Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 24, 2015

Upturn in Japan manufacturing PMI fuels third quarter growth hopes

Japan's manufacturing economy showed tentative signs of stirring back into life at the start of the third quarter after its worst performance for a year in the second quarter. However, signs of inflation picking up remain disappointingly scarce.

PMI at five-month high

The Nikkei Flash Japan Manufacturing PMI", compiled by Markit, rose to a five-month high in July. However, at 51.4, the index merely points to a modest expansion after signalling the worst quarter for a year in the three months to June.

The index is based on around 85% of usual monthly survey replies and provides an accurate insight into final data, published at the start of each month. The flash PMI is the first major economic indicator available each month.

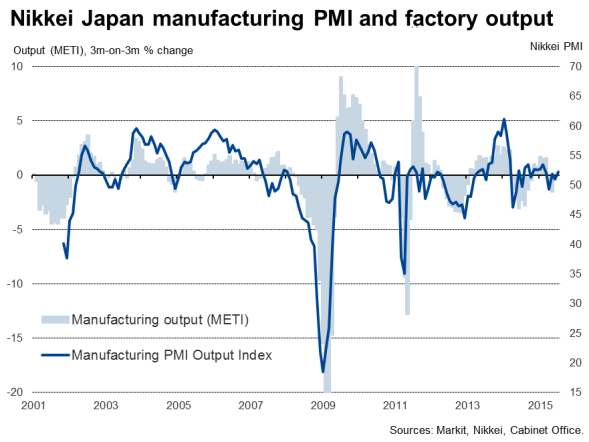

Although still subdued, the survey data suggest industrial production is at least picking up again after most likely dropping by 1.5% in the second quarter, a downturn which will have wiped out all the gains seen in the first quarter (the latest official data showed a 2.2% drop in industrial production in May).

The economy still looks set to have grown in the second quarter despite the poor performance of the manufacturing sector, buoyed by an upturn in the service sector. June PMI data showed the service sector growing at the strongest pace for nine months. However, GDP looks to have slowed, potentially quite markedly, compared to the surprisingly strong 3.9% annualised pace seen in the first quarter, and the signs of a third quarter upturn will be welcome news for a government that has already trimmed its growth forecasts for the current fiscal year from 2.0% to 1.7%.

Export-driven growth

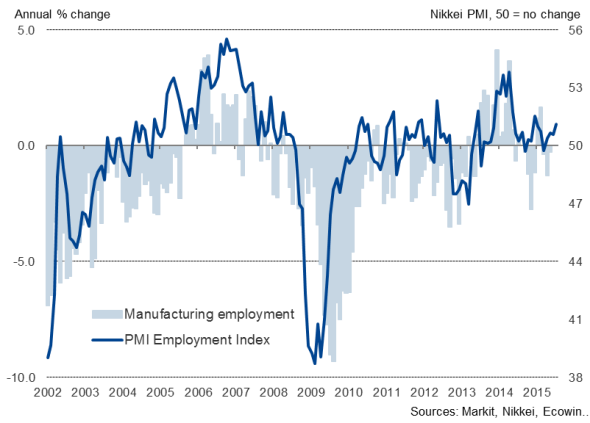

The flash PMI showed output growing at the fastest rate since February and factory job creation running at its highest since last December as firms raised capacity in response to a modest return to growth of order books. July saw the largest inflow of new orders since January.

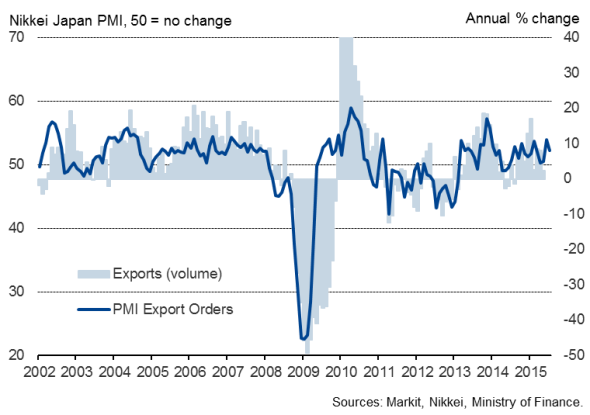

Goods exports

Exports appear to have played a role in the order book improvement, offsetting still-weak domestic demand. Although new export orders rose at a slower pace than June, the last two months have seen the largest combined rise in exports since the start of 2014. Companies are reporting that the weakened yen is helping raise sales in overseas markets. The yen has lost just over a third of its value since Prime Minister Abe introduced wide ranging stimulus measures after his election in late 2012, which included plans to double the country's monetary base via quantitative easing.

Lack of pricing power

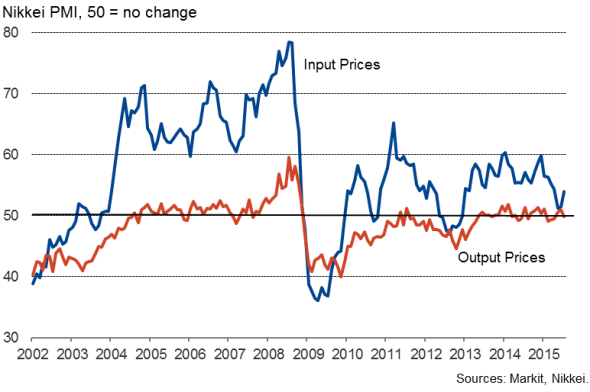

The weak yen continued to have a detrimental impact on the cost front, however, with higher import prices contributing to the steepest monthly rise in producers' input costs for three months, albeit the rate of increase was still well below that seen late last year.

For a central bank chasing higher consumer price inflation (a target of 2%), the survey brought the disappointing news that firms appeared unable to pass higher costs onto customers in the lion's share of cases, with average selling prices falling marginally, down for the first time in three months.

The lack of pricing power is a setback for the Bank of Japan that believes inflation will soon start to pick up markedly.

More will become known about the strength of demand and economic growth momentum at the start of the third quarter with the publication of services PMI data on 5 August.

Prices

Employment

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Economics-Upturn-in-Japan-manufacturing-PMI-fuels-third-quarter-growth-hopes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Economics-Upturn-in-Japan-manufacturing-PMI-fuels-third-quarter-growth-hopes.html&text=Upturn+in+Japan+manufacturing+PMI+fuels+third+quarter+growth+hopes","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Economics-Upturn-in-Japan-manufacturing-PMI-fuels-third-quarter-growth-hopes.html","enabled":true},{"name":"email","url":"?subject=Upturn in Japan manufacturing PMI fuels third quarter growth hopes&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Economics-Upturn-in-Japan-manufacturing-PMI-fuels-third-quarter-growth-hopes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Upturn+in+Japan+manufacturing+PMI+fuels+third+quarter+growth+hopes http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Economics-Upturn-in-Japan-manufacturing-PMI-fuels-third-quarter-growth-hopes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}