Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 21, 2016

'Brexit' vote spawns pessimism about six-month UK outlook, but longer term prospects are more balanced

UK individuals have grown more downbeat on average about the UK's short-term prospects in the light of the EU referendum, but views on the longer-term outlook are far more nuanced, although still negative on balance.

Of those expressing a view, some 55% of survey participants see the UK's economic prospects as having deteriorated following the referendum decision to leave the EU, outnumbering the 12% that see prospects as having improved by almost five-to-one (a resulting 'net balance' of those seeing prospects having got better minus those thinking prospects have got worse of -42.9%).

However, just 42% of individuals see prospects as having deteriorated over a ten-year horizon, only slightly more than the 39% who perceive the outlook as having improved as a result of the 'Brexit' vote (a resulting 'net balance' of just -3.5%).

Source: IHS Markit

The survey results therefore indicate that, on balance, respondents expect the UK economy to be adversely affected by the decision to leave the EU in the short run, but for the damage to lessen considerably in future years.

Negative sentiment rises with wealth, but falls with age. The poorest and the oldest are therefore the most upbeat about post-Brexit prospects for the UK economy. Very mixed results are meanwhile seen by region and by sector of employment.

Scots most downbeat on economic prospects

All regions are downbeat about near-term prospects for the economy, with the North West the least pessimistic. However, sentiment is considerably more varied for the ten-year outlook. Four regions see UK economic prospects as having improved over the longer term horizon as a result of the EU referendum, led by the South East (excluding London). The North East and Yorkshire & The Humber also saw positive sentiment about the ten-year horizon, as did the South West, albeit to a lesser extent.

The Scots are the most negative about how economic prospects have changed since the referendum, both in terms of the six-month and ten-year outlook. Some 55% of Scottish respondents see the longer term outlook as having deteriorated, double the 27% that perceive an improvement.

By region

Older generations most upbeat about long-term benefits of leaving the EU

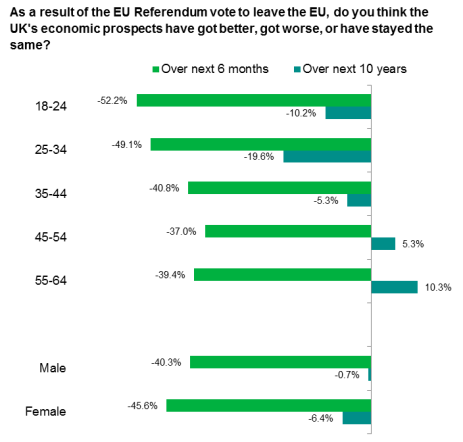

By age, older generations are the least negative about the six-month outlook and the most positive about longer term prospects. The most upbeat is the oldest (55-64) age bracket, where 49% see the UK economy benefitting from voting to leave the EU in 10 years' time compared to 38% seeing a negative impact. The most negative is the 25-34 age group, where the 30% of respondents feeling more positive about the ten-year outlook are considerably overshadowed by the 49% which sees prospects as having worsened.

There is also a gender divide, with females more pessimistic about both short- and long-term prospects than males.

By age & gender

Chart shows net balance of those seeing prospects having got better minus those thinking prospects have got worse.

Source: IHS Markit

Prospects vary by industry sector

Workers across all sectors of the economy are negative about how economic prospects have changed for the UK over the next six months, with those working in media, culture & entertainment the most downbeat.

Views are far more varied for the longer term, with those working in utilities, energy & transport themost positive about how prospects have changed, followed by construction sector workers. The retail sector also saw a slightly positive longer term outlook, with manufacturing also seeing a marginal net positive picture.

Media, culture & entertainment and education, health & social services employees are the most negative about longer term economic prospects.

Poorest perceive greatest benefit of Leave vote

By income, there is a clear correlation whereby negative sentiment about UK prospects rises with wealth. The only income group that perceives any net benefit from the UK's Leave vote is the poorest, earning "15,000 or less per annum.

Comment:

Chris Williamson, chief economist at Markit, which compiles the survey, said:

"Households are clearly expecting some short term pain for the economy following the vote to leave the EU, though the good news is that the longer term picture is far less gloomy. The survey results suggest that there's confidence in the ability of the UK to successfully adapt to life after 'Brexit', albeit to be slightly less well off - from an economic perspective - than would otherwise have been the case.

"By no means all are convinced, however, with the Scottish especially gloomy about prospects for the UK outside of the EU.

"Pessimism about future prospects rises with wealth, though this is perhaps also a sign that the less well-off perceive 'Brexit' as an opportunity to prosper."

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21072016-Economics-Brexit-vote-spawns-pessimism-about-six-month-UK-outlook-but-longer-term-prospects-are-more-balanced.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21072016-Economics-Brexit-vote-spawns-pessimism-about-six-month-UK-outlook-but-longer-term-prospects-are-more-balanced.html&text=%27Brexit%27+vote+spawns+pessimism+about+six-month+UK+outlook%2c+but+longer+term+prospects+are+more+balanced","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21072016-Economics-Brexit-vote-spawns-pessimism-about-six-month-UK-outlook-but-longer-term-prospects-are-more-balanced.html","enabled":true},{"name":"email","url":"?subject='Brexit' vote spawns pessimism about six-month UK outlook, but longer term prospects are more balanced&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21072016-Economics-Brexit-vote-spawns-pessimism-about-six-month-UK-outlook-but-longer-term-prospects-are-more-balanced.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=%27Brexit%27+vote+spawns+pessimism+about+six-month+UK+outlook%2c+but+longer+term+prospects+are+more+balanced http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21072016-Economics-Brexit-vote-spawns-pessimism-about-six-month-UK-outlook-but-longer-term-prospects-are-more-balanced.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}