Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 22, 2015

Expectations build for Bank of England rate hike by end of year

The minutes from the latest Bank of England's Monetary Policy Committee meeting reveal a mood of hawkishness developing steadily among policymakers.

The nine MPC members voted unanimously to keep interest rates unchanged at their historical low of 0.5%. However, the minutes indicate that, if it were not for the Greek crisis, the decision would clearly have been much more 'finely balanced'. Although most members would still have seen holding rates as the most appropriate stance, the minutes suggest that at least two members (most likely Ian McCafferty and Martin Weale) are clearly inching towards voting for borrowing costs to start rising.

Recent days have also seen Mark Carney, the Bank's governor, stressing that the decision to start hiking rates is drawing closer, remarking that "the decision as to when to start such a process of adjustment will probably come into sharper relief around the turn of this year".

Barriers slowly coming down

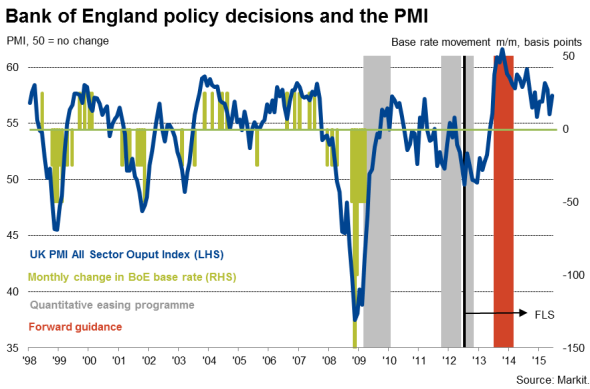

The barriers to hiking rates have steadily come down. The economy retains strong growth momentum, with the PMI surveys indicating economic growth of around 0.5% in the second quarter and the pace of expansion picking up in June after a lull due to the General Election. The PMI surveys are running at levels that are historically consistent with the Bank raising interest rates (see chart) to start to cool things down a little. Pay growth has also started to accelerate, rising to 3.3% in the private sector in the three months to May - its highest since 2008 - and up to 3.8% if bonuses are included. Again, these are rates of growth that would normally start encouraging policymakers to start tightening policy.

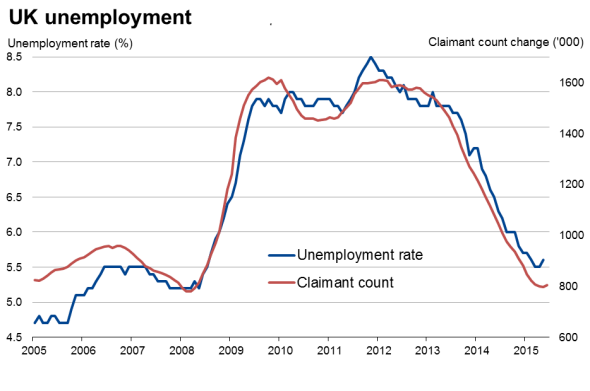

Although unemployment ticked higher in the three months to May, joblessness is likely to continue to come down in coming months, putting further upward pressure on wages, as the economy picks up speed again as General Election and 'Grexit' uncertainties subside. However, it should be noted that the minutes show a lack of unanimity on the extent to which wage growth and therefore inflation will pick up.

By the end of 2015, the fall in commodity prices (notably oil) and sterling's depreciation will have worked their way out of the annual inflation comparisons, lifting inflation higher and pushing up pay reviews.

Much will also depending on the external environment, though in this respect the easing of tension surrounding 'Grexit' - assuming no re-escalation of the crisis - suggests policymakers may be more hawkish at the next meeting.

The chances of rates rising toward the end of the year are therefore rising, with November widely seen as a strong possibility as the Bank will have updated its forecasts.

Household rate hike expectations rise

Households have already started to adjust to the reality of rate hikes drawing nearer, mentally at least. Markit's latest Household Finance Index - based on a survey of 1,500 households and providing the first indication of financial wellbeing each month "- showed 34% of households expect the Bank to starting hiking in the next six months, up from one-in-four in June. Roughly 44% of those that responded after Carney's speech on 16 July forecast tighter monetary policy in the coming six months, versus 31% before the speech was made.

Households' views on next move in Bank of England base rate**

The latest data were collected between July 15th and 19th 2015.

** "The interest rate set by the Bank of England is currently 0.5%. Please let us know when and how you think the Bank will next change interest rates by choosing one of the options below: Please choose one answer."

Source: Markit

The prospect of higher interest rates and signs of inflationary pressures picking up led to the lowest degree of household optimism about their future finances seen for a year.

The Bank will be eager to see how changes in interest rate expectations are feeding through to both the housing market and consumer spending, and any signs of marked deteriorations in either could easily lead policymakers to push rate hike talk into next year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072015-Economics-Expectations-build-for-Bank-of-England-rate-hike-by-end-of-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072015-Economics-Expectations-build-for-Bank-of-England-rate-hike-by-end-of-year.html&text=Expectations+build+for+Bank+of+England+rate+hike+by+end+of+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072015-Economics-Expectations-build-for-Bank-of-England-rate-hike-by-end-of-year.html","enabled":true},{"name":"email","url":"?subject=Expectations build for Bank of England rate hike by end of year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072015-Economics-Expectations-build-for-Bank-of-England-rate-hike-by-end-of-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Expectations+build+for+Bank+of+England+rate+hike+by+end+of+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072015-Economics-Expectations-build-for-Bank-of-England-rate-hike-by-end-of-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}