Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 23, 2015

Eurozone flash PMI rises in October but growth and inflation remain disappointingly weak

The euro area economic upturn regained some momentum at the start of the fourth quarter, but rates of expansion and job creation remain at levels that are likely to disappoint policymakers and, in the absence of improvements in coming months, will raise expectations of further stimulus from the ECB.

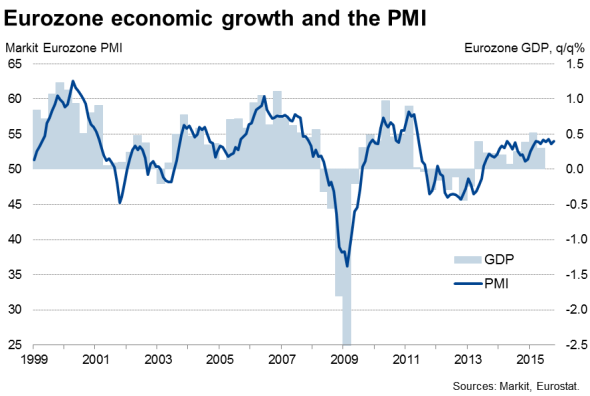

The Markit Eurozone PMI" rose from September's four-month low of 53.6 to 54.0 in October, according to the flash estimate. The latest reading remained slightly below August's recent peak but still signalled one of the strongest monthly expansions seen over the past four years. However, the PMI has remained constrained in recent months, tracking in a narrow band since an initial boost received after the ECB's announcement of quantitative easing at the start of the year.

The survey data signal a modest 0.4% quarterly rise in GDP in October, unchanged from the expansion signalled by the surveys for the third quarter. The ongoing lacklustre performance means the region will struggle to attain more than 1.5% overall growth in 2015.

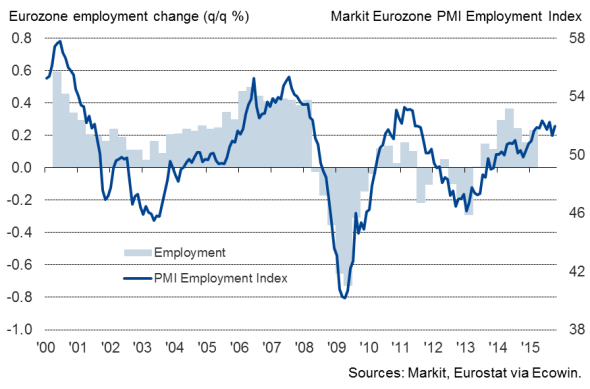

The rate of job creation, although on the rise, remains insufficient to make serious headway into reducing unemployment. The survey data are consistent with employment increasing at a quarterly rate of just over 0.2%.

Eurozone employment and the PMI

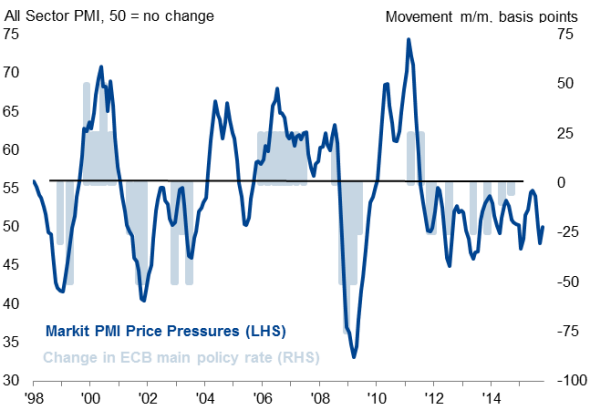

A renewed fall in output prices signalled by the survey in October meanwhile suggests that inflation will remain in negative territory as we head towards the end of the year. Average selling prices for goods and services fell for the first time in three months, albeit only marginally, led by a drop in the manufacturing sector amid continuing efforts to cut prices and boost sales.

Looking ahead, the forward-looking indicators point to a risk of growth slowing in November. Service sector expectations of activity in the year ahead hit a ten-month low, while the manufacturing orders-to-inventory ratio dipped to its weakest for nine months.

Unless the PMI business activity and price indices pick up significantly in coming months, the combination of relatively weak growth and deflation signalled by the survey will fuel expectations that the ECB will step up its quantitative easing programme at the December meeting.

Expectations of further QE and a further cut to the deposit rate (already at -0.2%) have already been raised after ECB chief Mario Draghi noted that "the degree of monetary policy accommodation will need to be re-examined at our December monetary policy meeting" at a press conference on 22nd October. It seems likely that the ECB's new staff projections for economic growth and inflation, due in December, will be revised down, paving the way for more stimulus.

PMI price pressures and ECB policy

Sources: Markit, ECB.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Economics-Eurozone-flash-PMI-rises-in-October-but-growth-and-inflation-remain-disappointingly-weak.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Economics-Eurozone-flash-PMI-rises-in-October-but-growth-and-inflation-remain-disappointingly-weak.html&text=Eurozone+flash+PMI+rises+in+October+but+growth+and+inflation+remain+disappointingly+weak","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Economics-Eurozone-flash-PMI-rises-in-October-but-growth-and-inflation-remain-disappointingly-weak.html","enabled":true},{"name":"email","url":"?subject=Eurozone flash PMI rises in October but growth and inflation remain disappointingly weak&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Economics-Eurozone-flash-PMI-rises-in-October-but-growth-and-inflation-remain-disappointingly-weak.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+flash+PMI+rises+in+October+but+growth+and+inflation+remain+disappointingly+weak http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102015-Economics-Eurozone-flash-PMI-rises-in-October-but-growth-and-inflation-remain-disappointingly-weak.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}