Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 28, 2016

US official data corroborate survey signals of stalling first quarter growth

US economic growth slowed sharply to a near stand-still in the first quarter, and early signs indicate that the malaise extended into the second quarter.

On an annualised basis, the rate of growth of gross domestic product weakened from 1.4% in the fourth quarter to 0.5%, according to the first 'advance' estimate of official data from the Commerce Department. That means the economy grew by just 0.1% between the fourth and first quarters, indicating that the pace of expansion almost ground to a halt. The expansion was the weakest seen for two years.

In the detail, all main parts of the economy slowed with the exception of the housing market, the latter probably reflecting low mortgage rates. Business spending fell at the fastest rate since the second quarter of 2009, dragged 5.9% lower by cost cutting in the energy sector in particular. Consumer spending growth also slid from 2.4% to 1.9% and exports fell at a 2.6% pace.

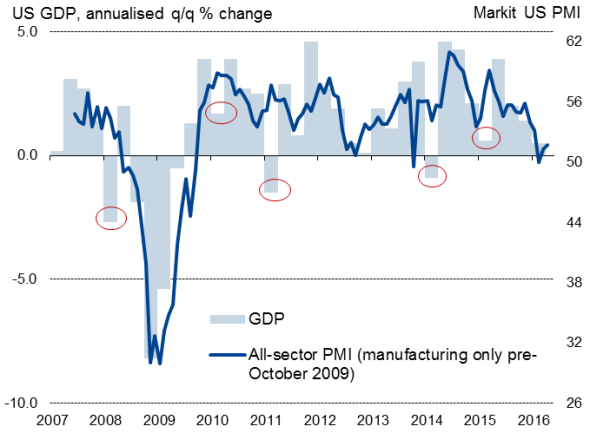

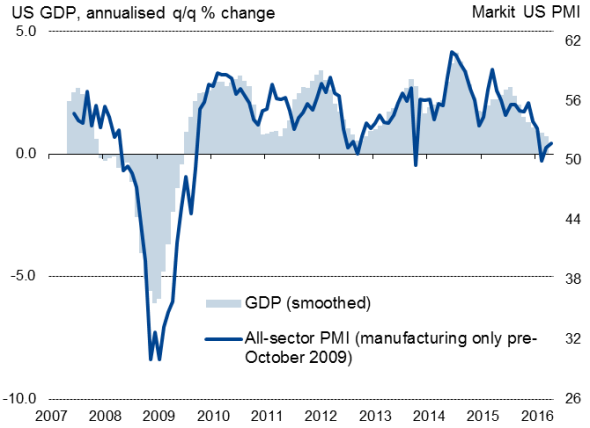

The picture is somewhat confusing because official GDP numbers appear prone to weakening in the first quarter (see chart), raising suspicions that the data have not fully accounted for seasonal trends in recent years. Survey data support this theory, but also indicate that this time the first quarter weakening is not to be brushed off as a statistical quirk.

Markit PMI data correlate closely with GDP, but do not suffer from the same volatility as the official data. A steep downturn in the February PMI data had signalled a heightened risk of the economy stalling - or even contracting - in the first quarter, but a small upturn in the survey data for March meant the surveys recovered to signal marginal first quarter growth.

Note that at the time of the February release, and right up until mid-April, the consensus was for 2% first quarter GDP growth.

US GDP data highlighting first quarter weakness plotted against PMI survey data

US GDP data smoothed to remove volatility plotted against PMI survey data

The first quarter slowdown is also by no means limited to the US, with surveys showing that the global economy grew at its weakest rate in over three years in the first three months of the year. It is therefore by no means surprising that net trade is acting as a drag on the economy, especially given the recent strength of the dollar.

Worryingly, the surveys indicate that the malaise affecting the US economy has extended into the second quarter, albeit with the pace of expansion picking up slightly to 0.8%. While the upturn in the April survey data is welcome news, the subdued rate of growth signalled suggests the economy remains in a fragile state. Survey respondents blame weak global demand, the strong dollar, the energy sector's recent plight and growing uncertainty about the presidential election as factors behind the recent slowdown.

The surveys also show weakness spreading from manufacturing to services in recent months, in a sign that consumer demand is being hit by worries relating to uncertainty about the economy, rising interest rates and a nascent recovery in oil prices.

With the Fed facing only a small window of opportunity to hike interest rates before the election, such disappointing data for the second quarter could raise the likelihood of any rate hike being pushed out until December, meaning the business survey data for May could be all-important for the Fed.

To find out more contact economics@markit.com.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-economics-us-official-data-corroborate-survey-signals-of-stalling-first-quarter-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-economics-us-official-data-corroborate-survey-signals-of-stalling-first-quarter-growth.html&text=US+official+data+corroborate+survey+signals+of+stalling+first+quarter+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-economics-us-official-data-corroborate-survey-signals-of-stalling-first-quarter-growth.html","enabled":true},{"name":"email","url":"?subject=US official data corroborate survey signals of stalling first quarter growth&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-economics-us-official-data-corroborate-survey-signals-of-stalling-first-quarter-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+official+data+corroborate+survey+signals+of+stalling+first+quarter+growth http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042016-economics-us-official-data-corroborate-survey-signals-of-stalling-first-quarter-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}