Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 24, 2016

US economic malaise extends into March as new work inflows hit post-recession low

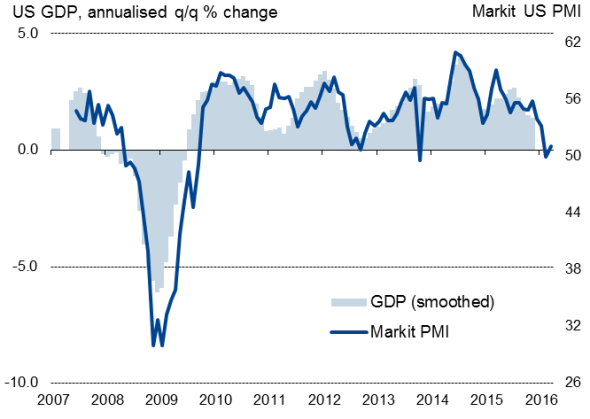

The US economy is going through its worst growth spell for three and a half years, according to flash PMI survey data from Markit. The headline index from the two PMI national surveys covering manufacturing and services had fallen to the stagnation-level of 50.0 in February and rose only modestly in March to 51.1. That was the third-lowest reading seen since the global financial crisis.

Collectively, the surveys point to the weakest quarterly expansion of the economy since the third quarter of 2012. The PMI surveys suggest the economy grew at a meagre 0.7% annualised rate in the first quarter, down from 1.0% in the fourth quarter of last year.

US 'economic growth v Markit PMI

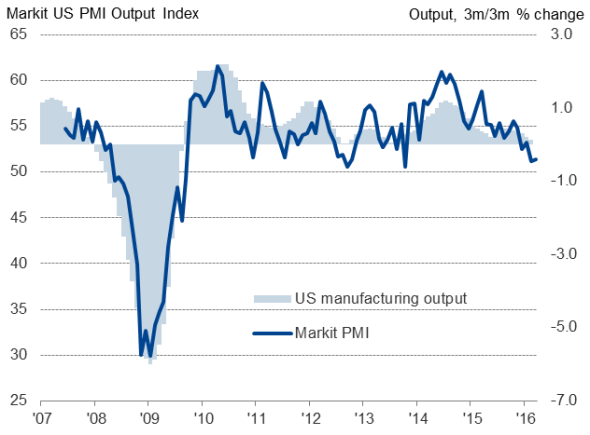

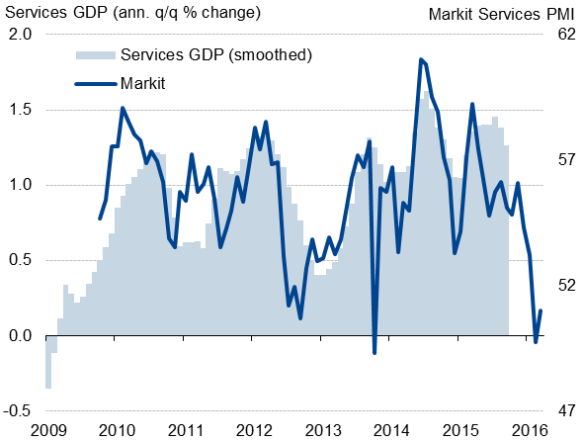

Output indices in both manufacturing and services remained near post-crisis lows in March, failing to revive from recent lows seen in February.

US manufacturing output v Markit PMI

US services GDP v Markit PMI

* GDP in the top two charts above is smoothed and converted into a monthly series by taking the mean of the current month and the preceding and following three month values.

The lack a strong rebound in March is a big disappointment, as bad weather had been blamed by companies for part of the weakness in the first two months of the year.

Worse may be to come. The greatest concern is the near-stalling of new business growth. The survey's indices of new order inflows indicate that demand for goods and services is growing at the slowest rate seen this side of the global financial crisis.

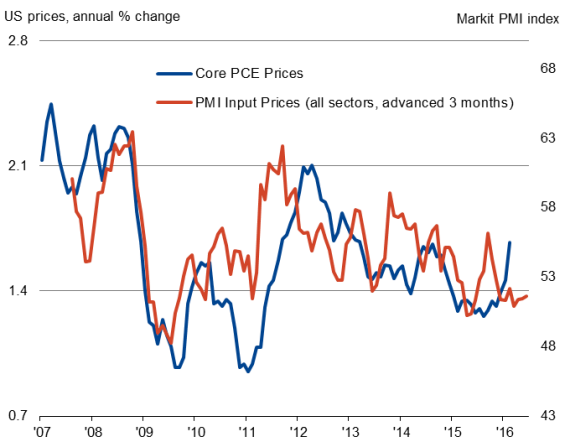

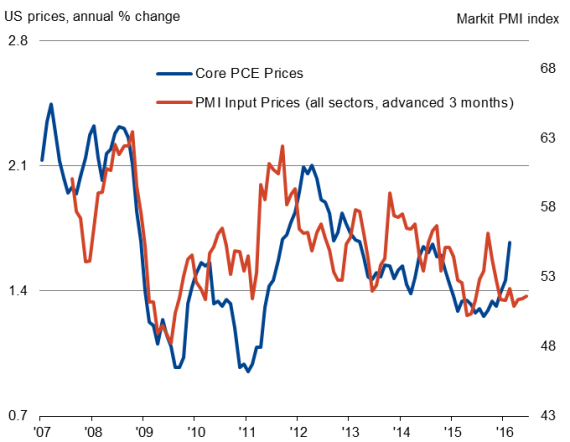

It's not surprising therefore that firms lack pricing power, as reflected in a near-stagnation of average selling prices in recent months.

US inflation

One positive is that the rate of hiring remained impressively resilient, signalling another month of 200,000 non-farm payroll growth in March. However, such strong hiring at a time of weak output growth suggests productivity is deteriorating at the fastest rate seen over the past six years.

US non-farm payrolls

Sources for charts: Markit, Datastream.

To find out more contact economics@markit.com.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032016-Economics-US-economic-malaise-extends-into-March-as-new-work-inflows-hit-post-recession-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032016-Economics-US-economic-malaise-extends-into-March-as-new-work-inflows-hit-post-recession-low.html&text=US+economic+malaise+extends+into+March+as+new+work+inflows+hit+post-recession+low","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032016-Economics-US-economic-malaise-extends-into-March-as-new-work-inflows-hit-post-recession-low.html","enabled":true},{"name":"email","url":"?subject=US economic malaise extends into March as new work inflows hit post-recession low&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032016-Economics-US-economic-malaise-extends-into-March-as-new-work-inflows-hit-post-recession-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+economic+malaise+extends+into+March+as+new+work+inflows+hit+post-recession+low http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24032016-Economics-US-economic-malaise-extends-into-March-as-new-work-inflows-hit-post-recession-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}