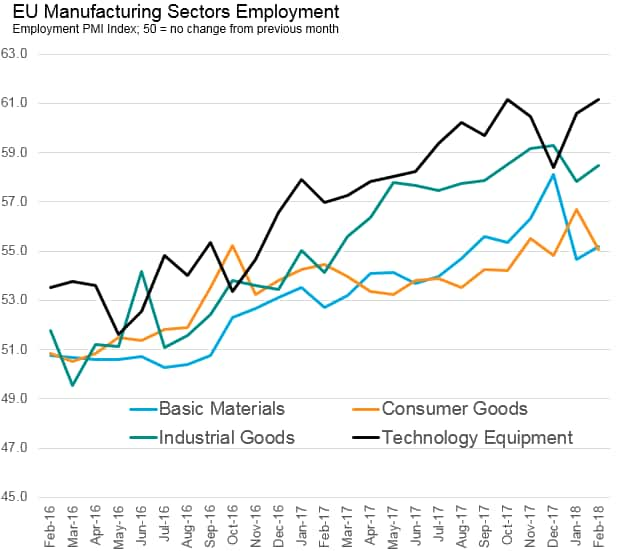

Firms hiring as a consequence

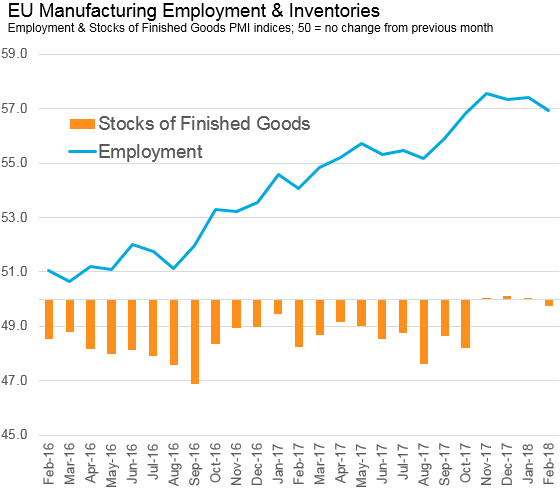

A direct consequence of growing pressure on capacity utilisation has been an increase in hiring. The increase has been evident across the European Union, where the manufacturing PMI employment index has risen from 50.7 in March 2016 to 56.9 in February 2018. Across sectors, technology equipment has seen the strongest employment growth over the last two years, also recording its best performance since records began (in January 1998) in February.

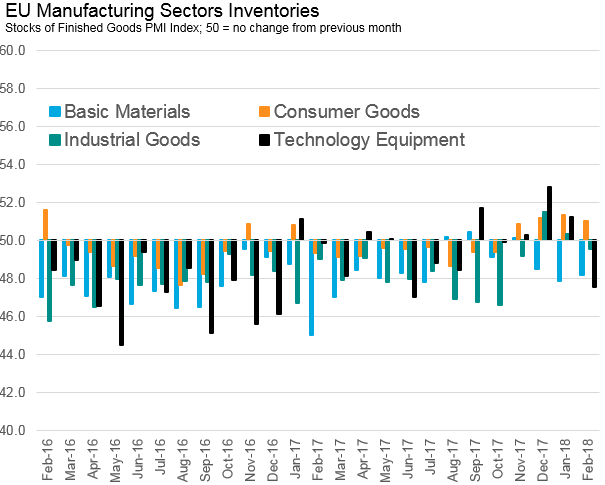

Finished goods stocks to anticipate supply chain constraints

The pressure on company supply chains potentially represents a risk for the economy, as it may contribute to rising inflation if the constraints are not mitigated. In the case of too many orders with not enough capacity, a sellers’ market will materialise and companies will be able to raise their prices. Within this context, an indicator to watch closely is stocks of finished goods, as shortages may indicate a problem of insufficient production. The technology equipment sector, for example, experienced some shortage of finished goods stocks across 2016 and subsequently sped up its hiring process early in 2017.

Mathieu Ras, Analyst Economic Indices at IHS Markit

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fEuropean-manufacturing-supply-capacity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fEuropean-manufacturing-supply-capacity.html&text=European+manufacturing+supply+capacity+stretched+but+not+broken","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fEuropean-manufacturing-supply-capacity.html","enabled":true},{"name":"email","url":"?subject=European manufacturing supply capacity stretched but not broken&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fEuropean-manufacturing-supply-capacity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+manufacturing+supply+capacity+stretched+but+not+broken http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fEuropean-manufacturing-supply-capacity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}