Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 17, 2015

Week Ahead Economic Overview

In a week that is still likely to be dominated by Greece, the release of flash PMI results will provide first insights into how the debt crisis has affected global economic trends. Consumer confidence numbers are meanwhile released for the eurozone and retail sales data are out in the UK. The central bank highlight is the Bank of England's publication of the minutes from its latest monetary policy meeting.

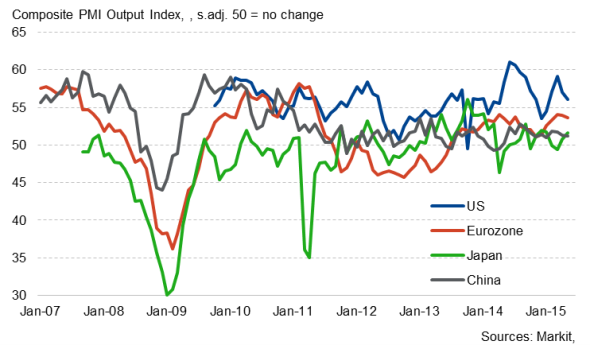

PMI surveys

Currency markets in particular will be focusing on the minutes from the Bank of England's July Monetary Policy Committee meeting for signs of interest rates rising later this year. Rates were left unchanged at their record low of 0.5% as heightened risks around 'Grexit' and weak manufacturing data were likely to have staved off talks of an imminent rate rise. However, the Bank's governor Mark Carney is laying the ground for a possible rate hike later in the year, linked in particular to faster pay growth. The minutes will therefore be scoured for signs that hawkish views are starting to dominate, with Martin Weale and Ian McAfferty both expected to start voting for rate hikes soon.

The UK also sees the release of retail sales data. Despite slowing slightly in May, the trend in retail sales remained impressively strong and clearly adds to the likelihood of rates being raised sooner rather than later. So far in the second quarter, sales are running 0.8% higher than in the first quarter.

In the US, Fed chair Janet Yellen has also warned that rate hikes are drawing closer, and flash manufacturing PMI data will provide clues as to when the first hike might take place. Yellen's Congressional testimony stated that "if the economy evolves as we expect, economic conditions likely would make it appropriate at some point this year to raise the federal funds rate". However, unexpectedly weak retail sales, stagnant factory output, disappointing wage growth and business survey data signalling the slowest improvement in business conditions since October 2013 add to uncertainty regarding the economic outlook.

In the eurozone, flash PMI results for July will provide data watchers with the first available information on the health of the region's economy at the start of the third quarter and will be eyed for signs of the extent to which the crisis in Greece has hit economic growth in the currency union as a whole. June's results showed the region enjoying its strongest growth for four years, but growth of order books slowed partly as a result of uncertainty surrounding the Greek debt crisis.

Other important releases for the currency bloc include consumer confidence numbers plus retail sales and industrial orders data in Italy.

The focus in Japan is increasingly moving to how more progress can be made in relation to the third of Prime Minister Abe's 'three arrows', which seeks to boost the economy's growth rate through structural reforms. Recent signs have not been encouraging: disappointing PMI data showed the goods-producing sector stagnating and business sentiment at Japanese private sector firms fell to its weakest level since 2012, with companies commenting that the depreciation of the yen and the resulting rise in imported raw material costs is likely to dampen growth over the coming year. Flash PMI data for July are released on Friday.

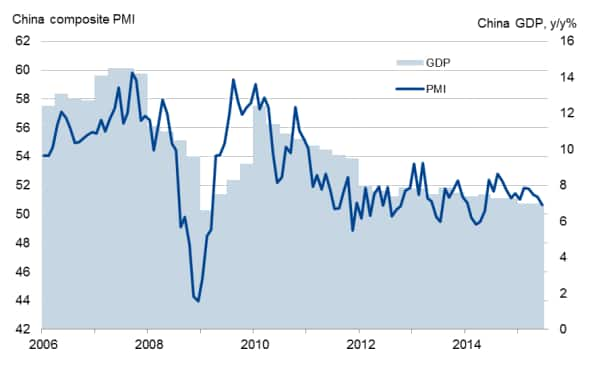

Friday sees the release of July flash PMI results for China, giving first clues as to whether stimulus efforts are helping the economy pick up speed moving into the second half of the year. China's GDP growth held steady at 7.0% in the second quarter, but PMI data signalled a weakening trend in June, with employment falling at the steepest rate since 2009.

Chinese GDP and the PMI

Monday 20 July

Monthly GDP numbers are out in Russia.

Producer price figures are meanwhile updated in Germany.

Eurostat issues current account data for the currency union.

The Bank of Scotland Report on Jobs is published.

In Brazil, payroll job growth numbers are released.

Wholesale trade figures are published in Canada.

Tuesday 21 July

The Reuters Tankan Diffusion Index for July is issued in Japan, while the Bank of Japan issues minutes from its June monetary policy meeting.

Current account numbers are updated in Greece.

In the UK, public sector borrowing data are released.

Wednesday 22 July

Consumer price numbers are updated in Australia and South Africa.

Meanwhile, M3 money supply information are published in India.

The Reserve Bank of South Africa announces its latest interest rate decision.

INSEE business confidence numbers are issued in France.

Italy sees the release of industrial orders and retail sales data.

The Bank of England publishes minutes from its latest monetary policy meeting.

Markit releases the latest UK Household Finance Index.

Inflation numbers and current account data are out in Brazil.

In the US, home price figures are issued.

Thursday 23 July

The Reserve Bank of New Zealand announces its latest official cash rate.

Japan sees the release of trade data for June.

Consumer confidence numbers are issued in the eurozone.

Trade data are meanwhile out in Italy.

In Spain and Brazil, unemployment figures are updated.

Retail sales numbers are published in the UK and Canada.

Initial jobless claims figures are issued in the US.

Friday 24 July

Flash PMI results are published for Japan, China, the eurozone and the US.

In Germany, import price numbers are released.

Wage inflation figures are issued in Italy.

The latest Knight Frank UK House Price Sentiment Index is released.

Consumer confidence data are meanwhile out in Brazil.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17072015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}