Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 28, 2015

UK economy shows impressive rebound in second quarter

Solid growth in the second quarter is welcome news that the UK economy continues to expand at an impressive pace in spite of headwinds from the general election, the stronger pound and eurozone worries.

The Bank of England had already pencilled in a 0.7% expansion, so today's data merely confirm the growth trajectory built into the Bank's forecasts and do little to change the outlook for interest rates. However, by the same measure, the data support the case for rates to start rising sooner rather than later.

Solid rebound

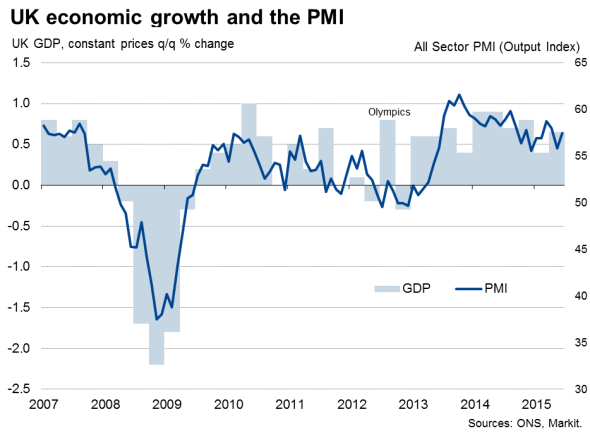

The first estimate of gross domestic product from the ONS showed the UK economy picking up speed again in the second quarter after a brief slowing in the first three months of the year. GDP rose 0.7%, exactly in line with analysts' expectations and survey data, and far stronger than the 0.4% increase seen in the first three months of the year.

The second quarter growth puts the economy 5.2% larger than its pre-crisis peak. Output per head is also now back to its pre-recession peak seen in the first quarter of 2008.

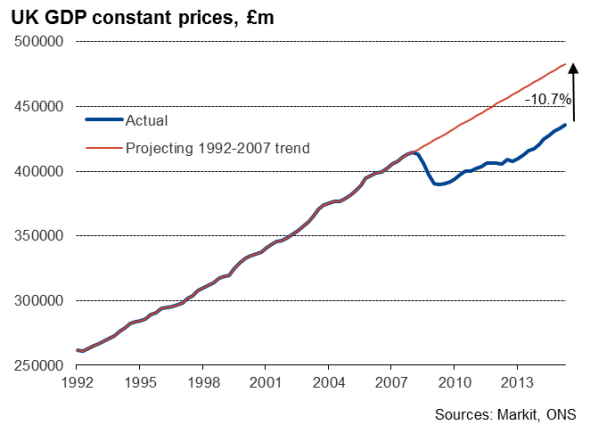

However, despite the recovery, policymakers have been in no rush to raise interest rates due to the failure of the economy to fully repair itself in respect to the output that was permanently lost in the recession. Had the UK continued to grow along the same trend rate seen prior to the financial crisis, the economy would be 10.7% larger than it is now, representing what appears to be a permanent loss of output due to the financial meltdown of 2007-8.

Rate hikes drawing closer

The economy is nevertheless continuing to show robust growth, meaning slack generated during the recession is being gradually eroded and, many would argue, the time to wean the economy off emergency levels of interest rates is drawing closer. Wage growth in particular is reviving amid an impressive reduction in the unemployment rate in recent years, removing the main hurdle to higher interest rates. The latest Monetary Policy Committee meeting at the Bank of England indicates that at least three of the nine members are likely to vote for a rate rise at the August meeting. Mark Carney, the Bank's governor, has also indicated that the decision to start hiking rates will come into focus at the turn of the year.

Today's data therefore bring the likelihood of a rate rise later this year that little bit closer, though policymakers will be keenly watching the data flow over the coming months to ensure the economic upturn remains on track and able to withstand higher borrowing costs.

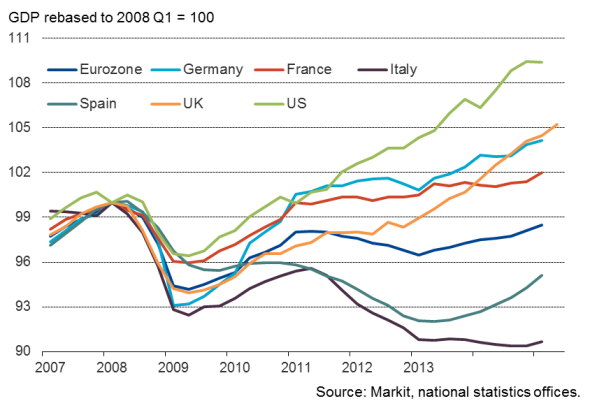

Manufacturing hit amid sterling worries

The Bank will also be concerned that higher interest rates will inevitably lead to upward pressure on sterling, which has already risen to its highest since 2007 on a trade-weighted basis and created an uneven recovery, hitting the export-focused manufacturing sector in particular, which has slipped back into decline. However, much depends on policy in other countries. While the UK economy's 5.2% increase in size compared to its pre-recession peak compares favourably with the eurozone, where the economy remains 1.5% smaller than before the crisis, data published later in the week looks set to show the US economy having grown some 9.4% larger than its pre-crisis peak, highlighting the US's superior recovery. While the pound may therefore appreciate against the euro as the ECB remains focused on stimulating the single-currency area, it may well fail to match the appeal of the US dollar as the US Fed looks set to be the first to hike interest rates.

In the detail, second quarter growth was driven by a 0.7% expansion of service sector activity, while manufacturing output fell 0.3%, its first decline for over two years. The solid second quarter performance was also helped by what's likely to have been a temporary surge in North Sea oil and gas production, which pushed mining and quarrying output up 7.8%. It seems unlikely that this will be repeated in the third quarter, posing downside risks to the short-term growth outlook. Construction output was unchanged.

International GDP comparisons

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-Economics-UK-economy-shows-impressive-rebound-in-second-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-Economics-UK-economy-shows-impressive-rebound-in-second-quarter.html&text=UK+economy+shows+impressive+rebound+in+second+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-Economics-UK-economy-shows-impressive-rebound-in-second-quarter.html","enabled":true},{"name":"email","url":"?subject=UK economy shows impressive rebound in second quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-Economics-UK-economy-shows-impressive-rebound-in-second-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+economy+shows+impressive+rebound+in+second+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28072015-Economics-UK-economy-shows-impressive-rebound-in-second-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}