Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 12, 2018

Australia PMI surveys point to steady growth in the first quarter

- Composite PMI edges up to 54.3 in February from 54.2 in January, signalling a solid expansion

- Manufacturing jobs growth at survey-record high, but services employment rises modestly

- Inflationary pressures pick up

The Australian economy maintained solid growth momentum in February, according to the latest Commonwealth Bank PMI surveys. The sustained upturn encouraged firms to take on more staff, though the rate of job creation was slower compared to the average in 2017 due to only a modest gain in services payroll numbers. There were also signs of a renewed pick-up in inflationary pressures.

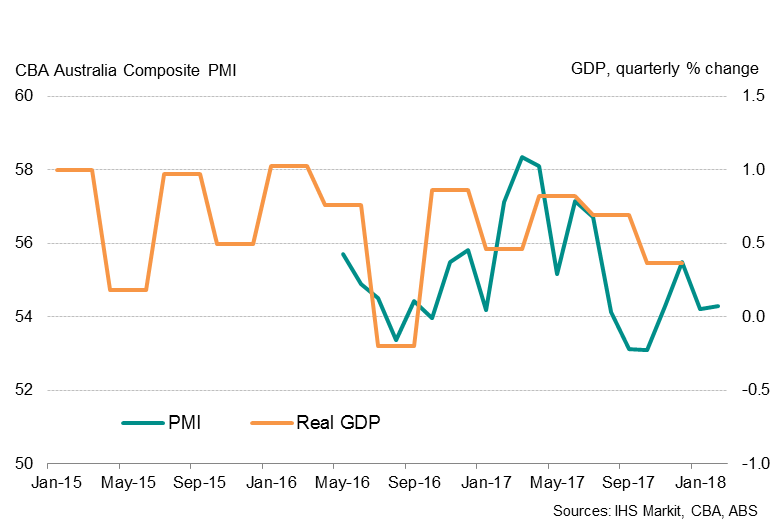

The Commonwealth Bank of Australia Composite PMI® Output Index ticked up from 54.2 in January to 54.3 in February. The average reading so far for the first quarter is the same as the closing quarter of 2017, suggesting a stable pace of growth.

Australia PMI and economic growth

Forward-looking indicators point to greater business activity in coming months. Inflows of new work accelerated to a seven-month high while business confidence about the year ahead remained elevated.

The economic expansion continued to be broad-based, with the manufacturing and service sectors both reporting solid rates of business activity growth.

Mild job gains

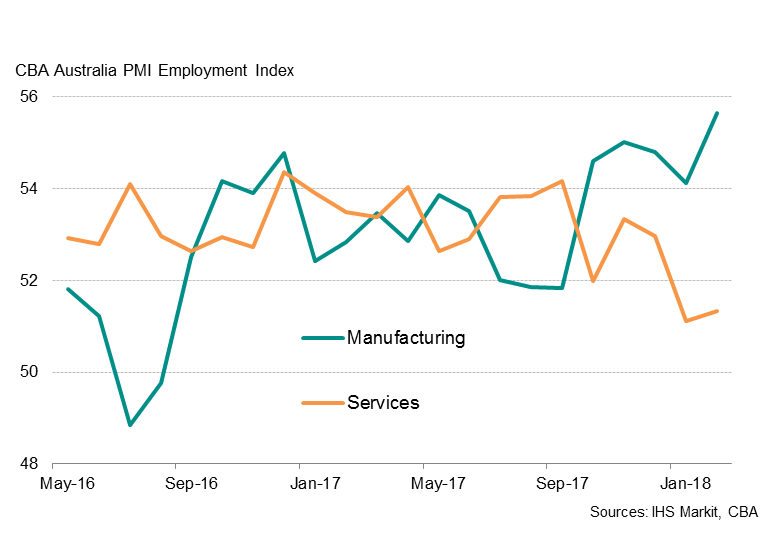

However, recent growth rates have been slower than those seen in the first half of 2017, which in turn has seen payroll numbers also rising at a reduced rate. Although February data signalled an acceleration in job creation since January, the pace of increase remained below the 2017 average. Digging into the details revealed a widening divergence in jobs growth between the two monitored sectors.

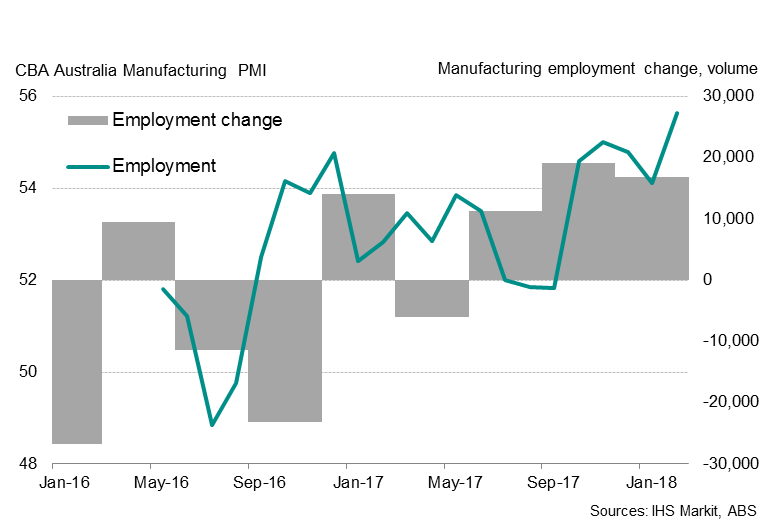

Service sector employment rose modestly, while factory jobs growth increased sharply to the fastest pace seen since the survey began in May 2016, suggesting an increase in the number of new jobs expected in February when official employment numbers are published. With a further increase in backlogs of work pointing to signs of persistent capacity constraints midway through the first quarter, firms will likely remain in hiring mode in the months ahead.

Employment in manufacturing and service sectors

Australia Manufacturing PMI and employment change

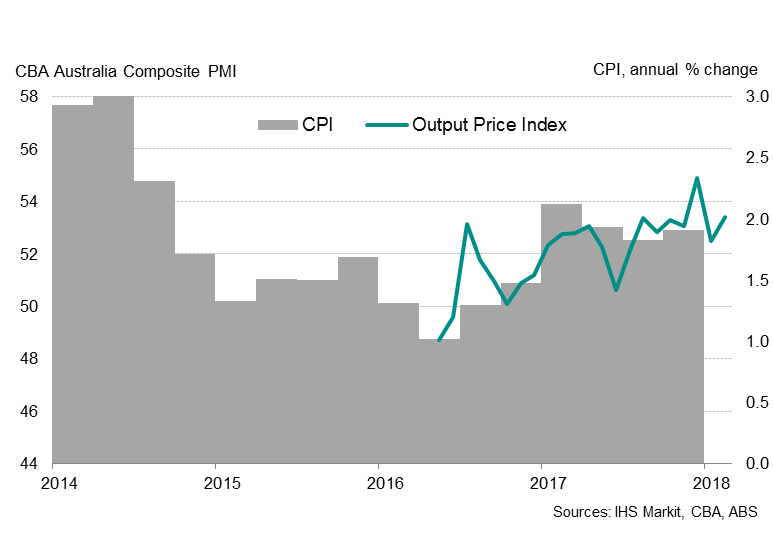

Higher price pressures

February survey data meanwhile showed a renewed pick-up in input cost inflation. An accelerated rise in input prices was seen across both sectors, with anecdotal evidence suggesting that increased raw material costs, in particular fuel, metals and food, were behind the input price inflation. There were few mentions of wage inflation, which will be disappointing news for the Reserve Bank of Australia. Increased costs led firms to raise average prices charged for goods and services at a faster rate than in January.

Australia PMI and consumer inflation

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fAustralia-PMI-surveys-point.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fAustralia-PMI-surveys-point.html&text=Australia+PMI+surveys+point+to+steady+growth+in+the+first+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fAustralia-PMI-surveys-point.html","enabled":true},{"name":"email","url":"?subject=Australia PMI surveys point to steady growth in the first quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fAustralia-PMI-surveys-point.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Australia+PMI+surveys+point+to+steady+growth+in+the+first+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fAustralia-PMI-surveys-point.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}