Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 16, 2015

Week Ahead Economic Overview

All eyes will be on China during the week, with GDP data possibly showing that economic growth fell below the psychological 7% mark in the third quarter. Flash PMI results in the Eurozone, Japan and the US will meanwhile be viewed for insights into economic growth trends in the final quarter. Moreover, the European Central Bank (ECB) announces its latest monetary policy decision.

The data flow in China has been disappointing in recent months: The Caixin China Composite PMI fell to its lowest level since January 2009 in September, pointing to a further waning of economic growth from the 7.0% seen in the second quarter. Furthermore, official data on industrial production and retail sales have also been softer than in previous quarters, adding to signs that economic growth in the world's second-largest economy slowed. Economists polled by Reuters predict that the Chinese economy expanded by 6.8% in the three months to September, with other forecasts pointing to an even sharper slowdown. If GDP growth falls below the 7.0% mark, this would be the slowest expansion since the first quarter of 2009, when the economy grew by 6.2%. This would clearly be an argument for China's Central Bank to cut interest rates further and possibly introduce other measures in order to stimulate the economy. The central bank has cut interest rates five times since November. GDP numbers are released by the National Bureau of Statistics China on Monday.

China GDP and the PMI

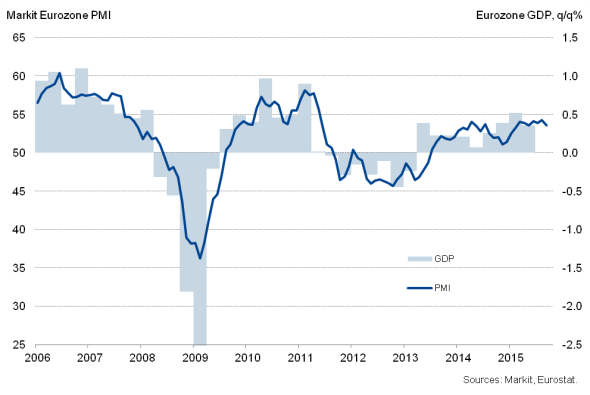

There have been mixed signals on the health of the eurozone economy in recent weeks. Retail sales data from Eurostat surprised on the upside, pointing to increased consumer spending, but the region continues to face high unemployment and consumer prices fell again in September, as lower oil and energy prices exerted downward pressure on costs. PMI data meanwhile signal that we should expect another quarter of moderate GDP growth despite only a marginal expansion in France.

What does this mean for monetary policy? While the ECB would no doubt like to see an acceleration of economic growth following the implementation of its QE programme, the recent data flow is not weak enough to convince policy makers to take more aggressive action just yet. Therefore, no change is expected when the ECB announces its latest monetary policy decision on Thursday.

Eurozone GDP and the PMI

Data watchers will also be interested in the latest set of flash PMI data, released on Friday. The data will give the first available information on how the region's economy is faring at the start of the final quarter of 2015. Not only the headline PMI number will be of interest though, as the dataset also includes information on other economic variables, for example price and employment trends.

In the US, the Fed will be viewing flash manufacturing PMI data for information on how the goods-performing sector is performing at the start of the fourth quarter. The business survey data highlighted that manufacturing has lost significant growth momentum in recent months, with the sector facing headwinds from a strong dollar and weak demand from foreign markets. Moreover, in its latest Beige Book, the Federal Reserve stated that "manufacturing conditions were generally sluggish", thereby adding to PMI evidence of a sector that is struggling to achieve any meaningful growth. However, with manufacturing accounting for only around one-tenth of total GDP, the growth slowdown looks insufficient on its own to deter the Fed from hiking rates later this year.

Flash manufacturing PMI results are also out in Japan. In September, the sector was close to stagnation, adding to signs that the various stimulus measures introduced under 'Abenomics' are failing to engender a sustainable economic upturn. In its latest monthly report, the Cabinet Office lowered its assessment on industrial production and the economy in general for the first time in 12 months and also stated that "the economy is in a gradual recovery trend, but there are some pockets of weakness".

Monday 19 October

China sees the release of third quarter GDP data.

In Russia, retail sales and unemployment numbers are issued alongside an update on real wages.

The latest Bank of Scotland Report on Jobs is out.

Payroll job growth data are meanwhile published in Brazil.

The NAHB Housing Market Index is released in the US.

Tuesday 20 October

Monthly GDP numbers are out in Russia.

Current account data are released in the eurozone.

Meanwhile, Germany sees the publication of producer price figures.

Wholesale trade numbers are out in Canada.

In the US, housing starts numbers and building permit figures are issued.

Wednesday 21 October

Japan sees the release of trade data.

Inflation and retail sales numbers are meanwhile published in South Africa.

Greece releases current account figures.

In the UK, public sector borrowing data are issued, while Markit releases its latest UK Household Finance Index.

The Bank of Canada announces its latest monetary policy decision.

Thursday 22 October

The European Central Bank announces its latest monetary policy decision, while the European Commission publishes consumer confidence data.

Business confidence numbers are issued in France, while trade figures are out in Italy.

In Spain, unemployment data are updated.

Retail sales numbers are released in Canada and the UK.

Unemployment data are issued in Brazil.

Initial jobless claims numbers and existing home sales figures are updated in the US.

Friday 23 October

Flash PMI results are published for Japan, the eurozone and the US.

House price numbers are released in China.

Germany sees the publication of import price figures.

Industrial orders, retail sales and wage data are updated in Italy.

Current account and foreign investment numbers are out in Brazil.

In Canada, inflation figures are released.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16102015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}