Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 22, 2016

Eurozone growth edges down to one-and-a-half year low

Euro area business activity growth edged lower in July, according to the Markit Eurozone Flash PMI", dropping to an 18-month low. July's flash PMI reading of 52.9 compared to 53.1 in the prior two months and signalled only a marginal easing in the rate of growth of output across both manufacturing and services.

Markit Eurozone PMI and GDP

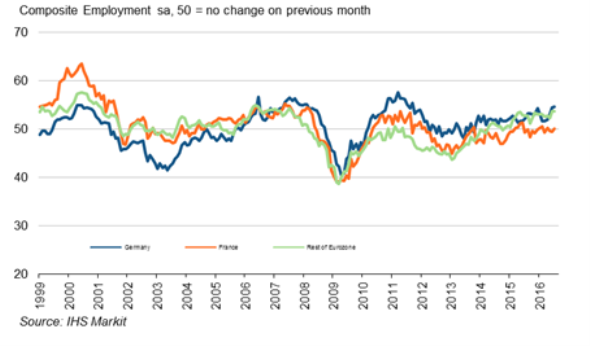

However, the overall pace of growth remained only slightly slower than the average seen so far this year, and employment rose at the fastest rate for almost five-and-a-half years as companies boosted capacity in line with the overall upturn in the economy.

Rates of expansion moderated slightly in both sectors, slipping to a one-and-a-half year nadir in services but merely easing to a two-month low in manufacturing. The relatively stronger performance in manufacturing was helped by a further upturn in new export orders, in turn linked to the weaker euro. However, export growth slowed fractionally from June's six-month high, in part due to weakened sales to the UK which were often blamed on the UK referendum and the weakening pound.

Although still signalling only modest economic growth, the surveys have now registered a continual expansion of eurozone business activity for 37 months, a sustained expansion which has given many firms increasing confidence to hire additional staff. Employment across the two sectors subsequently rose in July at the fastest rate since February 2011, the rate of job creation having steadily improved over the past four months.

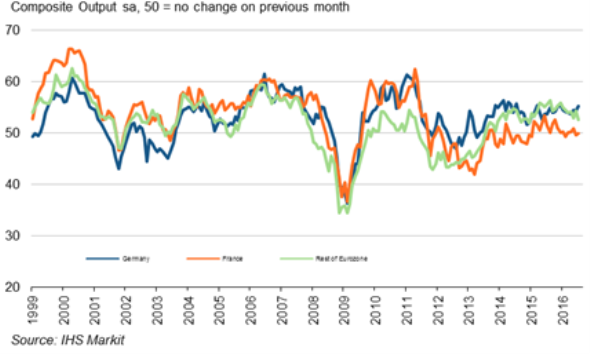

Core v. Periphery PMI Output Indices

The service sector led the job market upturn, taking on extra staff to the greatest extent seen since February 2008. While factory hiring slowed and remained subdued by comparison, July nevertheless saw one of the largest gains in manufacturing employment recorded over the past five years.

Whether the rate of job creation will continue to strengthen remains uncertain, as business expectations in the service sector fell to a 19-month low.

The weak currency as well as rising oil prices were meanwhile cited as key drivers of input cost inflation hitting a one-year high, though average selling prices for goods and services fell marginally again, albeit to the smallest extent since last October.

Service sector input cost inflation was unchanged since June while manufacturers' purchase prices rose for the first time in a year. Selling prices showed signs of near-stabilisation in both sectors.

In Germany, companies reported the fastest rate of output growth so far this year, driving one of the largest increases in employment seen over the past five years. Services growth revived from June's 13-month low and factories reported the largest improvement in production since April 2014.

In France, business activity stabilised after falling fractionally in June, buoyed by a marginal return to growth in services and an easing in the rate of decline in manufacturing.

The improvements in PMI data for France and Germany contrasted with the rest of the region, where the surveys signalled the weakest rise in activity since December 2014 as growth rates fell in both manufacturing and services.

Core v. Periphery PMI Employment Indices

Comment

Commenting on the flash PMI data, Chris Williamson, Chief Economist at Markit said:

"The eurozone economy showed surprising resilience in the face of the UK's vote to leave the EU and another terrorist attack in France.

"The overall rate of economic growth is largely unchanged, suggesting GDP is growing at a sluggish but reasonably steady annual rate of around 1.5%.

"It's especially encouraging to see employment growth continuing to improve, with firms' appetite to hire seemingly so far unaffected by the uncertainty caused by the Brexit vote, especially in Germany.

"However, business confidence about the outlook in the service sector has deteriorated to the worst for just over one-and-a-half years, linked primarily to the political and economic instability induced by the UK referendum, pointing to near-term downside risks for an already-lacklustre eurozone economy.

"Policymakers will be reassured by the resilience of the PMI in the immediate aftermath of the Brexit vote, but the fragility of the recovery leaves plenty of room for speculation about further stimulus later in the year."

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072016-Economics-Eurozone-growth-edges-down-to-one-and-a-half-year-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072016-Economics-Eurozone-growth-edges-down-to-one-and-a-half-year-low.html&text=Eurozone+growth+edges+down+to+one-and-a-half+year+low","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072016-Economics-Eurozone-growth-edges-down-to-one-and-a-half-year-low.html","enabled":true},{"name":"email","url":"?subject=Eurozone growth edges down to one-and-a-half year low&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072016-Economics-Eurozone-growth-edges-down-to-one-and-a-half-year-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+growth+edges+down+to+one-and-a-half+year+low http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072016-Economics-Eurozone-growth-edges-down-to-one-and-a-half-year-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}