Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 21, 2016

Bank of Japan maintains current policy settings but upgrades outlook

The Bank of Japan voted to maintain its stimulative monetary policy stance though also struck a more optimistic tone on its outlook due to recent brighter economic data.

The majority of the Policy Board of the Bank of Japan voted to continue with the current policy of Quantitative and Qualitative Monetary Easing (QQE) while actively managing the yield curve. There were two dissenters who thought current policy settings were excessive and could have an adverse impact on the financial system.

With inflation expectations remaining weak and growth risks still looming large, the expansionary monetary stance is designed to support the country's recovery. However, as was the case in the recent ECB policy meeting, the BOJ acknowledged the recent flow of improving economic data by upgrading its assessment of the Japanese economy.

Brightening growth prospects

The decision means the BOJ will keep buying assets as long as it is necessary until the inflation target of 2% is achieved and maintained in a stable manner. While the future path of inflation remains low, the central bank expects growth in Japan's economy to accelerate to a moderate pace, fuelled by rising domestic demand.

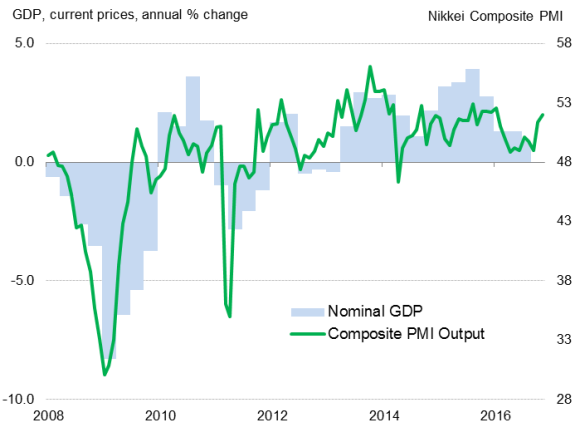

This decision to upgrade the economic outlook for Japan is not particularly surprising. Economic growth appears to be gaining strength. The latest flash Japan PMI survey signalled that manufacturing growth in the fourth quarter is the highest since the same quarter a year ago. Combined with recent services PMI data, latest survey data suggest 1.0% GDP growth in the fourth quarter, up from 0.3% in the third quarter.

Nikkei PMI signals faster GDP growth in Q4

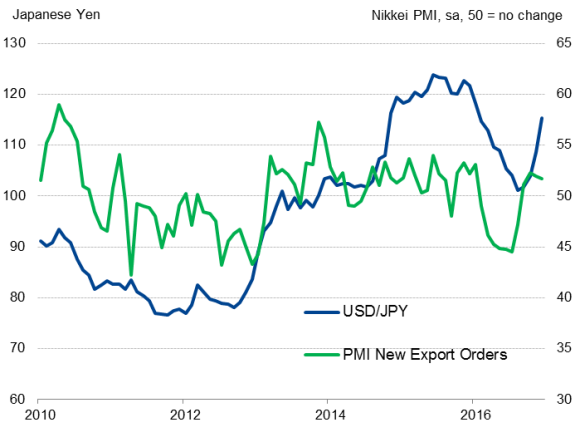

Apart from a recovery from earthquake-related supply disruptions and stronger international demand, companies have reported that the recent depreciation of the yen has helped contribute to improved export order books. Furthermore, the weaker yen is feeding through to higher import prices, which look likely to fan inflationary pressures in 2017. This will be welcome news to a government that continues to seek a way out of deflation.

Yen depreciation helps exports

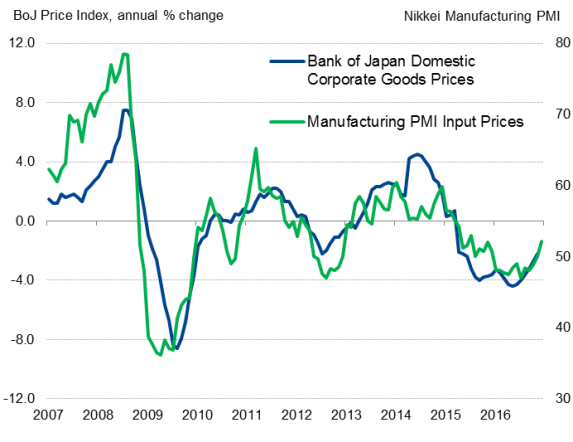

That said, a lack of pricing power among Japanese private sector companies means that rising costs are squeezing profit margins, which could make firms hesitant to add to headcounts.

Prices

Sources: IHS Markit, Nikkei, Datastream.

Rising interest rates

In September, the BOJ revised the framework governing the massive asset purchase programme after a comprehensive review of its monetary policy. Under the new policy framework, known as 'Yield Curve Control', the central bank adopted a target of around zero percent for the 10-year government bond yield, to offset a flattening of the yield curve. This means that the BOJ will purchase government bonds to keep 10-year yields around zero percent.

Now global interest rates have risen in the wake of the US elections, the central bank may be required to expand the amount of monthly asset purchases to keep yields near its target. Such a possibility fans market speculations that the BOJ may raise the yield curve cap if rates continue to march higher.

During the post-decision press conference, BOJ governor Haruhiko Kuroda stressed that it is too early to discuss raising the yield targets despite rate hikes abroad. While improving economic conditions in Japan suggest there is no need for more easing, recent developments in the bond markets may pressure the BOJ to go in the other direction if push comes to shove.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21122016-Economics-Bank-of-Japan-maintains-current-policy-settings-but-upgrades-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21122016-Economics-Bank-of-Japan-maintains-current-policy-settings-but-upgrades-outlook.html&text=Bank+of+Japan+maintains+current+policy+settings+but+upgrades+outlook","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21122016-Economics-Bank-of-Japan-maintains-current-policy-settings-but-upgrades-outlook.html","enabled":true},{"name":"email","url":"?subject=Bank of Japan maintains current policy settings but upgrades outlook&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21122016-Economics-Bank-of-Japan-maintains-current-policy-settings-but-upgrades-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+Japan+maintains+current+policy+settings+but+upgrades+outlook http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21122016-Economics-Bank-of-Japan-maintains-current-policy-settings-but-upgrades-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}