Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 28, 2015

UK economy slows sharply amid trade and industry weakness

UK economic growth slowed sharply in the first quarter of the year, denting widespread hopes that the pace of expansion would get revised higher. The data also highlight how the economy is being driven again by consumers, and that the unbalanced pattern of growth is likely to result in a slower expansion of GDP in 2015 than many have been expecting.

The economy grew 0.3% in the three months to March, confirming the initial estimate, according to the second release of gross domestic product data from the Office for National Statistics.

Weak manufacturing and construction

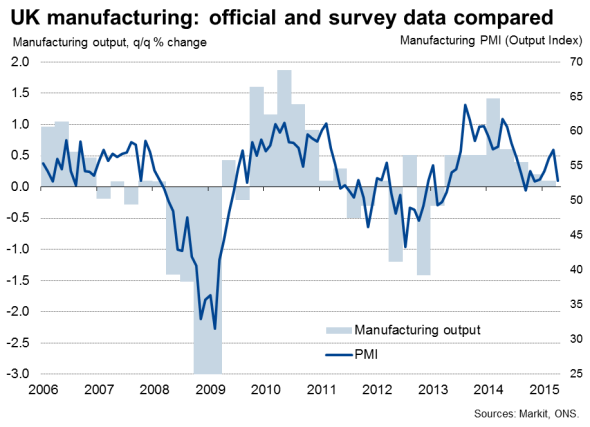

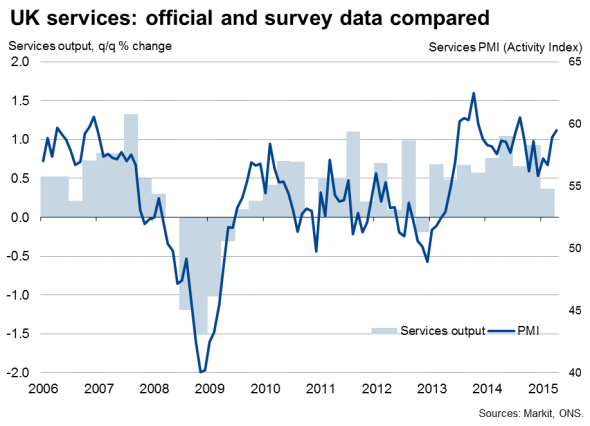

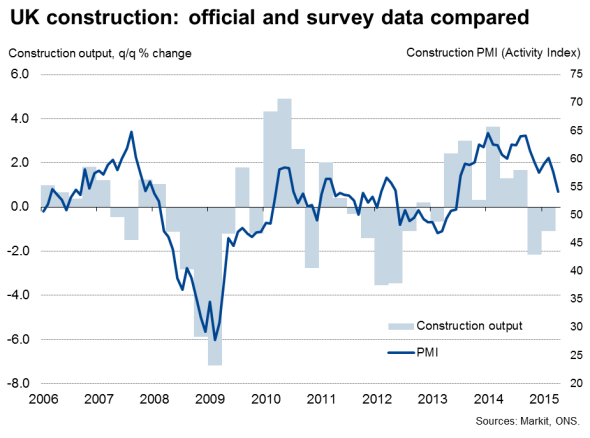

Delving into the data, there were few signs of strength in the main sectors of the economy. Services - the main engine of growth in 2014 - saw its pace of expansion slow from 0.9% at the end of last year to just 0.4%, weighed on by a sharp slowdown in the business services economy. Distribution, hotels and catering led the services expansion - a part of the economy that is driven to a large extent by household spending. Manufacturing eked out a meagre 0.1% growth and construction output fell by 1.1%, a second consecutive quarterly decline which puts the sector in a technical recession.

By category of expenditure, household consumption rose 0.5%, and there was a welcome 1.7% jump in business investment, though this latter rise needs to be treated with caution as the series is both volatile and subject to major revision (the rise also follows a 0.9% decline in the final quarter of last year).

Exports meanwhile fell 0.3% and imports surged 2.3%, meaning trade acted as a significant drag on the economy as a whole.

Recent upbeat PMI data have raised hopes that the pace of expansion is likely to have picked up again in the second quarter, led by strong service sector growth, but there is lingering weakness evident in some sectors, notably manufacturing. With signs of manufacturing and international trade being hurt by the strength of sterling, which is running at its highest since early 2008 on a trade-weighted basis, we should not be complacent about disappointing growth in the first quarter being merely temporary.

Slower economic growth in 2015

The weakness of manufacturing and the drag from trade leaves the economy reliant on consumer spending to drive growth this year, as low prices and modest wage growth provide support to household budgets. The squeeze on household finances is running at a post-recession low in May, though expectations about the year ahead have dipped, suggesting the consumer may play less of a role in driving the economy in coming months.

While the economy grew 2.8% last year, that performance looks unlikely to be repeated this year. The Bank of England has revised down its prediction of 2.9% growth to 2.5%, a figure which is still looking optimistic given the current data flow.

The economy is now 4.0% larger than its pre-recession peak seen in the first quarter of 2008. This compares favourably with the eurozone, which remains 1.5% smaller, but is not at all impressive when compared with the US, which has grown some 8.8% larger than its pre-crisis high.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28052015-economics-uk-economy-slows-sharply-amid-trade-and-industry-weakness.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28052015-economics-uk-economy-slows-sharply-amid-trade-and-industry-weakness.html&text=UK+economy+slows+sharply+amid+trade+and+industry+weakness","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28052015-economics-uk-economy-slows-sharply-amid-trade-and-industry-weakness.html","enabled":true},{"name":"email","url":"?subject=UK economy slows sharply amid trade and industry weakness&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28052015-economics-uk-economy-slows-sharply-amid-trade-and-industry-weakness.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+economy+slows+sharply+amid+trade+and+industry+weakness http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28052015-economics-uk-economy-slows-sharply-amid-trade-and-industry-weakness.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}