Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 24, 2016

UK retail sales show resilient start to 2016, but wider worries linger

Resilient retail sales provide welcome news that consumers remain in an upbeat mood so far this year, but bargain-hunting shoppers seem unlikely to counteract a weakening of growth in the wider economy.

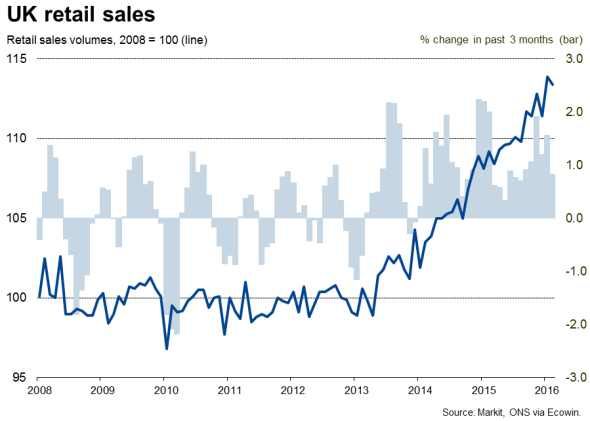

Retail sales fell less than expected in February, representing a smaller than feared pay-back from January's spending spree, according to data from the Office for National Statistics. Sales volumes had risen 2.3% in January but fell back 0.4% in February. Analysts had been expecting a 0.7% decline. Even with the drop in February, this still leaves sales some 3.8% higher than a year ago.

Clothing sales were apparently also hit by adverse weather, so some rebound may be seen in March alongside the improvement in the more spring-like weather.

Taken together, the first two months of the year suggest that sales are running 1.6% higher than in the fourth quarter.

However, all is not quite as rosy as the headline numbers suggest. The three-month trend is the weakest since last August, the rate of increase dropping from 1.4% in January to just 0.8% when sales volumes in the latest three months are compared against the prior three-month period.

Spending is also being driven by low prices, as indicated by the value of sales rising just 1.4% on a year ago in February compared to the 3.8% rise in volumes. A healthier picture, and one that the Bank of England would clearly like to see, would be one where rising demand is allowing retailers to push up prices to a greater extent.

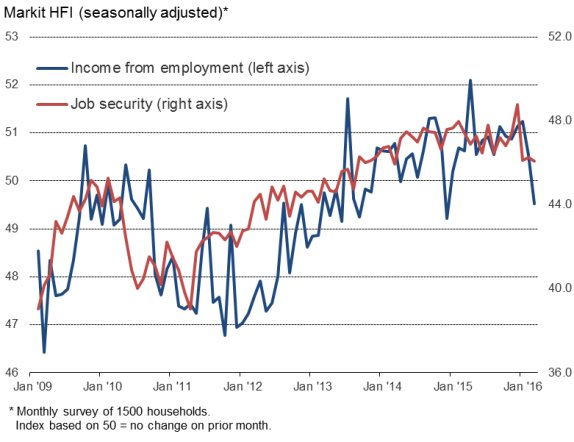

In contrast, there are increasing signs that households are growing concerned about incomes, which could weigh on spending in coming months. Despite news of record high employment, pay growth remains disappointingly meagre. Markit's Household Finance Index survey meanwhile showed income from employment falling for the first time since the end of 2014 during March, while job insecurity was the joint-highest seen over the past two years.

Household sentiment

Finally, although retail spending may be showing signs of resilience as shoppers are drawn to bargains, the wider picture of the economy has darkened. PMI data showed the pace of economic growth slowing to its weakest for almost three years in February. The headline index measuring growth of business activity fell to its lowest since April 2013, suggesting that the pace of economic growth may have slowed to 0.3% in the first quarter.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032016-Economics-UK-retail-sales-show-resilient-start-to-2016-but-wider-worries-linger.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032016-Economics-UK-retail-sales-show-resilient-start-to-2016-but-wider-worries-linger.html&text=UK+retail+sales+show+resilient+start+to+2016%2c+but+wider+worries+linger","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032016-Economics-UK-retail-sales-show-resilient-start-to-2016-but-wider-worries-linger.html","enabled":true},{"name":"email","url":"?subject=UK retail sales show resilient start to 2016, but wider worries linger&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032016-Economics-UK-retail-sales-show-resilient-start-to-2016-but-wider-worries-linger.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+retail+sales+show+resilient+start+to+2016%2c+but+wider+worries+linger http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032016-Economics-UK-retail-sales-show-resilient-start-to-2016-but-wider-worries-linger.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}