Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 26, 2015

Business optimism and robust growth fuel upturn in hiring in US

Robust growth of service sector activity provides further encouraging news that the US economy is reviving from the weakness seen earlier in the year.

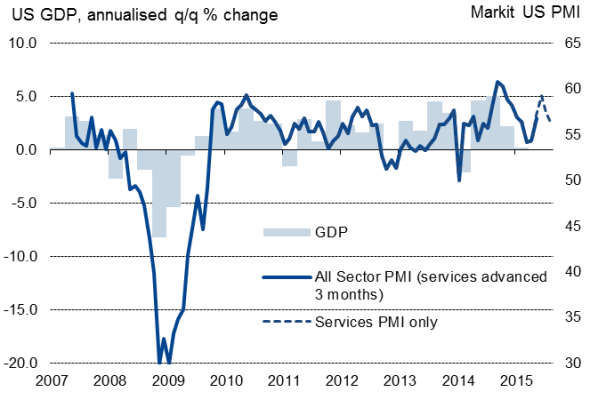

The flash Markit Services PMI" registered 56.4 in May, well above the 50.0 no-change level. When looked at alongside the sister manufacturing PMI, which also signalled further expansion in May, the surveys suggest the US economy is on course to enjoy solid annualised growth of approximately 3.0% in the second quarter.

However, while the GDP-weighted average output index from the two surveys remained elevated at 56.1 in May, that's down from a 2014 average of 57.3, highlighting how the rate of expansion has moderated from last year. Some cooling of domestic demand was evident as new order growth slowed in both sectors in May, but it is the manufacturing sector that has been the hardest hit, with new export orders falling slightly for a second successive month - the first back-to-back monthly falls in exports for almost two years. Disappointing export sales were linked by many companies to the recent appreciation of the dollar.

US PMI surveys and economic growth

Sources: Markit, US Bureau of Economic Analysis.

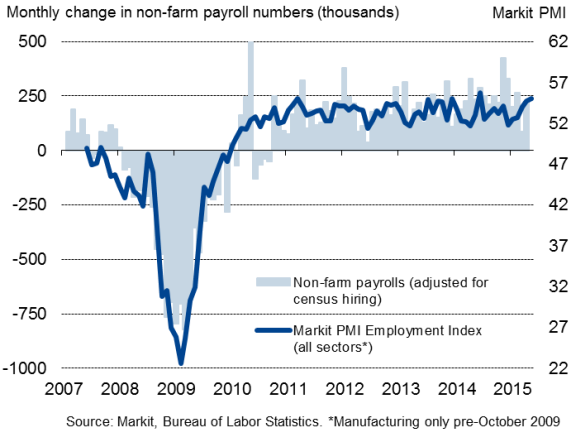

Robust hiring

Some comfort can be drawn from the fact that the slowdown in order book growth has yet to translate into weaker hiring. In fact, the combined employment index from the two surveys signalled one of the best months of job creation seen since the recession, pointing to another month of non-farm payroll gains in excess of 200,000 in May.

What's more, with May seeing a marked upturn in business confidence about the year ahead in the services sector - which employs around six times more people than manufacturing - it seems likely that hiring may remain buoyant as we move into the summer, even if job creation in the goods-producing sector comes under pressure from the dollar's appreciation.

US PMI surveys and employment

Costs rise at faster rate

The survey also brought some encouraging news on inflation. Input costs across the two sectors rose at the fastest rate since last October, the rate of increase picking up further from the post-recession low seen at the start of the year. Although the rate of growth of selling prices slowed compared to April's seven-month high, the combination of increased costs and higher oil prices should continue to feed through to rising prices and help offset some of the deflationary forces arising from the dollar's strength.

2015 rate rise still on the cards

The survey data therefore paint a brighter picture of the US economy than the latest official numbers, which showed GDP rising at an annualised rate of just 0.2% in the first quarter (a figure which could well be revised to show a contraction of the economy when updated later this week). The survey data suggest this slowdown was temporary in nature, attributable mainly to adverse weather and port strikes, and that a rebound is likely in the second quarter, sustaining a buoyant employment trend.

Such keen hiring and robust economic growth inevitably tips the scales in favour of the Fed hiking rates later this year rather than waiting until 2016, with September being the earliest likely date of the FOMC taking their initial step.

However, policymakers will be eager to see if the slower growth trend that was evident in May develops further over the summer months before risking any tightening of policy, especially if a stronger dollar continues to hit exports and corporate earnings.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052015-Economics-Business-optimism-and-robust-growth-fuel-upturn-in-hiring-in-US.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052015-Economics-Business-optimism-and-robust-growth-fuel-upturn-in-hiring-in-US.html&text=Business+optimism+and+robust+growth+fuel+upturn+in+hiring+in+US","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052015-Economics-Business-optimism-and-robust-growth-fuel-upturn-in-hiring-in-US.html","enabled":true},{"name":"email","url":"?subject=Business optimism and robust growth fuel upturn in hiring in US&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052015-Economics-Business-optimism-and-robust-growth-fuel-upturn-in-hiring-in-US.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Business+optimism+and+robust+growth+fuel+upturn+in+hiring+in+US http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f26052015-Economics-Business-optimism-and-robust-growth-fuel-upturn-in-hiring-in-US.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}